Investing in Stock Today REITs and Real Estate Mutual Funds Investing RISK v

Post on: 5 Июнь, 2015 No Comment

Share:

April 14, 2009 02:37 PM

If you are new to the world of investing you may look at every stock, bond, mutual fund and other offering on the stock market as an investment that is just waiting to help you make a lot of money. But the reality is that you really have to know what you are doing and how to do it in order to see a good profit from investing.

One of the important things you need to learn about any investment is risk vs. return.

This is a two-fold process of looking into the risk that is involved with an investment (will it be there tomorrow or will the company that I purchased shares in and my money be gone?) as well as the return (how much will I make off of this investment?).

Risk

The first thing you want to look at is risk. If you have a lot of money and don’t mind tossing some away, you may be willing to take more risk with your investment. But most investors fit into a category of people who are not rolling in the dough. They are people who have a little extra cash and are trying to invest it wisely to see that money grow so they can use it in the future. It could be the beginning of a college fund or retirement fund. Either way it is vital the money be there down the road.

To this end you need to make sure you select a lower risk investment. The wise investment in this case is real estate. Real estate is based on a tangible item, property. While values may fluctuate with the market, property itself will never disappear and will be there in the long run. That is much more than can be said for many businesses.

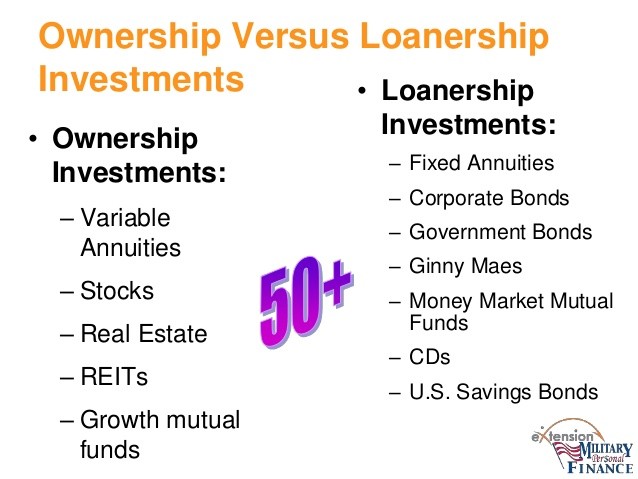

The second level of risk is in whether you are going to purchase a single item or a lot of them. In this case you may want to look at REITs and real estate mutual funds. REITs are real estate investment trusts. Both REITs and real estate mutual funds are essentially portfolios of stocks and bonds of real estate related companies and services. By purchasing into one of these you are not putting all of your money in one place, but rather diversifying by buying into a portfolio.

Return

The next thing to look at is returns. This one is easy. Simply look up the REIT or real estate mutual fund you are considering purchasing on REITBuyer.com. You will be able to take a look at the fund’s performance over the past year, three years, five years and longer in many cases. This will give you a good look at what type of return it has been making.

Remember when you are looking at returns that the last year has been a very unusual one for the market, so you may want to look at the longer-term returns on the funds you are considering to understand how they will perform in a normal market.

Most REITs offer an average of 6% returns on an investment. This is a nice steady growth of your money.