Investing in Municipal Bonds Taxes on Municipal Bonds Municipal Bond Rates

Post on: 16 Март, 2015 No Comment

What are municipal bonds? How are municipal bonds taxed?

Municipal bonds are simply bonds issued by some municipality — that is, some public agency at the city, state, county, or local level. Municipal bonds are a way for cities to raise money for new schools, or for states to build highways, for example, or for counties to build a sewage treatment facility. Municipal bonds pay interest just like regular corporate bonds, but with one catch — they are exempt from federal income tax, and if you live in the state from which they are issued, you are generally exempt from state and local taxes as well on the interest income they generate. How come they are tax exempt? It’s just the federal government messing around with the tax code again, basically allowing other government agencies to borrow money at rates below the going interest rate. Why do municipal bonds pay lower interest rates that other bonds? For 2 main reasons: number 1, municipal bonds are normally backed by the taxing authority of the local government, meaning they almost never default, making them very safe investments; number 2, since they are exempt from state and federal taxes, you might KEEP more of the interest money you earn from a municipal bond, even if the interest rate is lower that a competing corporate bond which you would have to pay taxes on (5% on a municipal bond would be the same as 10% on a corporate bond if you had a 50% tax rate and had to pay half of your interest earnings in tax, leaving you with 5%).

So that’s the basic info on municipal bonds — when you buy a municipal bond, you are lending money to some local government agency, they will pay you some interest rate each year, and then they will pay you back all the money you lent them when the bond reaches maturity (whatever its life was, 10 years, 20 years, etc.). And the interest you earn will be exempt from federal income tax, and exempt from state tax if you live in the state that issued the bonds. As a general rule, it only makes sense for higher income investors (who are paying high marginal state and federal income tax rates) to invest in municipal bonds — you need to work through your own tax status to figure out if you are better off buying corporate bonds and paying the taxes, or buying muni bonds that are tax exempt. Another tip — you DONT want to hold muni bonds in your 401K or other tax-exempt accounts, since you don’t pay taxes on gains and interest until retirement anyways, and you’ll just be earning a lower interest rate in the mean time.

How to Buy Municipal Bonds

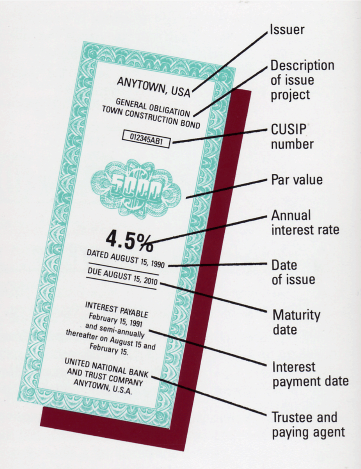

Just like any other bond, you can invest in municipal bonds in several ways. You can buy them directly from the issuer — this is called the primary market. When you purchase a municipal bond directly from an issuer, you pay the full face value (par value) of the bond, and you are guaranteed to receive the stated interest rate (coupon) for as long as you hold the bond, and you are guaranteed to receive the full face value when the bond matures. But just like anything else, you can also buy and resell bonds to other investors in the secondary market. In the secondary market, bonds are sold according to their price and yield, which is usually different from their par value and coupon interest rate. Why is the price different? All bonds are priced according to the current interest rates.

