INVESTING New online brokers let you build your own mutual fund at a bargain price

Post on: 22 Май, 2015 No Comment

Four new Internet-based brokerage firms have begun offering investors the opportunity to create their own mutual funds.

They are capitalizing on a widespread, growing discontent with conventional funds.

Although they differ in details — most notably, their fee structures — all four firms offer investors the opportunity to pick their own stocks and assemble diversified portfolios at low cost.

The premise is that at least some individuals can make out better financially by creating home-brewed mutual funds, rather than entrusting their money to mutual-fund managers.

Mutual funds hold more than $4 trillion in investor assets, says John Collins. a spokesman for the Investment Company Institute. the fund industry’s chief trade organization. On the surface, that seems to suggest that there is hardly any discontent at all.

But many people who invest in mutual funds do so grudgingly.

Those who participate in 401(k) retirement plans at work usually have no choice but to channel their money into funds. Their employers require it.

In addition, people with limited assets who want to invest on their own often choose mutual funds because the funds offer convenient diversification. For a few hundred or a few thousand dollars, a mutual-fund shareholder can buy a stake in dozens or even hundreds of companies.

Nonetheless, mutual funds have some glaring faults.

Their most unforgivable fault is that they can’t seem to consistently beat or even match the stock market averages.

In recent decades, close to 80 percent of equity mutual funds have performed worse than the Standard & Poor’s 500 index, the fund industry’s principal benchmark.

Adding insult to injury, mutual funds charge substantial man agement fees despite their inferior performance. The average is somewhat more than 1.2 percent of assets per year — year after year after year.

Over many years, that can take a heavy toll on investor wealth.

Another common gripe against the funds is that most of them are not tax efficient. By and large, fund managers buy and sell stocks frenetically, without regard to the tax consequences for their shareholders.

That may not bother people in 401(k)s and other tax-deferred plans, but it can be extremely annoying to people who hold fund shares directly.

By law, any capital gains realized when a fund sells stock must be passed along to the fund shareholders, who then must dig deep to pay the tax man.

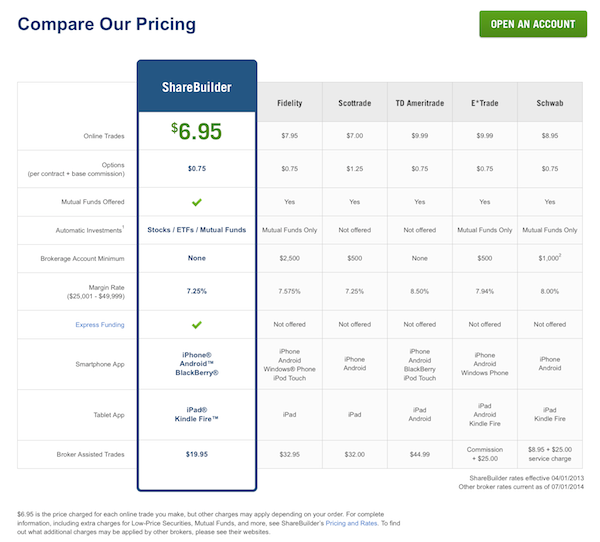

Riding to the rescue are brokerage firms called Sharebuilder .com. BuyAndHold. Foliofn and eInvesting. BuyAndHold started up in November, Sharebuilder.com in December.

Each is designed to let individual investors gain greater control over their investments.

To accomplish this, they let investors buy stocks in specified dollar amounts, rather than according to the number of shares. This means that the investors can buy one share of a particular stock and even a fraction of a share.

For example, if you have only $2,000 and want to spread it evenly among 10 stocks, you can do it. If one of the stocks that interests you is Berkshire Hathaway, which recently was priced at close to $60,000 per share, you can allot $200 to buy 1/300th of a share.

There is no such thing in the real world as 1/300th of a share of Berkshire Hathaway — or any other stock. To get around this problem, the brokerage firms pool the purchases (or sales) of all their customers, piecing together fractional- share transactions to make whole shares.

On the broker’s account books, however, the individual with $200 to invest in Berkshire Hathaway will be credited with ownership of 1/ 300th of a share — no more, no less.

Two of the brokerage firms — Sharebuilder.com, which began doing business last November, and BuyAndHold.com, which opened shop in December — are designed mainly for low-asset investors — those with only a few thousand dollars or even a few hundred to invest.

They feature extremely low commission costs, which allow investors to make small purchases and sales without giving up a substantial percentage of their assets.

Foliofn, which began operating last March, and eInvesting, which is still in the startup phase and not yet accepting accounts, are designed for somewhat more upscale customers — those with assets in the tens of thousands of dollars and higher.

