Investing Money Markets Money Market Funds

Post on: 28 Апрель, 2015 No Comment

Money market funds are pools of short-term securities such as Treasury bills, Commercial Paper, Banker’s Acceptances, and Certificates of Deposit selected by fund managers to provide a portfolio that has very low risk but typically better returns than savings accounts. The lowest risk is a fund that invests in Treasury bills exclusively – and this fund will also pay the lowest return. However, there is only about a 1.5 percentage point difference between the worst and best returns among all money market funds.

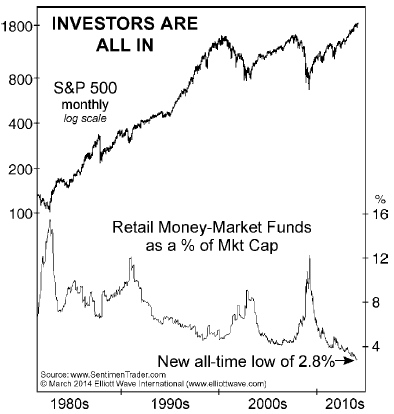

Money market funds are useful if an investor wishes to “park” his or her money while seeking other investment opportunities or if funds will be needed in the near future. They are also excellent for emergency fund purposes – the three to four months’ equivalent-to-net income that financial advisors recommend all clients have available for immediate use should the need arise.

To benefit from a money market fund, an investor should invest only in a fund that does not charge a sales fee (load) and that offers the lowest management expense ratio.

The price of money market funds is set at $10 per unit. Thus, it is the yield of the fund that fluctuates and not the unit value in almost all cases. Advertisements for mutual funds will give two rates of return, known as the “effective” yield and the “indicated” yield. The indicated yield is the amount earned by the fund over the last seven days expressed on an annual basis. The effective yield assumes that the indicated yield will hold true over the next year. This assumption can be highly inaccurate if, for instance, interest rates were to decline over the year.

Interest rate risk is one major risk faced by money market investors. If the investments within the fund are longer-term in nature, say perhaps closer to a year before maturity, and interest rates rise in the interim, the fund will not be able to react to that increase. For this reason, the investor should examine the portfolio of investments within the fund to ensure it is oriented towards the short-term.

The other major risk incurred when investing in money market funds is inflation risk. If the return from the fund is 3% and the inflation rate is 5%, the investor is actually losing purchasing power. This is one reason money market funds are recommended for short-term investing. Over the long haul, the investor will want to find an investment solution that comes closer to returning an amount equal to or greater than the rate of inflation.

Mutual funds in Canada are highly regulated, and performance data is easy to acquire. Mutual funds are issued by prospectus and it is important to note that returns are not guaranteed and principal is not guaranteed. Unit values fluctuate in value and investors may pay commissions to buy and/or redeem and sell mutual funds. Investors should always read the prospectus prior to making an investment into a mutual fund.