Investing Unit 5 MortgageBacked Securities

Post on: 21 Август, 2015 No Comment

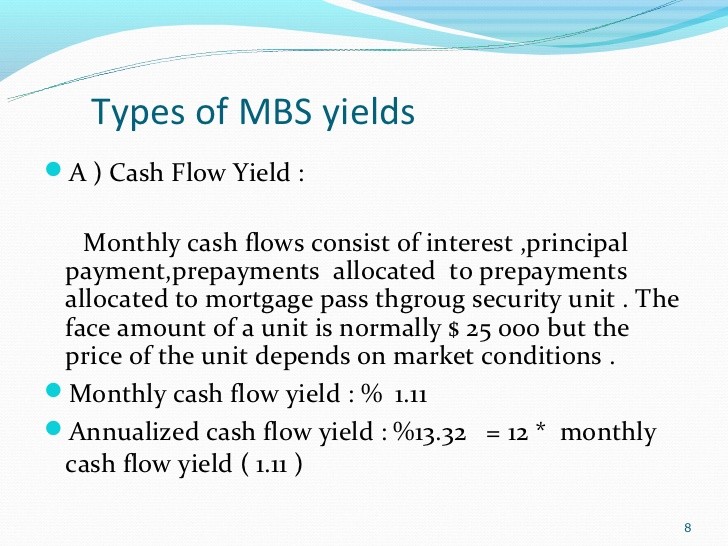

Mortgage-backed securities are investments in a portfolio of home mortgages and are sometimes referred to as pass-through securities because homeowners’ mortgage principal and interest payments are passed through to investors. The most well-known mortgage-backed security is the Ginnie Mae. which is issued by the Government National Mortgage Association (GNMA). Ginnie Maes carry the full faith and credit guarantee of the federal government and require a $25,000 minimum purchase through a broker. You can also sometimes buy them at a discount for less than $25,000 if their interest rates are low compared with current interest rates. Ginny Maes can also be purchased indirectly for $1,000 through units in a Ginnie Mae unit investment trust and through mutual funds that invest in U.S. government agency securities (minimum amounts vary per fund).

The biggest disadvantages of mortgage-backed securities are an uncertain maturity and irregular monthly payments. Although the mortgages in their portfolios are issued for 30 years, the average life of a mortgage-backed security is only 10 to 12 years because homeowners frequently move or refinance. Also, if investors spend the part of their monthly check that is a return of principal, instead of reinvesting it, they will have nothing left when the last mortgage in their Ginnie Mae portfolio is repaid.

Collateralized Mortgage Obligations

Collateralized mortgage obligations (CMOs) are another type of mortgage-backed security. CMOs were developed to address investors’ concern about receiving income from other mortgage-backed securities in unpredictable increments. With CMOs, the portfolio of mortgages is divided into various classes, called tranches. thus offering investors a choice of estimated maturity dates to match financial goals. Investors in a particular tranche receive periodic income payments (typically monthly) that differ from period-to-period and from other tranches. Tranches with a longer maturity generally pay a higher return to compensate investors for incurring greater interest rate risk. The principal portion of mortgage payments corresponding to all tranches goes to investors in a single tranche until that tranche is retired. Each tranche gets its principal back when all the tranches before it have been repaid.

CMOs are available in $1,000 increments through brokerage firms and pay a higher yield than comparable mortgage-backed securities. Two disadvantages are their complexity and the fact that principal prepayment can still come sooner (or later) than expected. Just as with other mortgage-backed securities, investors must realize that principal is being repaid throughout the life of a CMO, not at maturity like bonds. Investors who mistakenly think that CMO payments are just interest may inadvertently spend their principal.