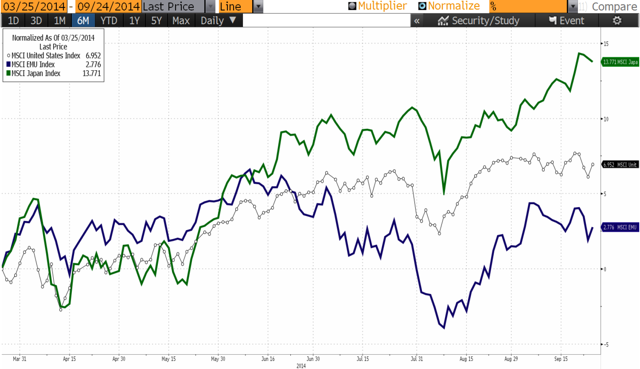

Japan ETF Investors Eye Yen s Strength

Post on: 16 Март, 2015 No Comment

NEW YORK ( TheStreet ) — Japan’s markets are currently trading near seven-month lows, but there is reason to believe that a turnaround could occur in the near future.

Japanese corporations are expected to have a good earnings season in the coming weeks, making this a potentially opportune time for investors to gain exposure to the country with an ETF such as iShares MSCI Japan Index (EWJ ) or WisdomTree Japan Hedged Equity Fund (DXJ ).

Investors looking at Japan should take the yen’s strength against the U.S. dollar into consideration when planning an ETF investment.

EWJ is unhedged to currency fluctuations, so a strengthening in the yen against the dollar will translate into an equal percentage gain in EWJ, before the performance of equity holdings is taken into account.

This can be helpful when the yen is gaining ground, as it has over the past few months.

For instance, in the trailing three-month period, while the yen rose about 5% against the dollar, EWJ was only down about 10%, whereas the broader Japanese markets were down by about 15%.

Going forward though, the yen is reaching a point in its exchange rate when Japan’s business leaders start to become concerned that its strength against the euro and the dollar will eat into sales and profits going forward.

For instance, earlier this week, the chairman of the Japan Auto Manufacturers Association made a comment requesting that the government act to prevent the yen from advancing against foreign currencies.

While the government seems willing to weaken the yen, it has yet to be seen, suggesting it may not have the power to influence currency markets.

However, considering that the yen is now pushing up against levels of strength that acted as resistance in the past, it appears likely that there will be room for the yen to weaken against the dollar going forward.

This means that investors looking at EWJ right now will find that the same currency effect that helped the fund in the past three months, could act as a drag on performance if it begins to move in the opposite direction.

ETF investors interested in Japan are fortunate though since there is a solution to this problem in the form of DXJ. This ETF hedges against currency fluctuations so that investors are exclusively exposed to the equity holdings in its portfolio, which are comparable to those of EWJ.