Investors start to flee bond ETFs as rates rise

Post on: 14 Июнь, 2015 No Comment

Story Highlights

- Rising interest rates prompt flight from bond ETFs The speed of the rise caught many investors offguard Third-quarter statements could be a shock for fixed-income portfolios

Bond ETFs have seen steady inflows through much of 2013 but the trend has reversed the last month as the rise in interest rates kicks into high gear on speculation the Federal Reserve will begin pulling back from economic stimulus sometime before the end of the year.

So far this month through August 26, investors have pulled more than $45.7 billion from bond mutual funds and ETFs, according to TrimTabs Investment Research.

For the trailing month, fixed-income ETFs have experienced redemptions of about $3.5 billion, according to ConvergEx Group. Year to date, bond ETFs have gathered $10.4 billion, and quarter-to-date flows are still positive despite the bout of selling the past month.

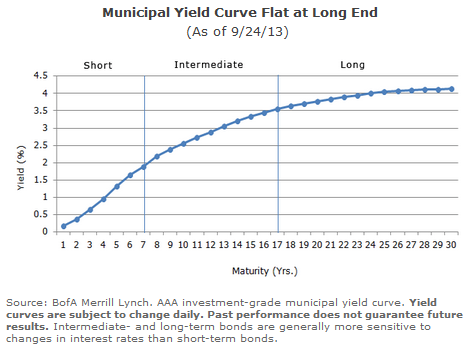

The recent rise in Treasury yields has dealt a harsh lesson to investors conditioned to believe bonds can’t lose value after their three-decade bull market. Bond ETFs with longer durations have been hit particularly hard.

For example, the $3 billion iShares 20+ Year Treasury ETF (TLT) has fallen nearly 30% from its July 2012 all-time high.

Bond prices and yields move in opposite directions. Yields on 10-year Treasury notes climbed above 2.9% last week – for perspective, they briefly dropped below 1.5% last summer. Treasury yields fell this week after the release of the minutes from the Federal Reserve’s July meeting fueled expectations the central bank will begin tapering its bond purchases before the end of the year.

With abnormally low yields over the last few years, investors have been on high alert to the potential impact that an unpleasant end to a 30-plus year bull run in bonds could have on their portfolios, says David Mazza, head of ETF investment strategy at State Street Global Advisors.

As the economy continues to recover from the Great Recession and the lingering impacts of the European sovereign debt crisis subside, it comes as no surprise to see rates on the rise, he added. What seems to have caught investors by surprise however, is the speed at which rates moved after Fed Chairman Ben Bernanke suggested that QE may be tapered off sooner than consensus expected.

What’s worse, a recent poll revealed that nearly two-thirds of Americans don’t even realize how rising interest rates can hurt their fixed-income investments. The results are alarming because many investors have fled stocks and piled into bonds after the financial crisis. Demographically, aging Baby Boomers are also shifting into bonds for income and perceived safety.

According to a survey by financial-services company Edward Jones, 63% of Americans don’t know how rising interest rates will affect investment portfolios. Nearly one-quarter of respondents said they felt completely in the dark about the potential effects.

Therefore, many investors who purchased bonds and fixed-income funds for safety may be in for a shock when they get their balance statements at the end of the third quarter.

In the Edward Jones survey, one-third of respondents between the ages of 18 and 34 replied they have no idea how interest rate changes will affect their portfolios. One-quarter of those 65 and older also said they had no clue.

Of course, the recent rise in rates and corresponding decline in bond values doesn’t mean investors should abandon bond ETFs. They remain important portfolio diversifiers, and rising Treasury yields are at least welcome news for income investors saddled with rock-bottom interest rates the past several years.

Also, investors can tap specialized bond ETFs to soften the blow of rising interest rates.

One possible solution is to favor bond ETFs with shorter durations that are less sensitive to rates. For example, speculative-grade corporate bond ETFs with shorter durations such as PIMCO 0-5 Year High Yield Corporate Bond (ticker symbol: HYS) and SPDR Barclays Short Term High Yield Bond (SJNK) have been a popular choice recently with investors seeking a balance of yield and protection from rising rates. Yet key risks for this sector include a slowdown in the economy or a credit-market shock.

Bank loan ETFs also offer decent yields and shelter from higher rates because they track floating-rate securities. PowerShares Senior Loan Portfolio (BKLN) is the largest fund in the category and also one of the top-selling ETFs this year with inflows of more than $3.8 billion. Other bank loan ETFs include Highland/iBoxx Senior Loan (SNLN), First Trust Senior Loan Fund (FTSL) and SPDR Blackstone/GSO Senior Loan ETF (SRLN).

Steady returns and higher yields with secured claims to a business’s assets (are) the attraction for investor’s to this asset class, S&P Dow Jones Indices said in a recent note on bank loans.

Finally, ETFs that bet against Treasury bonds have seen an uptick in activity lately. These sophisticated products are designed for short-term traders rather than buy-and-hold investors. ProShares UltraShort 20+ Year Treasury (TBT), a so-called leveraged inverse ETF, has grown to more than $4 billion of assets.

Other ETFs that profit from lower Treasury prices and rising yields include ProShares Short 20+ Year Treasury (TBF) and Direxion Daily 30-Year Treasury Bear 3X Shares (TMV).