Investment Policy Statement_3

Post on: 16 Март, 2015 No Comment

Date: October 9, 2014

“California Attorney General sued directors and officers of Monterey County AIDS Project…Settlement created $1M fund plus barred 16 former officers and directors from serving as a fiduciary of any California charity for at least 5 years.” – from the Office of the Attorney General, State of California

Unfortunately, the above or similar types of headlines are becoming far too common for the officers and directors of many not-for-profit organizations. In many cases, board members graciously donate their time and effort to furthering the cause of their chosen charitable related organization; the last thing on their minds is becoming involved in a nasty lawsuit or related litigation. Even more surprising to many board members is that their personal net worth and balance sheet may become subject to risk if they are not fulfilling their fiduciary duty, just as if they were a board member of a publicly held company such as General Electric or Google.

One simple example of a board not fulfilling or breaching its fiduciary responsibility is with respect to the proper execution, adherence, review and modification of the organization’s Investment Policy Statement (IPS). This simple breach of duty may expose board members to personal liability risk. Donors, beneficiaries, insiders, outsiders, the entity itself, the State Attorney General and others are examples of potential claimants in a suit against directors and board members.

Does the above risk mean that you need to turn down all your board positions? The answer is, of course, “no”. However, you do need to follow and comply with well-established best practices to help you enjoy working on a board AND help protect yourself from liability.

First, board members must operate in harmony with well-established case law, which spells out what their fiduciary duties are. These fiduciary duties include making decisions solely in the best interests of the organization, with the appropriate care of a prudent person and free of conflicts of interest. Second, board members are required to act in accordance with the Uniform Prudent Management of Institutional Funds Act (UPMIFA) or similar state act. UPMIFA provides guidance and authority to charitable organizations within its scope concerning the management and investment and spending of funds held by those organizations.

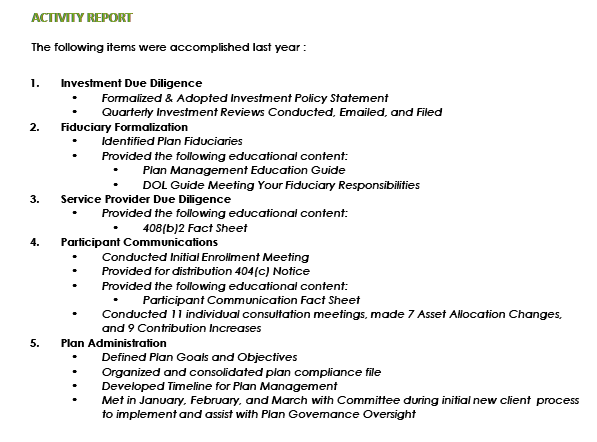

Here are a few tips and items that should be addressed in your investment policy statement:

- Review spending policies. Document and have controls for appropriations and the handling of funds. Make sure the spending level outlined in the policy can be maintained in perpetuity and will not “spend out” the endowment in a few years.

- Be very clear with respect to the objectives and related financial goals, attitudes and expectations.

- Create a prudent diversified portfolio in accordance with UPMIFA standards. Stick to the allocations in your IPS or timely modify in writing if the objectives and guidelines change. Make sure you change the guidelines before your new investments are made into different asset allocation classes or weightings. Have a method of disposing of inappropriate assets (assets that don’t fit in your IPS).

- Understand the true costs of your investments and determine if they are appropriate.

- Use third-party experts to help periodically analyze your procedures and IPS. These experts should have an unbiased point of view and can suggest any necessary changes in policy to your board.

- While you can delegate activities to consultants and money managers, you should remember that the board has the ultimate fiduciary duty and decision making authority. Make sure the board monitors all service providers on a regular basis.

- Lastly, avoid conflict of interest and do not have the consultant reviewing the investment policy be the investment manager, your best friend, a fellow Board member, or an acquaintance performing a favor for the charity.

Staying in compliance with UPMIFA is an on-going regular process, not a one-time event. Organizations, board members and goals can change, so it’s important that policies and documents are monitored periodically. Following best practices, basic and well documented review procedures will reduce the personal liability risk for all Board members and officers as well.

Warren Averett has a knowledgeable and dedicated Nonprofit Service Group, who offer hands-on experience and technical skills to serve the unique needs of nonprofits. To learn more about our nonprofit services, visit our non-profit page (www.warrenaverett.com/industries/nonprofits ).