Investing in International REITs

Post on: 28 Апрель, 2015 No Comment

I called up my Fidelity broker to inquire about investing in International REITs (Real Estate Investment Trusts). Foreign REITs provide you with added global diversification, and safety against sharp US equity losses.

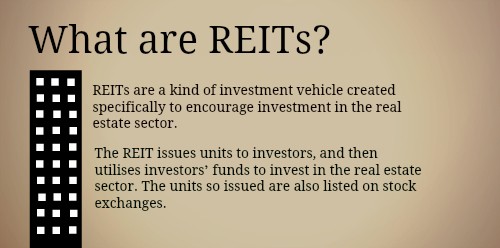

Investopedia defines REITs as:

A security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. (Source: Investopedia REIT defintion )

Basically, owning a real estate investment trust is like owning a portion of equity in commercial and/or residential real estate. You can purchase a stake in a company that controls and owns highly valuable real estate, which is the next best thing to owning real estate yourself.

Global REITs are bought and sold like traditional stocks, and typically pay out 90% of its taxable profits to shareholders to be considered for REIT status. Since most of the real estate profits are paid out to shareholders, REITs avoid paying corporate income taxes, unlike most publicly traded companies.

Different Types of REITs

- Equity REITs Equity REITs invest in and own properties (thus responsible for the equity or value of their real estate assets). Their revenues come principally from their properties rents.

- Mortgage REITs Mortgage REITs deal in investment and ownership of property mortgages. These REITs loan money for mortgages to owners of real estate, or purchase existing mortgages or mortgage-backed securities. Their revenues are generated primarily by the interest that they earn on the mortgage loans.

- Hybrid REITs Hybrid REITs combine the investment strategies of equity REITs and mortgage REITs by investing in both properties and mortgages.

Why Invest in International based REITs

The world is changing rapidly. Are you invested in any of the projects?

If not, then do not worry. With the power of the internet and the spread of capitalism throughout the non-western world, investing in international real estate investment trusts adds another element of diversification to your portfolio, and can increase your annual investment returns.

Ways to Invest in International REITs

Foreign REIT Stocks

The easiest way to find solid foreign REIT stocks is to check out what the professional money managers are picking. When pursuing through international REIT funds, one manager comes to mind, Samuel A. Lieber from Alpine Investments.

Sam Lieber has managed the Alpine International Real Estate Equity fund (EGLRX) for 18 years. EGLRX was the very first ever international REITs fund in the USA, so this looks like a good place to start.

Liebers Top 10 Fund Selections:

When I encounter a particular sector that Im not familiar with, I always spy on what the pros on Wall Street purchase.

International REIT Mutual Funds

When investigating any mutual fund regardless of sector, performance, or weight, I scrutinize the expense ratio. manager tenure. fund goals. and long-term past performance .

Using Fidelitys mutual fund screener, I located the following international REIT funds that are worth a look: