Investment Diversification_2

Post on: 2 Июнь, 2015 No Comment

Diversification is a smart move for all investors, beginner investors or seasoned Wall Street veterans It is defined as “a technique for the identification and assessment of potential risks and combines a diverse array of investments in a portfolio.” Diversifying investments means that the risks associated with investing is spread amongst different kinds of investments. These are known as different asset classes. Diversification is also known as a diversified portfolio, or portfolio diversification.

In a diversified investment regardless of what happens in the economy there are some asset classes that will benefit. What this means is that the potential for your overall portfolio to lose at any point of time is much less. Over a lengthy span of time having a diversified portfolio of investments means in essence that you will have better returns with a lower risk factor attached to them. A well diversified investment or well diversified portfolio is often composed of U.S. small caps and large caps, as well as foreign stocks. It may also contain bonds, mutual funds and commodities. Many investors start out with small and stable investments such as certificates of deposit (CDs) that come with very little risk and then start to add more investment options to their portfolios once they become more comfortable with the investing process.

The importance of investment diversification becomes obvious the more you invest. Diversification is a kind of technique whereby risks are reduced when investments are allocated to an array of financial instruments, not to mention financial industries. The goal of such is to maximize the returns that can be made when investing takes place in different areas. Each of these areas often reacts in a different and unique manner to the exact same event. It is important to stop here and note that the vast majority of investment experts caution that while diversification does not guarantee that losses will not occur it is the most significant aspect of reaching the financial goals that an investor has on a long-term basis while at the same time reducing risk. Here we explore this even further. Read on.

Investment Risks

Risk is something that every investor must be prepared to deal with. Some investors thrive on risk while others worry more about it. Regardless of which type of individual you are, risk and investing walk hand in hand. You will not find one without the other. There are two main kinds of investment risks. There are undiversifiable risks and diversifiable risks.

Undiversifiable risks are also sometimes referred to as market risks or systematic risks. This type of risk is connected to every company. These risks come about due to such things as interest rates, exchange rates, inflation rates, war or political instability. This particular risk is not specifically tied to a certain industry or company. An undiversifiable risk is one that an investor must be willing to accept as it comes with the investing territory. Diversifying your investments will not reduce or eliminate the risk so accepting its reality is essential.

Diversifiable risks are the flip side of undiversifiable risks. They are also called unsystematic risks and they are specific to a country, a market, an economy, a company or an industry. This type of risk can be reduced by diversifying a portfolio. The two most common sources of this kind of risk include financial risk and business risk. The goal behind this then is to invest in a selection of assets in order that market events play no role whatsoever in your returns.

Why Diversification is Investment Savvy

Let us stop here at look at an example to illustrate the point of why diversification is a wise move when you invest. Let us imagine for a moment that your investment portfolio contains only airline stocks. If suddenly pilots decide to go on an indefinite strike and therefore flights are canceled then this will cause the share prices of the stocks for the airline to plummet. This means that your investment portfolio will drop in its value. If on the other hand you decide to also have some railway stocks in your portfolio then only a portion of your portfolio will be affected by the strike. It is likely in this case that the airline strike will cause passengers to look to trains as an alternative mode of transportation for their travel plans which can cause a rise in the stock prices of the railways stocks.

However let us take this one step further. There are risks inherent in airline and railway stocks because both are forms of transportation. For this reason you should choose to diversify even further. In other words, expand your investments to other areas. There is a strong correlation between airline stocks and rail stocks which is why you need to diversity to other companies but also other industries, and not just the transportation industry. Think of it this way, the more uncorrelated the stocks are that you decide to purchase, the better it is for you overall.

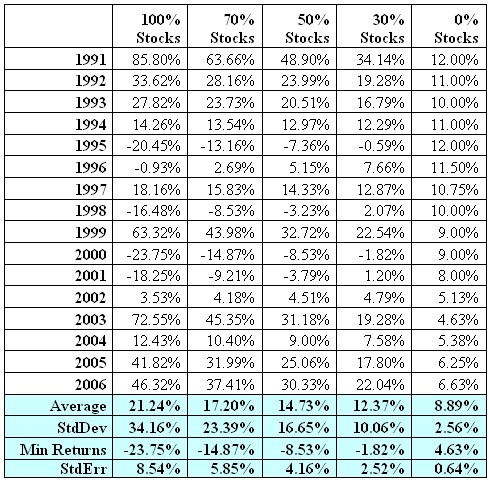

It is also wise to diversify your investments amongst different classes of assets. This is because different assets, such as bonds, mutual funds and stocks will not react in the exact same manner to unfortunate market events. If you have a combination of asset classes then this makes your portfolio less sensitive to the up and down swings that are common to the financial markets. As a general rule the bond markets and equity markets move in different directions. For the investor this means that if you diversify across a selection of areas then negative movements will be countered by positive effects in other areas. It is all about balance.

An investor’s risk in terms of tolerance levels is a significant consideration when it comes to the importance of diversification. There are plenty of synthetic investment products available that allow for diversification but are too involved and complicated to be put to use by novice investors and/or those investors who wish to start small and stay small for awhile. For the new investor who does not have a lot of experience or the investor who lacks financial backing with which to hedge activities, bonds are one of the best ways and indeed the most popular manner with which diversification against the stock market is possible.

Even when an investor does a thorough analysis of a given company and the company’s financial statements this does not guarantee 100 percent that it is not an investment that will result in some loss. It cannot be emphasized enough that diversifying an investment portfolio will not necessarily prevent the potential for a loss but what it can do is reduce the impact that bad information and fraud can have on your all-important portfolio.

Investing in ETFs offers investors broad diversification of mutual funds with the instant liquidity

It does not take a technical analysis expert to figure a trend in the stock market. It is hard to ad

It is important not just to have an investment portfolio but to have a well-maintained and profitabl