Investor Say on Pay Is a Bust

Post on: 2 Июль, 2015 No Comment

This was supposed to be the year when shareholders at public companies finally had their say about executive pay. As a result of the passage of the Dodd-Frank Act last July, shareholders for the first time can cast proxy votes on top executives’ compensation. Median pay of chief executives jumped 35 percent, to $8.4 million, for Standard & Poor’s 500 CEOs in 2010. So shareholders’ say-on-pay votes, although only advisory, were expected to widely challenge companies where compensation didn’t reflect performance or were out of line with those at competitors.

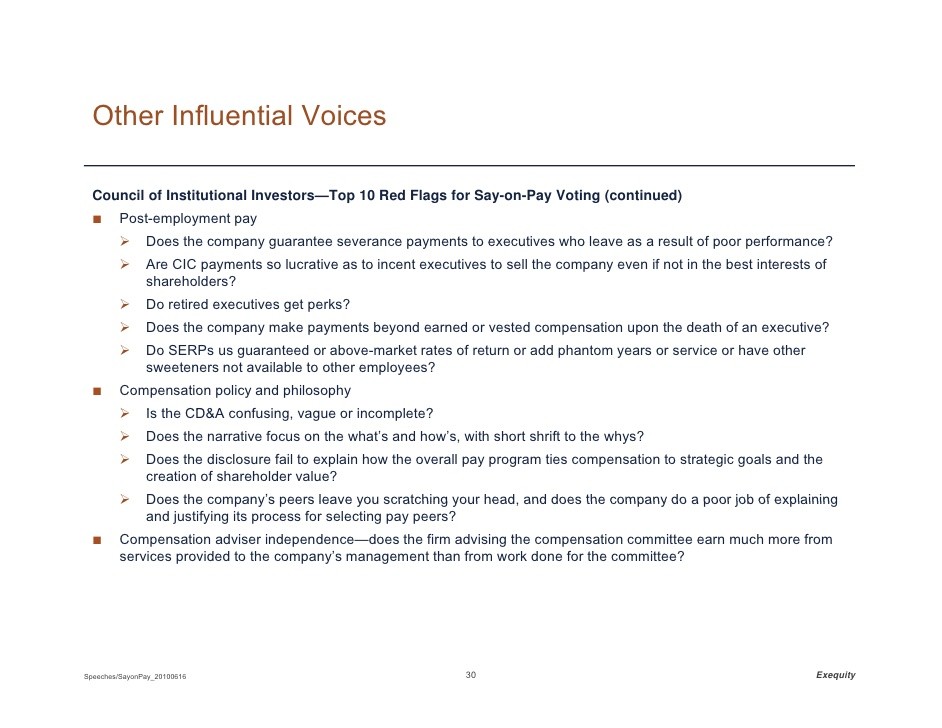

Institutional Shareholder Services (ISS), which advises investor clients on proxy and shareholder issues and is the largest firm of its kind in the U.S. has recommended nay votes on pay for 293 companies so far this year. Among them: Pfizer (PFE ), whose ex-CEO Jeffrey Kindler resigned in December with a severance package valued by ISS at $34.4 million. Another is JPMorgan Chase (JPM ), where chief Jamie Dimon was awarded a 1,474 percent compensation boost for 2010, to $20.8 million.

Yet through June 14, shareholders by a majority vote objected to executive comp at just 32 of the 1,998 companies that have convened annual meetings this year. Say-on-pay is at best a diversion and at worst a deception, says Robert A.G. Monks, the veteran corporate governance activist who founded ISS in 1985. You only have the appearance of reform, and it’s a cruel hoax.

Given that the proxy advisory firm’s clients typically comprise 20 percent of a company’s shareholder base, why so few nays on pay? Some of the credit—or blame—goes to the Center on Executive Compensation. The three-year-old center is an offshoot of the HR Policy Assn. a lobbyist on human resources issues for 300 of the largest U.S. companies, including Procter & Gamble (PG ) and IBM (IBM ).

The center advised companies that received negative ISS recommendations to send rebuttals to shareholders and itself warned the nation’s 100 biggest institutional investors about possible bias and errors in proxy advisers’ recommendations. We provided some guidance on how to tell their pay-for-performance stories, says Charles Tharp, the center’s CEO. The center also published a white paper in which it said ISS has published errors, holds excessive power, and has conflicts of interest because it both consults with some companies on corporate governance and issues proxy voting recommendations on them. The paper recommended that ISS, Glass Lewis, the No. 2 proxy advisory firm, and others, be more strictly regulated by the Securities and Exchange Commission.

Patrick McGurn, executive director of ISS, disputes the center’s claims and says the proxy adviser isn’t an irresponsible disrupter. He notes that ISS supported management on 88 percent of say-on-pay votes. These are K Street lobbyists who get a good revenue stream out of saying things companies don’t want to say, he says.

Many companies countered ISS’s recommendations in letters to shareholders. Pfizer took umbrage with ISS’s objections to ex-CEO Kindler’s severance package, calling it necessary to secure noncompete terms and in the best interests of shareholders. JPMorgan Chase said ISS’s objection to CEO Dimon’s pay hike failed to grasp the big picture. The Firm has come through the worst economic storm in recent history stronger than ever, and a major part of the Firm’s success is due to Mr. Dimon’s long-term vision, leadership, disciplined approach and business acuity, the company said in its letter.

ExxonMobil (XOM ) also countered ISS’s objection to CEO Rex Tillerson’s $88 million pay package over the past three years, when its stock generated a 5.8 percent negative return. ExxonMobil took issue with ISS using one-year and three-year returns to gauge performance. We believe the ISS model is contrary to the best interests of shareholders, its letter said. The Compensation Committee of the Board uses well-informed judgment when setting compensation.

The rebuttals were effective. Pfizer won 57 percent of the shareholder vote on executive pay. ExxonMobil and JPMorgan Chase received 67 percent and 73 percent shareholder support, respectively.

Lynn Turner, a former managing director for research at Glass Lewis and former chief accountant at the SEC, says mutual funds, which own 70 percent of U.S. equities and are many companies’ biggest shareholders, cast few negative pay votes out of business considerations. Corporations contract with big mutual funds to run (401)k plans for their employees, he says, making funds disinclined to dissent. The big mutual fund companies won’t vote against management on compensation unless they’re really bad, says Turner.

Some companies that received negative ISS recommendations this year made changes and then won the firm’s blessing. General Electric (GE ) initially got a thumbs down this year because it granted CEO Jeffrey Immelt 2 million options despite a lagging stock price. GE then conferred with major shareholders, according to an SEC filing, and made the vesting of Immelt’s options contingent on the company meeting performance targets. ISS then dropped its objections. ISS’s McGurn says cases like this show how say-on-pay helps foster accountability. Anything that creates more engagement between management and shareholders is good for corporate governance, he says.

The bottom line: Shareholders this year for the first time could vote on executive pay. A majority voted against pay plans at only 32 of 1,998 companies.