Sharebuilder.com (www.sharebuilder.com ) is a unit of Netstock Direct, a broker-dealer based in Bellevue, Wash.

It lets its customers select investments from a list of 2,000 stocks and charges as little as $2 per transaction — far below the average online brokerage commission of $15 or so. Each investment can be as small as the investor chooses; there is no minimum.

To qualify for the $2 commission, you have to be willing to invest on a regular, automatic basis, and you may have to wait up to a week before the broker places your order, along with all the others it has accumulated from customers.

By contrast, the firm’s commissions on one-shot transactions executed instantly run as high as $19.95 per transaction.

Jeff Seely, Sharebuilder.com’s chief executive, says most of his firm’s customers have been putting together portfolios of three to 10 stocks.

Sharebuilder.com encourages clients to make fixed-dollar purchases at regular intervals, after the manner of dividend reinvestment plans. Seely considers his firm’s investment program an improvement over DRIPs, however, because only about 1,000 companies offer DRIPs. That is half the number of stocks on Sharebuilder’s list.

Seely points out that such investor favorites as Microsoft, Cisco Systems and Dell Computer do not offer dividend reinvestment plans, but they can be bought through Sharebuilder.com.

Marisa Williams. 25, of Oakland, an editor with a management-consulting firm, says she switched her securities account to Sharebuilder from Morgan Stanley Dean Witter to save money on brokerage fees.

She wanted to put some of her money in a self-directed brokerage account because she wasn’t entirely satisfied with the mutual funds offered by her company’s 401(k) plan.

Only having to pay $2 per trade has encouraged me to invest on a regular basis, she says. She opened her account a few months ago with $5,000 and has been putting in more money every week. She now has a portfolio of seven stocks — mainly consumer and Internet issues — worth close to $20,000.

It’s wonderful that you can do it yourself, she says. You are totally in control.

New York’s BuyAndHold (www.buyandhold.com ) also lets customers pick from a list of about 2,000 stocks. It executes customer transactions twice each market day, during a one-hour period in the morning and another one-hour period in the afternoon.

Investors can invest as little as $20 at a time, and the commission for a purchase or sale is a flat $2.99.

Peter Breen, chief executive of BuyAndHold, boasts that his firm allows customers to control their diversification and risk — something that is harder to do when they buy mutual funds.

Unlike the executives of the other firms, he is willing to say how many customers he has: 90,000. The average account is close to $2,000, he indicates, so total customer assets amount to about $200 million.

Foliofn (www.foliofn.com ), based in Vienna, Va. was founded by Steven Wallman, a former commissioner with the Securities and Exchange Commission. After leaving the SEC a couple of years ago, he founded Foliofn as a viable alternative to mutual funds.

In years gone by, such an enterprise wouldn’t have been cost efficient, says Nancy Smith, a Foliofn vice president. But thanks to the Internet, the savings on labor and other costs are great enough to let Foliofn provide its services at reasonable rates.

The firm doesn’t charge by the transaction. Rather, it imposes a flat fee of $29.95 per month or $295 per year.

That is roughly what the average mutual fund charges to manage a portfolio of $25,000. Foliofn’s services should appeal to investors with considerably more than that, but its fee might seem too pricey to those with considerably less.

However, you get a lot for your fee. You can buy and sell shares as often as you please in up to 150 different companies. The transactions are executed twice per market day — early in the morning and late in the afternoon.

The most mysterious of the four brokerage firms is eInvesting.

Based in San Francisco, it recently was acquired by E-Trade Group, one of the pioneer online brokerage firms. That appears to have complicated its planning.

It has said in the past that it will begin operating next month, but now that isn’t certain, says Ben Phillipps. vice president for marketing.

Phillipps says eInvesting might charge a fee based on the amount of assets in a customer’s account. Just how large that fee might be is up in the air, he adds.

However, he stresses that eInvesting will go out of its way to cater to its customers’ most extreme quirks. He says, for example, that if someone wants to emulate an index fund by investing a few dollars in each of the Standard & Poor’s 500 stocks, we expect to be able to accommodate them.

Russ Kinnel, a research analyst with Morningstar Inc. the Chicago firm that tracks mutual-fund performance, calls the build-your-own movement innovative and really interesting. He expects it to put pressure on the fund industry to reduce its fees.

However, he warns that many individual investors don’t have enough time or savvy to make sensible choices when they pick their own stocks.

If you’re not smarter than the market, he says, you may as well just buy an index fund or buy the services of a fund manager you think is smarter than the market.