Is Whole Life Insurance A Good Investment

Post on: 19 Май, 2015 No Comment

Good is a relative term, but given recent market volatility, the melt-down of 401Ks and the down-right miserable performance of interest-bearing accounts, some people are rethinking whole life insurance as a more secure place to park their money. A recent article in the Wall Street Journal reported that after years of downsizing, the venerable big insurance companies are actively recruiting agents to meet the anticipated demand.

Although whole life fell out of favor in the 1980s with the advent of mutual funds, sales of whole life insurance policies during the second half of 2009 were up 12% from the previous year, while term life sales remained flat.

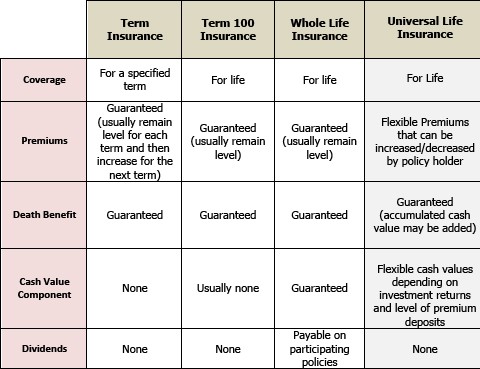

Whole life is more expensive than term life insurance, but unlike term, your whole life policy will accrue tax-free interest as long as you continue to pay the premiums. Whole life combines insurance with a saving account feature that includes what the insurance industry calls living values (aka cash). Under certain conditions, you can make withdrawals, use your policy as collateral on a loan and surrender the policy for cash. Or you can let it ride let your beneficiaries collect the full value of the policy when you shake off this mortal coil.

Sound good? Well, it can be if youre an informed buyer who understands the pros and cons of whole life insurance. As mentioned, whole life costs considerable more than a term life policy, although like everything else these days, whole life rates are pretty good bargains at the moment. But, and this is a big but, you best be prepared to stick with it for the long run. Cash out or give up during the first five years of the policy and you wont have much to show for your money. Stay the course, and youll be providing protection for your family and youll have an investment thats as safe as the insurance company that sold you the policy. By the way, whole life insurance is definitely a product where it pays to research the provider. Youre looking at 20, 30 or 40 years of premiums, so get your whole life insurance quotes from companies with a long-established, solid reputation.

There is an old adage that says buy term insurance and invest the difference; if youre a disciplined person, that can certainly work to your financial advantage. But if youre simply looking for a secure investment that will give you the peace of mind of knowing your family will be taken care, whole life insurance may be the right choice for you.