Jack Bogle Rebalance Portfolio Older Investors

Post on: 16 Март, 2015 No Comment

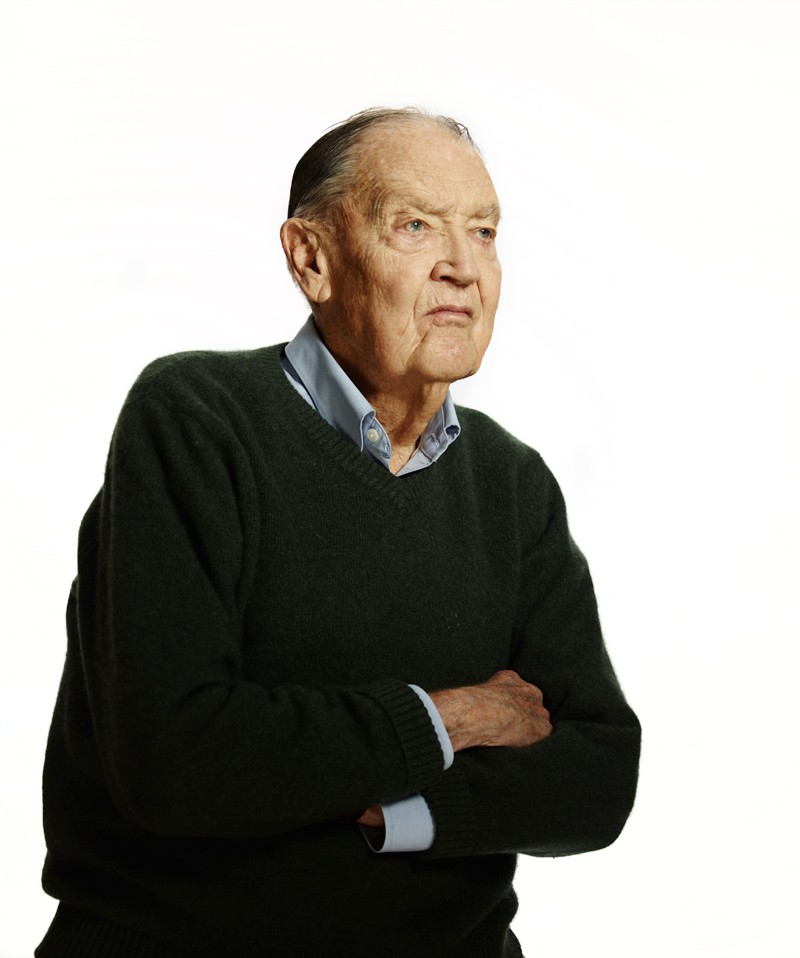

I’ve admired Vanguard founder Jack Bogle for a long time. In my eyes, he was instrumental in bringing on a revolution in the financial industry that led to low-cost ways for small investors like me to put their money to work in a huge array of markets. Without the index funds he helped pioneer, investors would likely have paid quite a bit more in fund management fees and other ancillary costs.

But in a recent discussion with the Fool’s Robert Brokamp, which appears in the brand-new issue of Motley Fool Champion Funds . Bogle said something that surprised me quite a bit: He hasn’t rebalanced his portfolio in years. After adjusting his asset allocation during the bull market of the late 1990s, he largely left his portfolio alone, as the roller-coaster ride of the last nine years took stocks down, up, and down again. He’s comfortable with the small allocation of stocks he has now and thinks he’ll keep it, regardless of which direction the financial markets move in the future.

Why not rebalance?

In general, I’m a big fan of rebalancing. The idea just makes intuitive sense. When a portion of your portfolio has gotten more expensive compared to another, selling something when it’s up in order to buy more of something else that’s down meets the buy low-sell high test, especially for investments that tend to move up and down in cycles over time.

But Bogle’s comment serves as a good reminder that rebalancing blindly isn’t smart either. Before you rebalance your portfolio, you should understand exactly why you’re rebalancing — and what impact it will have on your overall portfolio. So, here are some reasons why you wouldn’t want to rebalance:

- Changing investment goals and risk tolerance. Typically, investors become more risk-averse on the risk/reward scale as they grow older. Although recent declines in the stock market have caused many investors’ portfolios to have below-normal allocations to stocks, that might be exactly what you want if you’re close to or already in retirement. If so, there’s no need to rebalance.

- Costs. With no-load mutual funds, rebalancing usually costs little or nothing. But if you have to pay high commissions or sales charges to switch, then rebalancing may not be worth it.

- Sector rebalancing. The implicit assumption behind rebalancing is stocks that have fallen are more likely to bounce back in the future, while rising stocks are more likely to give up some of their gains. But if you don’t think that’s the case, then rebalancing isn’t the right move.

Here’s a simple example of that last point. In 2007, financial stocks fell sharply, while defensive stocks like consumer staples and low-end retailers did fairly well. Because financials were down, you might have rebalanced some of your money away from defensive issues back to the financials.

Yet as it turned out, that would’ve been a bad move. The run of outperformance for defensive stocks was far from over at the beginning of 2008. Here’s how those stocks did last year: