Juice Your Portfolio Returns WIth REIT Funds

Post on: 30 Март, 2015 No Comment

Historically Real Estate Investment Trusts (REITs) have offered enhanced yield with lower volatility. They have also been good diversifiers with low correlation to the overall market. All this changed in the bear market of 2007 and 2008. Concern about falling property values, unemployment, and the difficulties financing debt caused REITs to tumble with the rest of the market. During the bear market, REITs became highly correlated with the S&P 500. REIT indexes fell 16% to 18% in 2007 and another 37% to 40% in 2008. The good news is that REITs also joined the market recovery in 2009 and have been on a tear ever since (with a slight hiccup in 2011).

This article will analyze the performance of REITs over the last three years to assess how well REITs have maintained their historical attributes of high total return, low volatility, and low market correlation. But first, I will provide a quick tutorial on REITs for the investor that may not be familiar with this asset class.

In 1960, Congress created a new type of security call REITs that allowed real estate investments to be traded as a stock. The objective of this landmark legislation was to provide a way for small investors to participate in the income from large scale real estate projects. A REIT is a company that specializes in real estate, either through properties or mortgages. There are two major types of REITs

- Equity REITs purchase and operate real estate properties. Income usually comes through the collection of rents. About 90% of REITs are Equity REITS.

- Mortgage REITs invest in mortgages or mortgage backed securities. Income is generated primarily from the interest that is earned on mortgage loans.

One of the reasons REITs are so popular is that they receive special tax treatment and as a result, are required to distribute at least 90% of their taxable income each year. This usually translates into relatively large yields.

The first REIT was traded on the NYSE in 1965. There are currently over 160 United States REITs trading on major exchanges. REITs are also offered in over 20 countries. REITS can be purchased as individual stocks or through Closed End Funds (CEFs), ETFs, or mutual funds. This analysis will not consider individual stocks and will only analyze funds that have at least a 3 year track record.

For the nine CEFs that met my criteria, I plotted the annualized rate of return in excess of the risk free rate (called Excess Mu on the charts) versus the volatility for each of the CEFs. This data is shown in Figure 1. The Smartfolio 3 program (smartfolio .com) was used to generate this chart. The data is summarized in Table 1, which also provides the distribution rates and some notes on whether the portfolio is US based or global and if the portfolio contains preferred stocks as well as REITs. Two of the CEFs sell at a premium and this is also noted.

Figure 1: Risk Reward for REIT CEFs

(click to enlarge)

Table 1: REIT CEF Data

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe, that measures risk adjusted performance. It is calculated as the ratio of the excess return over the volatility (the reward-to-risk ratio if you measure risk by the volatility). It is a good way to compare peers to assess if higher returns are due to good investment decisions or from taking additional risk. The Sharpe Ratios for the CEFs are tabulated in Table 1 along with the ratio for the SPY.

Over the last three years, the SPY ETF (representing the overall market) had an excess return (in excess of the return from a 1% risk free security) of about 12% and a volatility of 18%. This equates to a Sharpe Ratio of .67. The red line on the plot represents a Sharpe Ratio the same as the SPY. If a CEF is above the line, it has a better ratio than the SPY and vice versa.

As dramatized by the plot, REIT CEFs have been more volatile than the SPY. However, if you had purchased one of the CEFs, you would have been adequately compensated for this increased risk by receiving a higher return. Overall, the reward-to-risk ratios of these CEFs have been quite good when compared to the SPY. The highest return CEF was RQI and the best Sharpe Ratio was RNP. Both of these offerings are from Cohen and Steers, which is one of the top players in both the Real Estate and Preferred Stock arena with more than 45 billion dollars in assets.

Let’s turn our attention to REIT ETFs, which are plotted in Figure 2 and summarized in Table 2. The reward-to-risk characteristics for these ETFs are similar to those experienced by CEFs. Generally the returns and volatilities of REIT ETFs are higher than the SPY, but as with CEFs, the increased risk is compensated by an increased reward. The only exception is REM, which is a mortgage REIT and therefore has a different profile than equity REITs. One interesting observation is that many of the ETFs are closely clustered on the Risk-Reward plane. This is likely due to the similarity of the US REIT indexes (see notes in Table 2) used for their benchmarks.

Figure 2: Risk Reward for REIT ETFs

(click to enlarge)

Table 2: REIT ETF Data

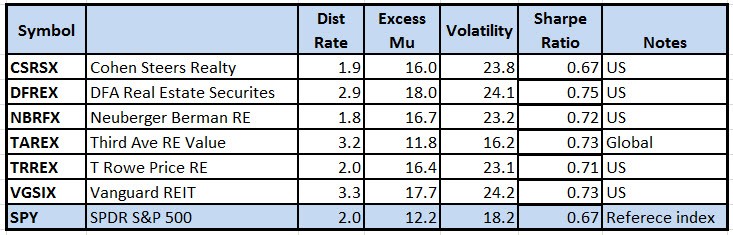

The final REIT funds that I analyzed were mutual funds. There are multitudes of REIT mutual funds, so I limited this analysis to mutual funds that have been analyzed by Morningstar (morningstar .com) and have received at least a 3 stars rating. These mutual funds are listed in Table 3 and plotted in Figure 3. Again, REIT mutual funds have delivered more return than the SPY, but were also more volatile. The Sharpe Ratios associated with mutual funds were very close to one another and were also close to the ratio of the SPY. TAREX was one the of the few REITs funds that have a volatility less than the SPY. TAREX has a significant position in Real Estate Operating Companies (REOCs) that are different than REITs, because REOCs do not have to distribute 90% of their taxable income.

Figure 3: Risk Reward for REIT Mutual Funds

(click to enlarge)

Table 3: REIT Mutual Fund Data

To assess diversification, I calculated the correlation coefficient for every pair of assets mentioned in this article. As you might expect, REITs are correlated with one another, with correlation coefficients ranging from 50% to over 90%. In addition, over the last three years, REITs have also been highly correlated with SPY, with coefficients generally over 60%. REIT mutual funds (except for TAREX) are almost perfectly correlated with one another. Of all the REIT assets analyzed, JRS(NYSEMKT:JRS ) and RFI (NYSE:RFI ) exhibited the lowest correlations among peers and the SPY.

In conclusion, REITs can indeed juice the return of your portfolio, but are not for the faint of heart. They are not low volatility assets, but if you can live with the volatility, the increased risk is more than compensated by the increased return (as evidenced by the larger Sharpe Ratios). The amount of diversification received by investing in REITs is not as great as it was early in the millennium (when correlations were smaller). However, due to the strong bull market, it is difficult to find uncorrelated assets, so I would not let diversification rule out REIT investments. The fact that REITs have performed well during the past does not guarantee future performance, but I believe this class will outperform as long as the bull is healthy.

Disclosure: I am long IYR. IGR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.