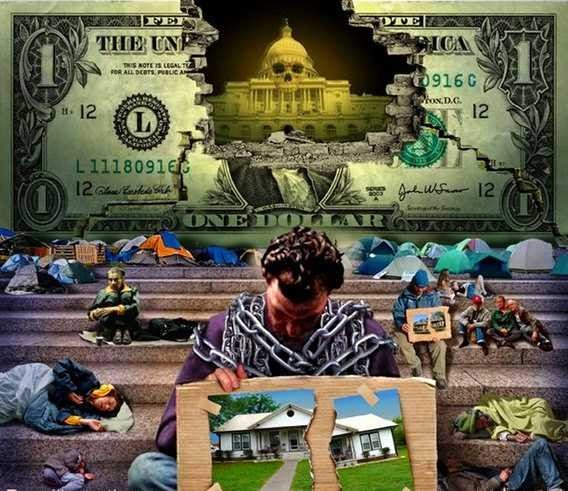

Investments for a dollar collapse independent financial advice

Post on: 1 Июль, 2015 No Comment

Investors have inquired about devalued dollar investments, investments for a dollar collapse, and have asked “will inflation cause a crash?” The standard answer that most advisors offer is that to protect from a possible collapse of the U.S. dollar one should invest in gold, silver, precious metals, oil, energy stocks, stocks of companies that save on the cost of fuel such as railroads, etc.

An alternative technique to protect from a possible collapse of the U.S. dollar one should consider investing in foreign currency.

How does one invest in foreign currency?

• Open a bank account denominated in foreign currency

• Buy U.S. based actively managed mutual funds or ETP’s that invest in foreign currency

• Buy U.S. based actively managed mutual funds or ETP’s that invest in foreign currency denominated bonds

• Buy commodity futures contracts for foreign currencies

• Buy options on foreign currency

The Least Risky Strategy

All of these have risks. The least risky may be actively managed U.S. based open-end mutual funds because the management tries to forecast the risks and make changes. By contrast a passive investment has no one other the individual investor to manage the risks. ETP’s have the risk of counterparty default and tracking error, which can be a concern. Options have counterparty risk and risk of expiring worthless. Futures are highly leveraged and have risk of Backwardation and Contango which produces tracking error.

Few U.S. banks offer foreign currency denominated accounts. By buying mutual funds that hold bonds denominated in foreign currency the investor is getting investment management from the mutual fund and interest earned on the bonds and may get appreciation of the assets. Of course there is risk that the bonds could default. Many Emerging Markets bond mutual funds have a “BB” grade credit quality for their holdings, which is one notch below investment grade, meaning it is junk bond grade. There is always risk in investing. The good news is that carefully selected portfolio of bonds in a mutual fund that has holdings rated an average of “BB” or “BBB” may have a standard deviation (a measure of risk) of 13 which is better than the stock market’s standard deviation of 20. Past performance is no guarantee of the future.

I certainly hope the dollar regains its health and then stays healthy. To make it healthy requires producing better goods and services for export, and making the government solvent. If politicians wont take steps to make the government solvent and make American exports competitive then the dollar will continue to suffer. We need to compete not only in terms of making quality export goods but also in terms of having a high quality, solvent government. For example, when people find out how insolvent U.S. Social Security is compared to Singapores retirement system is then people may wish to avoid investing in the dollar or in U.S. Treasuries.