Junk bonds turn up the risk for retirees

Post on: 10 Июнь, 2015 No Comment

Ken’s Latest Posts

Olivier Le Moal/Shutterstock.com

The greater the yield, the higher the risk.

With interest rates so low, it’s a lot harder to be a retiree these days.

In a “normal” interest rate environment, a retiree fortunate enough to have $1 million could get about $45,000 a year in income by investing in 10-yearTreasury bonds without risking principal if held to maturity. Yields have recently risen from historic lows, but in today’s low-rate world, an investor with $1 million can only get an annual income of about $25,000 by investing in 10-year Treasurys.

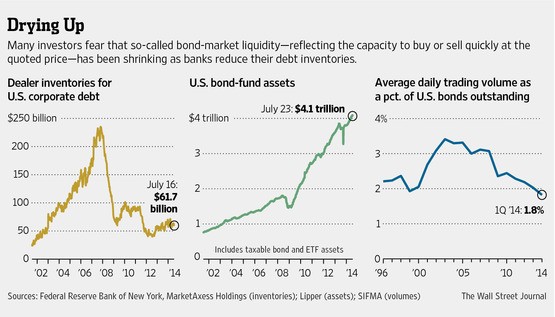

For the last five years, the Fed has maintained a zero interest-rate policy, known as ZIRP,” to help stimulate the economy. Low-interest rates hurt conservative savers and investors and one of the consequences is that income investors have been taking on more risk to maintain their lifestyle.

T.S. Eliot once said, “Only those who risk going too far can possibly find out how far they can go.”

Bloomberg

How Charles Schwab got religion on retirement indexing

Eliot was a great writer, but he certainly wasn’t referring to retirees. Retirees venturing too far out in the risk pool are just asking for trouble. Yet, the stretch for yield is taking some retirees to places they would never have considered in the past.

Many investors fled bonds and shifted into dividend paying equities. Others sought to increase their income by buying high-yield bonds. High-yield bonds are also known as junk bonds — and they are called junk for a reason.

Retirees with junk bonds need to be aware of the risks and determine if they are being adequately compensated for assuming those risks.

Interest risk

One type of risk is interest-rate risk. If rates rise, the price of those bonds will fall. Interest-rate risk is measured by a complex mathematical formula known as duration. The higher the duration, the more volatile the bond. A bond with a low coupon rate, a low yield to maturity and a long term to maturity will have more price volatility than a bond with the opposite characteristics.

The duration tells you how much the value will bounce around as interest rates rise or fall, so investors need to understand their own tolerance for volatility in their portfolio. Provided the issuer doesn’t default, you’ll get the par price for your bond at maturity — as long as you are satisfied with today’s yield and actually hold it until maturity.

Default risk

Another type of risk bond investors face is default risk.Bonds have a credit rating associated with them; the safest bonds have a rating of AAA. Junk bonds have ratings from C to BB. Pluses and minuses are also used in addition to the letters; a BB+ bond carries a higher rating than a BB-. According to Fitch, global default rates for corporate bonds were low in 2013 at a rate of 0.51%.

Historically, default rates have been higher in times of recession and lower when the economy is stronger. So, just because default rates were fairly low last year doesn’t mean that investors should become complacent. From 1982 to 2008, default rates for bonds rated C to CCC averaged 22.7%, with a minimum of 0%, a high of 44.6% and a standard deviation of 11.9%. That means in the worst year, nearly half of those bonds defaulted.

Harvard Business School did a study of institutional investors who buy high yield bonds. Insurance companies are the largest buyers of junk bonds followed by pension and mutual funds. Their study found that,as a group, insurance companies that reach for yield don’t generate higher performance but do appear to hold riskier bonds.

Now might be a good time to consider your own risk tolerance and check your portfolio’s exposure to the high-yield market.