Invest in hedge fund

Post on: 30 Апрель, 2015 No Comment

Author Topic: Invest in hedge fund? (Read 492 times)

on: March 13, 2015, 06:28:14 PM

All of our portfolio is index fund and some emergency cash/CD. Recently I heard from a few friends around that they are investing in hedge fund and they perform well, which makes me very interest in hedge fund.

Reply #10 on: Today at 09:30:12 AM

Take everything that is wrong with an actively managed mutual fund, then times it by a hundred, and you get a hedge fund.

1. The fees are insane. Sometimes you pay over 2% expense ratio plus 20% of profits. There are countless studies showing that high fees leads to.

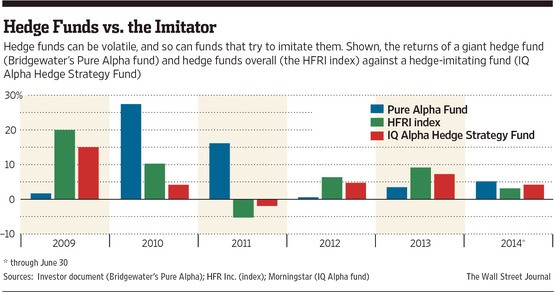

2. Poor performance. Hedge funds as a group perform very very badly. A big thing is the high fees. They also have performance that is all over the place because.

3. They are all very very different. Some of them try to 'hedge' by lowering risk using options and short strategies. A fund like this should do better in a crisis, however thanks to the high fees they rarely do any better than a very conservative mutual fund(something 80% bonds, 20% stocks like VASIX) in terms of risk or returns. So why not just get the conservative mutual fund? Some of them try to speculate, they are basically using options and short strategies to bet on the market. In theory such a fund could have 20% returns in a good year, or in a crisis like 2008. In practice the manager who can pull that off doesn't appear to exist. Such a fund is just as likely to have a -20% return in 2008 and then ALSO a -20% return in a good year. Loads of risk, loads of fees, very little return. Regular mutual funds don't do this crap because it has shown to be very risky, and this type of behavior is highly regulated which brings me to point #4.

4. They aren't regulated. This is why they attract the Madoffs of the world. In theory they can do whatever they want. Options, shorting, etc. The fact that they aren't regulated and they can trade with very complex strategies also makes them.

5. Very illiquid. A hedge fund manager can require that the money stay locked up for at least a year, sometimes longer. This isn't like a variable annuity where there is a penalty for taking the money out. The hedge fund is normally organized as a limited partnership with you as a limited partner and the manager as the general partner. He has 100% control so if he says you can't have your money back yet. you can't have your money back yet.

So your money is invested in this highly illiquid very very expensive investment being managed by a guy who can just about do whatever he wants with it and all the evidence says your money will do worse than just putting it in an index fund with a similar risk profile.

Oh, and did I mention the minimum investment in one of these things is normally 1 million?

Hedge funds have shown to be VERY good at making some people rich. the managers. All the evidence shows they aren't good investments, but they still exist for one reason. If you are a multi millionaire(10m+) drinking a thousand dollar bottle of wine at the country club with your friends bragging about your Ferraris and Lamborghinis, and the conversation goes to investments you can't say oh I just index. That is what commoners do. And if you are the money manager for these people you can't just say oh put it in an index. That doesn't justify your insane fees, they could just call up Vanguard and pay a fraction of a fraction of those fees to have a professional manager their money with index funds. No you have to give your super wealthy clients something 'exclusive' that only you can get to justify paying you so much. a meeting with a hedge fund manager.

If index funds are a used reliable Prius. Hedge funds are the brand new Bugatti. Its not about value or efficiency. Its to show off.

Last Edit: Today at 09:40:06 AM by Indexer