Investment fees and costs

Post on: 26 Июнь, 2015 No Comment

Content

The investment fees and costs you pay will depend on the types of investments you make and how you purchase them. The costs will have some impact on your returns, so it is important to understand how much you are paying and what for. You can then decide whether the service is worth the cost.

Most fees and costs relating to investments fall into five categories:

- costs to buy an investment

- costs when you sell an investment

- investment management fees

- financial advisor fees

- administration fees for registered plans.

Not all types of costs apply to all investments. In some cases, costs such as sales commissions are included in the price you are quoted to buy the investment. This is generally the case for bonds.

Costs to buy an investment

- If you buy investments such as stocks and exchange-traded funds, you will usually pay a trading fee every time you make a purchase. For this reason, it is better to limit the frequency of your purchases. Brokerages and investment firms set their own fees, so the amount will depend on the company you use.

- For “no load” mutual funds, there is no fee to purchase units.

- Other mutual funds charge “front-end load” fees when you buy them. The fees are generally a percentage of your purchase price.

Costs when you sell an investment

With some mutual funds, instead of paying a fee when you buy the investment (“front-end load” fee), you pay a fee when you sell. This is known as a “back-end load” fee.

The fee is generally a percentage of your selling price. It is normally highest in the first year after purchase and gradually decreases for every year you hold the investment. If you hold the investment long enough (often for several years), the fund dealer might agree to waive the fee. Think carefully before agreeing to buy funds with back-end load fees because the fees come out of the selling price of the investment and can be as much as 7 percent if you want to sell in the first year.

Investment management fees

Investment funds, including mutual funds and segregated funds, charge a fee for managing the fund. The fees are called the Management Expense Ratio (MER) and may include an ongoing commission paid to advisors who sell the fund to their clients. The MER is paid regardless of whether the fund makes money. It is deducted before calculating the investor’s return.

For more information on MER and a detailed example of its potential impact on your investment return, see the FAQ “What is a management expense ratio? ”

Advisor fees (how advisors are paid)

Advisors are paid in different ways, depending on the type of service they provide. For example, an advisor helping you put together a financial plan might be paid an hourly fee, whereas an advisor making trades on your behalf might be paid per trade.

If you plan on using the services of an advisor. it’s important to know exactly what kind of services the advisor provides and the cost as well as how the advisor is paid.

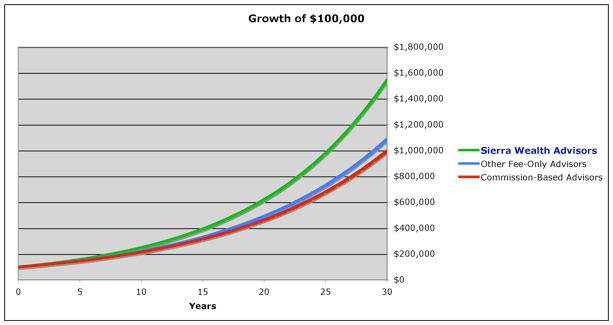

While most advisors strive to give good advice, advisors who are paid by commission have an incentive to encourage you to invest where they will earn the highest commission. Those who are on salary, on the other hand, may have an incentive to promote what their employers offer. Ask for information on your investing options and fees before you purchase any investment product.

Administration fees for registered plans

When a bank, brokerage firm or other financial institution sells a registered product such as a registered retirement savings plan (RRSP) or a tax-free savings account (TFSA), the Income Tax Act requires the product to have a trustee.

Investors generally have to pay an administration fee (also known as a “trustee fee”) for the services the trustee provides — for example, filing the necessary documents with the Canada Revenue Agency. In certain cases, if the overall value of a portfolio is above a certain amount, the company that holds your plan may waive the fee.