Investment Plus About Style Analysis

Post on: 14 Июль, 2015 No Comment

MANAGER STYLE ANALYSIS

The returns-based investment style optimization capabilities found in Investment Plus can add a whole new dimension to your investment decision making. Investment Plus uses the same techniques popularized by Prof. William Sharpe which have received industry-wide attention. At no extra charge, it comes complete with all of the necessary analytical features.

STYLE BENCHMARK

Investment Plus helps you determine the appropriate weighting of different types of investment styles (called "e;asset classes"e;). You can analyze all major types of mutual funds, money manager products, and multi-manager funds including: domestic equity, domestic fixed income, international equity, international fixed income, and globally balanced.

What is the appropriate benchmark for evaluating a particular fund’s investment performance? Investment Plus provides insight by creating the best Style Benchmark for the fund. That is, the combination of the asset classes which have best tracked the historical performance of the fund over the time period being analyzed. Using optimization techniques, Investment Plus will find the portfolio of asset classes that have had the highest correlation to the fund.

PERFORMANCE ATTRIBUTION

Does the fund manager exhibit superior security selection ability? Investment Plus can be used for evaluating the fund’s returns performance. When using the Style Benchmark as a tool in performance measurement, the returns obtained from the Style Benchmark are compared with the returns achieved by the fund.

The Style Benchmark is used to separate the market return and the style return from the fund’s return. By viewing whether the fund outperformed its Style Benchmark, the Style Benchmark can be used to evaluate the security selection ability of the manager. Positive excess returns indicate superior selection ability, while the opposite is true of negative excess returns. See if the manager has earned their active management fee.

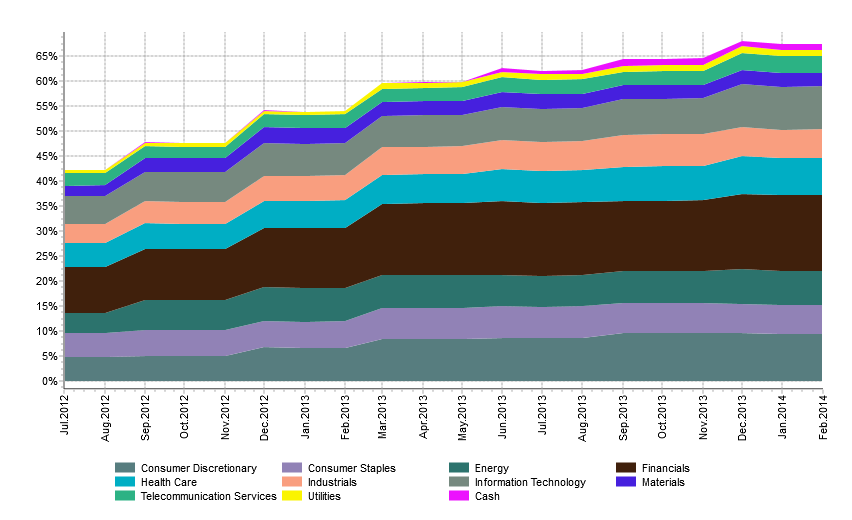

STYLE DRIFT

Has the fund’s management style remained fairly constant, or has it changed dramatically over time? Investment Plus can examine the behavior of the fund’s Style Benchmark over time. From this history, shifts in the management style of the fund can be observed.

To generate the history of the Style Benchmark, the optimization calculations are repeated many times (according to the time period covered and averaging period used) to compute the style points at each interval. Before, this type of analysis would be impossible using the traditional approach of dissecting the individual fund holdings.

The Historical Style Map in Investment Plus is another way of showing the history of the Style Benchmark over time.