Investor Alert Understanding Mutual Fund Classes

Post on: 28 Март, 2015 No Comment

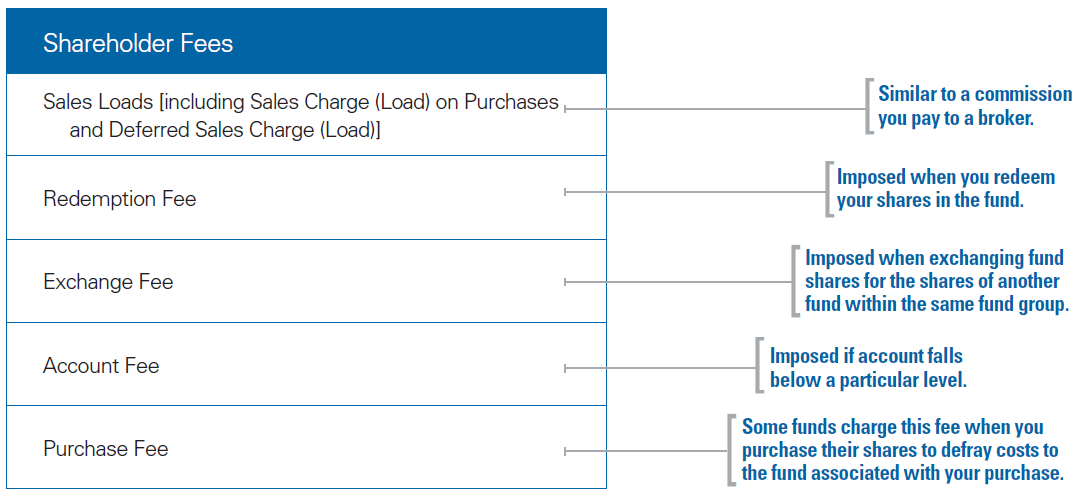

What Types of Fees and Expenses Will I Pay?

Like most investments, all mutual funds charge fees and expenses that are paid by investors. These fees and expenses can vary widely from fund to fund or fund class to fund class. Because even small differences in expenses can make a big difference in your return over time, we’ve developed a Fund Analyzer to help you compare how sales loads, fees and other mutual fund expenses can impact your return. You can also check the fee table in the mutual fund’s prospectus to find out about its fees and expenses.

If You Buy Class A Shares:

Class A shares typically charge a front-end sales charge. When you buy Class A shares with a front-end sales charge, a portion of your dollars is not invested. Class A shares may impose an asset-based sales charge (often 0.25 percent per year), but it generally is lower than the charge imposed by the other classes (often 1 percent per year for B and C shares).

A mutual fund may offer you discounts, called breakpoints discounts, on the front-end sales charge if you:

- Make a large purchase.

- Already hold other mutual funds offered by the same fund family.

- Commit to regularly purchasing the mutual fund’s shares.

You should ask your financial adviser whether any breakpoint discounts are available to you. For more information, read our Investor Alert Mutual Fund Breakpoints: A Break Worth Taking .

If You Buy Class B Shares :

Class B shares typically do not charge a front-end sales charge, but they do impose asset-based sales charges that may be higher than those that you would pay if you purchased Class A shares. Class B shares also normally impose a contingent deferred sales charge (CDSC), which you would pay if you sell your shares within a certain period, often six years. For this reason, these shares should not be referred to as no-load shares. The CDSC normally declines the longer your hold your shares and, eventually, is eliminated. Within two years after the CDSC is eliminated, Class B shares often convert into lower-cost Class A shares. When they convert, they begin to charge the same fees as Class A shares.

Class B shares do not impose a sales charge at the time of purchase. So unlike Class A purchases, all of your dollars are immediately invested. But your annual expenses, as measured by the expense ratio, may be higher. You also may pay a sales charge when you sell your Class B shares.

If you intend to purchase a large amount of Class B shares (over $50,000 or $100,000, for example), you may want to discuss with your financial adviser whether Class A shares would be preferable. The expense ratio charged on Class A shares is generally lower than for Class B or C shares. The mutual fund also may offer large-purchase breakpoint discounts from the front-end sales charge for Class A shares.

To determine if Class A shares are more advantageous, refer to the mutual fund’s prospectus, which may describe the purchase amounts that qualify for a breakpoint discount.

If You Buy Class C Shares:

Class C shares do not impose a front-end sales charge on the purchase, so the full dollar amount that you pay is invested. Often Class C shares impose a small charge (often 1 percent) if you sell your shares within a short time, usually one year. They typically impose higher asset-based sales charges than Class A shares and, since they generally do not convert into Class A shares, those fees will not be reduced over time.

Additionally, in most cases, your total cost would be higher than with Class A shares, and even Class B shares, if you hold for a long time.

Glossary of Terms: Fees and Expenses

Contingent Deferred Sales Charge (CDSC)

This fee is charged when you sell your mutual fund shares. For example, if you redeem shares valued at $1,000, and the mutual fund imposes a CDSC of 1 percent, you would be charged $10 and receive $990. For B shares, CDSCs normally decline over time and, eventually, are eliminated after six years from the purchase of those shares.

Expense Ratio

A measure of the fund’s total annual expenses expressed as a percentage of the fund’s net assets. For example, an expense ratio of 1 percent represents an annual charge to the fund’s assetsincluding your proportional interest in those assetsof 1 percent every year.

The expense ratio includes management fees, marketing and distribution fees (often called 12b-1 fees) and other ongoing fees that are deducted from a mutual fund’s assets. These fees pay for the services of the mutual fund’s investment adviser, the selling advisor or broker, transfer agent, and for other expenses. Front-end sales charges and CDSCs are not included in the expense ratio because they are charged once, and directly to the investor.

The fee table in the front of a mutual fund’s prospectus shows the expense ratio, front-end sales charges, and CDSCs.

Front-End Sales Charge

This fee is charged when you purchase mutual fund shares. For example, you spend $1,000 to purchase Class A shares and the fund imposes a front-end sales charge of 5 percent. You are charged $50 on your purchase and receive shares with a market value of $950. Depending on the size of your purchase, a breakpoint discount can lower this sales charge.

Breakpoint Discounts

A mutual fund may offer you discounts, called breakpoint discounts, on the front-end sales charge if you:

- Make a large purchase.

- Already hold other mutual funds offered by the same fund family.

- Commit to regularly purchasing the mutual fund’s shares.

Asset-Based Sales Charges

These are fees you would not pay directly, but which are taken out of a mutual fund’s assets to pay to market and distribute its shares. For example, asset-based sales charges can be used to compensate a broker for the sale of mutual fund shares, for advertisements and to print copies of the prospectus. Asset-based sales charges include Rule 12b-1 fees, which are dedicated to these types of distribution costs.