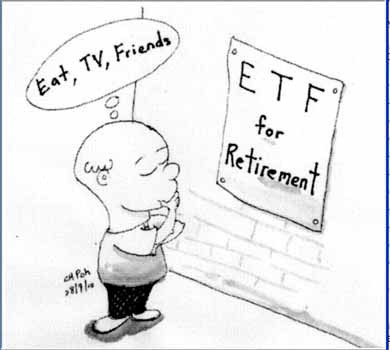

Investing in Exchange Traded Funds (ETFs) Investing It!

Post on: 2 Май, 2015 No Comment

Investing in Exchange Traded Funds (ETFs)

Exchange traded funds or ETFs are mutual funds that invest in the stocks of the index. There are many types of ETF covering a gamut of investment assets which can be traded in the market just like stocks. ETFs are pretty popular in matured market like USA and it has been a part of portfolio of many investors. In fact ETFs are considered the best bet in mutual funds for passive investors. In India, however, ETFs did not impress the investors. The situation is slowly changing.

Burton Malkiel, a professor of economics in Princeton University, says that buying and holding index fund is the best way to build wealth in the long term. He is well known for his book, “a random walk down wall street”.

In this article, we will discuss the ETF and its importance in investors’ portfolio.

ETF Funds

Exchange traded funds are also called passively managed funds because the fund invests in an index. The fund has no say in what the index should consist of. For example, in case of Nifty, if a fund invests in nifty, it will have no say which stocks should be part of Nifty and which should not be there. This is not the case with actively managed mutual funds which decide which should be part of the mutual funds and which should get out. In fact actively mutual funds change their investment and companies based on the new information.

Since the funds are passively managed, the management fee is less. It could be even less by 1% compared to actively managed mutual funds. Why should you pay any fee to a fund manager who puts your money in index stocks and sleep, Isn’t it?

The returns of ETFs will closely follow the market with slight error of tracking because of management fee. Hence if the Nifty rises up by 30% in a year, the Nifty ETF will also rise by the same with some marginal error.

Exchange traded fund can be traded like stocks. Investors with demat account can do the trading and can see the net asset value (NAV) of their fund online in real time. Placing limit order and market order is also allowed.

Show me the ETF

Investors can find varieties of ETFs in the market. Let’s take a look at some of the types which exist in the market.

Nifty ETF – Nifty ETFs tracks movement of Nifty index comprising of 50 large cap companies. Nifty BeES is an exchange traded fund which tracks the performance of Nifty. The returns from this fund will be very close to Nifty’s returns. There are other ETF like Nifty Junior BeES. This ETF tracks companies which are part of Nifty Junior index.

Sensex ETF – Sensex ETF tracks the sensex index comprised of 30 stocks. These are again large cap companies. You will find almost all of them are also part of Nifty. SPIcE is one of the sensex ETF launched by ICICI prudential.

Gold ETF – As the name implies, Gold ETF is based on gold prices. Its returns depend on the variation of price of Gold. For example, if the price of Gold goes by 5000 from of 20,000, the returns will be 25% with marginal error of tracking. The unit of Gold is based on 1 gm. of Gold usually but some funds base it on 0.5 gm. of gold too. For example, ICICI prudential gold ETF trades at 2740 Rs a unit (NAV value). This clearly implies that the underlying asset is 1 gm. of Gold. Quantum gold ETF trades at 1320 which is basically 0.5 gm. of Gold. The difference is because of fund fee and tracking efficiency.

Sector oriented ETF – Sector oriented ETF focus on a sector and invest in a basket of securities belonging to the specific sector. For example Reliance banking ETF tracks all the banks that form CNX banking index.

Liquid money market ETF – Liquid money market ETF invests in money market instruments. They are Government securities, bonds, and money market assets. Because of their conservative investment, the liquid ETFs are risk free. However, the returns are also low. Goldman Sachs liquid ETF is one such fund whose main objective is to provide money market returns and protect the capital.

Important point for ETF investors

Even though value of ETFs is based on underlying assets like Gold or Index funds, their returns will not match the exact returns of index or Gold. This distortion is because of fee and other charges associated with trading. The fund managers also keep a small fraction in cash to face any eventuality. This also induces tracking error.

ETFs, because of low popularity in India, are not traded as much as other assets. Hence there could be liquidity problem with few ETFs. Nifty BeES ETF can be traded easily because it has high liquidity but SPIcE by ICICI prudential is not as liquid.

The net asset value of ETFs, even though they have the same quantity of same underlying assets, could be different. For example, Kotak Gold ETF fund may have different value than Religare Gold ETF even though they have same 1 gm. of gold as underlying asset. Investors should select the ETF which is closest to the actual price of underlying asset.

The author Pankaj Priyadarshi is a financial consultant and can be reached at pankaj@verticalgrass.com. He is B.Tech from IIT, Kharagpur and MBA from ISB, Hyderabad.