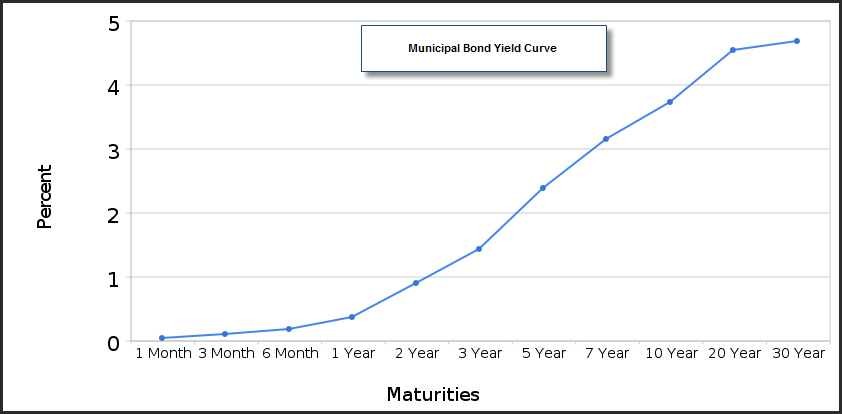

Think about it. Today, interest rates are 5%, and you buy a bond that pays 5% interest. The face (par) value of the bond is $100, so you pay $100 for it. A year from now, interest rates have fallen to 1%. Someone who wants to invest their money can only get 1% for it instead of the 5% from a year ago. What does that do to the price of your bond? If I can get a 1% return for a new $100 bond, what do you think I would pay for your 5% bond that will keep paying 5% for the next few years? You can bet I’ll pay more than $100. In fact, the price will go up so that the yield (the amount of interest and principal money you will receive over the remaining years, annualized) will work out to be close to the new prevailing 1% interest rate — it might be worth $115 now. The opposite is true if interest rates rise. If rates jump to 10%, who would want to buy your crummy 5% bond? They will only buy it if you drop the price, so the price drops until it is yielding close to 10% (maybe it sells on the secondary market for $88). That is the relation between interest rates and bond prices — they move inversely to one another. As interest rates rise, prices on existing bonds go down, since you can now get a better return on new bonds. As interest rates fall, prices on existing bonds go up, since those bonds now pay a higher comparative rate and are worth more.

If you don’t want to buy individual bonds (or can’t — the minimum investment is usually around $25,000), you can also invest via mutual funds or ETFs that specialize in municipal bonds. Just like regular stock mutual funds, a muni bond fund might hold hundreds or thousands of municipal bonds, so you can diversify and reduce risk by owning a big pool of bonds instead of just a few individual bonds. You can buy muni bonds directly through bond dealers at your bank or through your broker (Schwab, Fidelity, Vanguard, etc.).

How Safe are Municipal Bonds?

Municipal bonds are considered an ultra-safe investment — Moody’s tracking of more than 25,000 municipal bonds from 1970 to 2000 showed only 18 on default, 10 of which were for non-profit health care agencies (historically, the rate is well under 1%). And investors still recovered more than 60% of their principal on average even from those in default. To be even safer, you can always diversify your bond holdings by buying into a mutual fund which specializes in muni bonds, thus spreading your exposure over hundreds of bonds and reducing the default rate essentially to zero. Keep in mind that all bonds are subject to interest rate risk as well as default risk — if interest rates rise, your bond values will generally decline.

Municipal Bond ETFs — Municipal Bond Mutual Funds

There are many structured vehicles for investing in muni bonds. For example, the State Street SPDR family of ETFs includes (remember, you’ll want state specific funds to match the state you live in if you are looking for interest exempt from state taxes as well as federal):

- SPDR Barclays Capital New York Municipal Bond ETF — Symbol = INY

- SPDR Barclays Capital California Municipal Bond ETF — Symbol = CXA

- SPDR Barclays Capital Short Term Municipal Bond ETF — Symbol = SHM

- SPDR Barclays Capital Municipal Bond ETF — Symbol = TFI

- SPDR S&P VRDO Municipal Bond ETF — Symbol = VRD

- SPDR Lehman Municipal Bond ETF (TFI)

iShares also offers a number of municipal bond funds, such as:

- iShares S&P National AMT-Free Municipal Bond Fund (symbol=MUB)

- iShares S&P California AMT-Free Municipal Bond Fund (symbol=CMF)

- iShares S&P New York AMT-Free Municipal Bond Fund (symbol=NYF)

Some sample Vanguard muni bond funds include:

- California Long-Term Tax-Exempt (VCITX)

- California Intermediate-Term Tax-Exempt (VCAIX)

- Florida Long-Term Tax-Exempt (VFLTX)

- Massachusetts Tax-Exempt (VMATX)

- New Jersey Long-Term Tax-Exempt (VNJTX)

- New York Long-Term Tax-Exempt (VNYTX)

- Pennsylvania Long-Term Tax-Exempt (VPAIX)

Other municipal bond fund managers include Nuveen, Eaton Vance, Van Kampen, Blackrock, PIMCO. Here is the complete list of Fidelity muni bond funds.

Send email to: galtemail (@) yahoo.com