Investment Evaluation – How to Carry Out SWOT Analysis

Post on: 16 Март, 2015 No Comment

Last Updated: 8 th Jul 2012

Published: August 2011

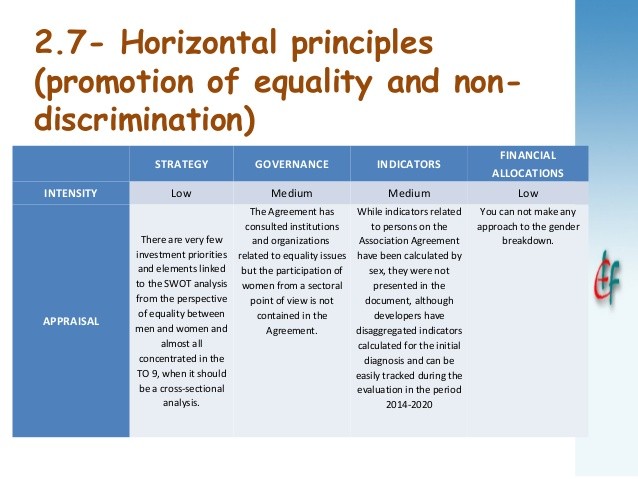

Prior to spending hard earned money on an investment, it’s worth making a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities and Threats, or simply, it’s an investment evaluation procedure that looks at what a company is able to do and what it can’t do. On the ‘can’t’ side, you mainly look at threats the company can’t do anything about.

Some threats such as natural calamities can be overlooked if the investment evaluation proves to be profitable in the near future. That said one has to prepare a plan for such eventualities. If you want to evaluate an investment before spending money on it, the following will help.

How long will you be investing: You should start any investment evaluation by first deciding how long you wish to invest. Will you be going for short term usually a few months, medium term or long term usually more than a couple of years?

If you are going for short term, you might what to take a look at blue chip companies especially startups since most boom and go burst rapidly. As Bill Gates said, technology has the shelf-life of a banana, so you need to get in and out fast.

Those looking for medium to long term investments, go for solid companies with large asset bases especially those that have been in the market for long. Also, choose companies that have a proven track record.

Present value and future income: Most companies will sell you their stock promising higher returns in the future and although some are right, 9 out of 10 companies fail in their first 10 years.

It’s tempting to focus on large amounts in the future, but wise to look at what the company is doing now. For example, when buying a stock, don’t fixate on the price rather than dividends paid per stock.

Return on Investment: Do not spend money on an investment before you have a clear understanding of what and how much you expect. Also, have an exit strategy. Most people enjoy the ride upwards and fail to notice when a down turn begins. This is vital especially for short term investors who are looking for price gain on a stock.

Risks: Part of SWOT analysis entails evaluating weaknesses and threats on the company side as well as your side as an investor. Ask yourself if your family would be rendered homeless if the company you are about to invest in went belly up. Also, does the company have enough capital and assets that can be liquidated to give your money back? Never invest money you cannot afford to lose.

Expense ratios and conflicts of interest: Although an investment looks good today, it could translate to losses in the future. Factor in elements such as inflation, taxes, legal fees and other expected expenses that might be encountered in the future. Also, be on the lookout for representatives selling you investments which are part of their job. Sometimes they might mislead you just to make a commission.