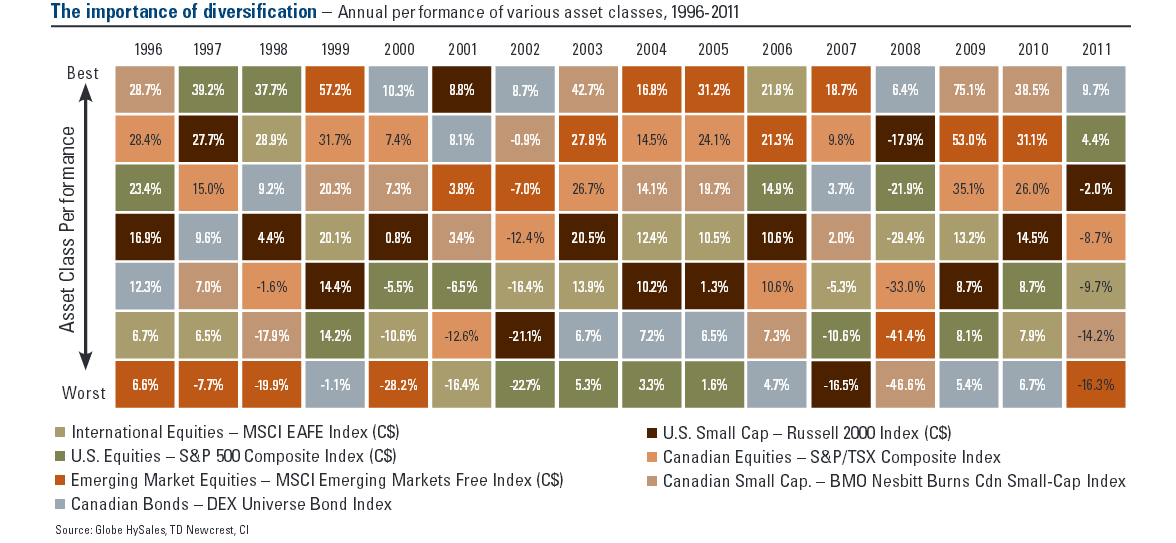

Investing The Importance of Diversification

Post on: 4 Август, 2015 No Comment

Consumer Investments

The Importance of Diversification

If you asked a dozen stock experts to pick their favorite publicly traded company, chances are, you might get a dozen different answers. However, if you asked each one if it is important to diversify your stock holdings, most likely you would get unanimous agreement in the affirmative.

To look more closely at how industries are divided and how many are available in one form or another to investors, let’s look at the companies that make up the best known market index out there — the Dow Jones Industrial Average. No longer simply comprised of companies in the industrial sector, from which it’s name originates, the Dow Jones Industrial Average, or more often simply called the Dow, tracks the value of a selected group of stocks over a given time, with the index being constantly updated throughout the trading day.

The Dow is comprised of 30 large publicly traded US-based companies and the industries that these particular companies belong to include, among others: aerospace; banking; beverages; broadcasting and entertainment; chemicals; computer networking; computers and technology; construction; consumer finance; consumer goods; fast food; food processing; oil and gas; pharmaceuticals; retail; semiconductors; software; technology, telecommunications. In addition, there are three conglomerates, such as General Electric that have holdings in too many different industries to be specifically classified.

In looking over the industries of the companies tracked in the Dow, it’s easy to see the diversification. For instance, could two industries be further apart in our economy than banking and beverages? Or what about aerospace and food processing?

Of course, there are many other reputable and financially stable companies traded in the US that are part of other industries, such as in consumer discretionary; energy; health care; information technology; and utilities.

From the wide range of publicly traded stock available, it requires research and education for us to find profitable investments, but the diversification is already there waiting for us to pick and choose our favorite companies. Investing in stocks can be much more interesting, even enjoyable, if we stick with what we know, meaning companies we particularly like, e.g. patronize regularly, and spread our investment dollars out across the wide spectrum of sectors in the market. Or, if we do not have time to do the necessary homework to build a diversified portfolio, we can purchase shares of index funds that provide immediate diversification and there are also mutual funds galore available on the market that supply instant diversification. It’s our money, it’s our choice.