Investing In Mutual Funds

Post on: 21 Июнь, 2015 No Comment

Are you interested on investing in mutual funds? Do you want to know how mutual funds work and what are the advantages and disadvantages of investing in mutual funds? Then read on and hopefully, I can help you learn the basics of this investment instrument.

If its your first time to hear about mutual funds, then you might be asking what they are. In very simple terms, a mutual fund is a pool of money from many different people (which could be hundreds, even thousands). This money is collected by a company which acts as the mutual fund manager who then invests the money in stocks, bonds, the money market and many other locations.

In other words, investing in mutual funds is like entrusting your money to someone in the hope that he can make your money grow better than you can. Of course this someone is not just some ordinary Joe, but one that has years of experience in investing.

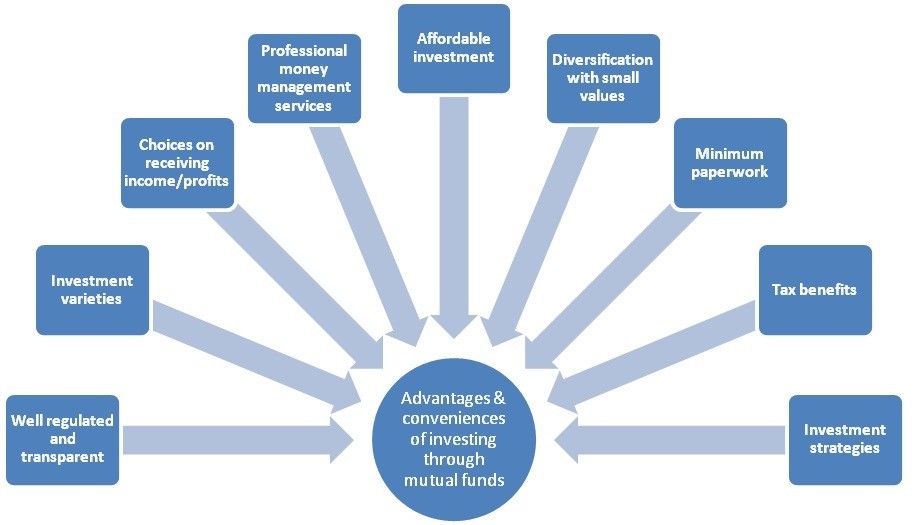

Advantages of Investing in Mutual Funds:

- Professional management your mutual fund manager does all the research, selection and monitoring of investments

- Diversification mutual fund investments are spread across a wide range of companies and industry sectors which lowers your risk if a company or sector performs badly

- Affordable mutual funds require relatively low initial investments, in fact, some mutual fund companies such as MFMCP only requires P5,000 to start

- Liquidity mutual fund investors can redeem their shares at the current net asset value (NAV) of their investment easily and at any time

Disadvantages of Investing in Mutual Funds:

- Uncertainty of returns unlike fixed-income products (such as time deposits), your investment does not guarantee a positive return, you can lose money, this fact makes mutual funds a low to medium risk investment instrument

- Lack of control investors cannot directly influence which securities the fund manager should invest in, thus, youre left just sitting at home and hoping that your portfolio adviser makes good investment decisions

- Costs and fees sales commissions and redemption fees are applied to your investment if you decide to redeem your mutual fund investment, this could significantly affect your expected returns

- Investment horizon mutual funds are not get rich quick schemes, its a medium to long term investment, people who have earned significantly in mutual funds have been in it for several years already

How do you start investing in mutual funds?

In my beginners guide to investing. I mentioned several things you should consider before investing in any type of instrument. When it comes to mutual funds, the same principles apply. In a nutshell, there are five basic steps you need to do:

- Define your objectives. Be clear about why you want to invest. Is it to have the money to buy a car? To start a business without needing merchant cash advance companies? For your retirement?

- Assess your financial situation. What are your current assets and liabilities. Do you already have an emergency fund ?

- Determine your investing capabilities. How much money are you exactly willing to invest? For how long? How much of that can you afford to lose?

- Look for a mutual fund company that can meet your requirements and objectives. Talk to their financial adviser and seek consultation.

- After buying shares in a mutual fund, commit some time to monitor your investment and learn more about mutual funds.

Remember that all these are just basic knowledge. If youre really interested to learn about mutual funds, I suggest some due diligence on your part. Your investing IQ and the probability of a successful investment portfolio highly depends on how much you know about your chosen investment.

One last note, its important to know that your money thats invested in a mutual fund is not protected by the Philippine Deposit Insurance Corporation or PDIC. In the Philippines, mutual funds and their investment advisers are regulated by the Securities and Exchange Commission (SEC) and not by the Bangko Sentral ng Pilipinas (BSP).

In the next couple of weeks, Ill be giving you more articles about mutual funds including a list of mutual fund companies in the Philippines. Ill also be writing about other investment instruments you can choose aside from mutual funds. Be sure to catch those and subscribe to Ready To Be Rich .