Investing Like the Harvard and Yale Endowment Funds

Post on: 16 Март, 2015 No Comment

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

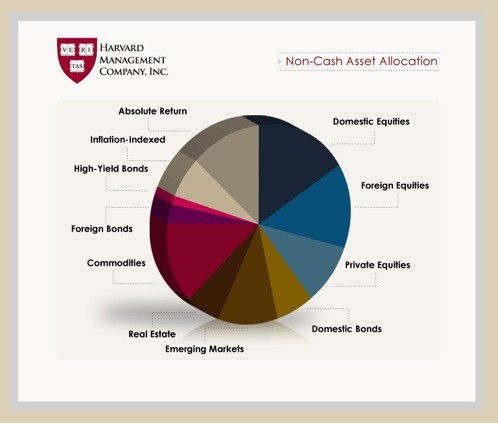

The university endowment funds of Harvard and Yale have been leaders in diversified multi-asset class investing for over two decades. Through this approach to investing and their exposure to alternative asset classes they have consistently achieved high double-digit annual returns with low risk and only moderate draw-downs.

The rationale for investment across multiple asset classes is supported by Modern Portfolio Theory. This theory, which was developed by Nobel Prize winner Professor Harry Markowitz, shows how risk adjusted returns of a portfolio can be improved by diversification across assets with varied correlations. Modern Portfolio Theory is at the heart of the investment philosophy of the Super Endowment Funds and is the foundation upon which their portfolios are constructed.

The Endowment Funds are very well resourced and have access to the best institutional, private equity and hedge fund managers, and this adds to their investment success. However, in this note we show that by adopting asset allocation principles similar to the Super Endowments it is possible for high net worth investors to also obtain high levels of risk adjusted return; superior to traditional equity/bond portfolios and most balanced investment funds.

Overview of US Endowment Funds

US endowment funds are non-taxable vehicles established to contribute towards the future funding requirements of colleges and universities. Their funding comes from a combination of legacies, gifts and investment returns. In the US there are over 750 endowments with an average of $520 million in funds; the largest fund has over $34.9 billion.

Examining the strategies of the US endowment funds is of relevance to investors for a number of reasons. Firstly, US endowment funds have consistently achieved superior investment returns. This is especially the case for the largest endowment funds those with assets greater than $10 billion comprising Harvard, Yale, Stanford, Texas System and Princeton. They have achieved an average 10 year annualized return of approximately 14.6%, roughly double the returns for traditional 50% equity and 50% bond portfolio while incurring a lower level of investment risk (see Table 1). 1

Table 1 10yr Annualised Returns by Endowment Fund Size to June 2007