Investment India Foreign Investments FDI India

Post on: 16 Март, 2015 No Comment

Investment India, Foreign Investments, FDI India

Welcome to Invest in India

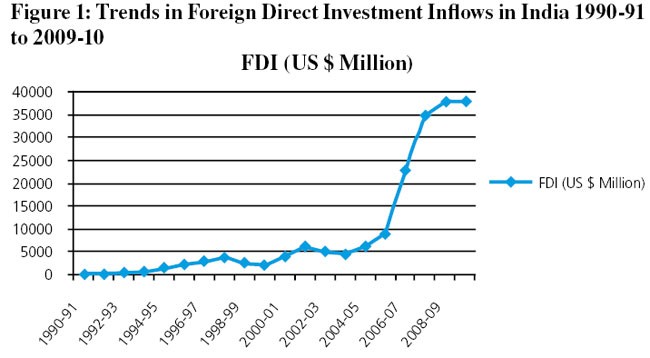

INVESTMENT in India and FDI India inflows are a by-product of improved market sentiment across the globe. In recent times it has become obvious that more and more share market punters are open to investment in India, with a widespread revival of foreign direct investment (FDI) seeing FDI India-bound thanks to an upward movement in consumer confidence levels.The types of investment India has, that interest overseas investors, include interest in the banking sector. The investment in India in the banking sector has gained momentum in the last 3 years especially as investors are willing to invest India thanks to the commercialisation of banks, and consider FDI India through financial collaborations.

Investment in Indian joint ventures by foreign investors is also a growing area, but FDI India is not permitted in certain industrial sectors such as arms and ammunition, railways, iron mining and coal mining – to name a few. Foreign investors got more used to the idea of to invest India thanks to the ability of Indian companies to raise equity through Global Depository Receipt (GDR). This type of foreign interest is the kind of investment India needs to try to encourage to globally attract more investment in India into the future.In terms of investment India previously treated FDI India and FDI as a whole as a necessary evil.These days, thanks to new industrial policies in India, foreign investment in India is no longer seen as “taboo” by westerners, and more and more westerns are likely to begin to invest India and enjoy the lessening of operational constraints that used to plague foreign investors who first began westernised breakthrough investment in India.

India now boasts a bustling and vibrant private sector of business that is continuing to pique the interest of foreigners who have been researching the most lucrative investment India can offer. A new policy in India also permits ease of approval for equity investment in India with the proviso that such transactions are made in priority industries, of which there are 35. These priority industries in India are believed to be the drivers of foreign investment in India, but are also opening many investors up to the complicated system of tax India contends with. The main source of foreign investment India attracts is within the 35 industries that determine the industrial activity in India and therefore the FDI India attracts overall.

Some foreign investors believe that investment in India has too many constraints and will not even consider to invest India at all.

The Indian economy needs to focus not on convincing those unlikely to consider the types of investment India offers up, but nurture the foreign investors who already have investment in India and plan to continue to build upon this.