Introduction To Exchange Traded Funds (etfs)

Post on: 13 Апрель, 2015 No Comment

An Exchange Traded Fund (or ETF for short) trades on stock exchanges just the like any other stock. ETFs are usually linked to a stock, bond or commodity index. The underlying basis for an ETF is that it is backed by assets in the same proportion as the index to which it is linked. This process is known as replicating the index.

Some stock-index ETFs undertake representative sampling, in which case the ETF comprises of the key stocks which represent the index. The ETF price therefore moves up and down in line with the index it is tracked to. Essentially investing in an ETF is like investing in the market as a whole (for a particular index) as against investing in specific stocks.

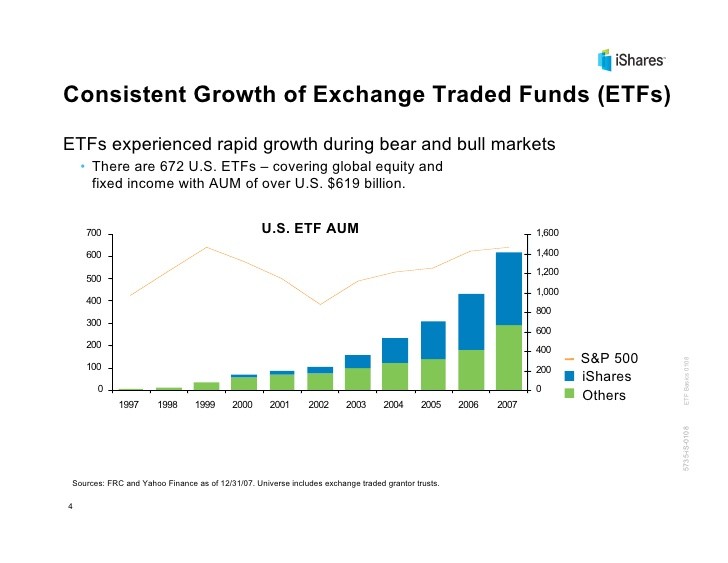

ETFs were introduced in the United States in 1993 and up to 2008 were all index funds. Subsequently the creation of active managed ETFs has been allowed.

How Are ETFs Different From Mutual Funds?

To the layman, ETFs would seem to be similar to mutual funds. This however is not entirely true. There are a number of key differences between exchange traded funds and mutual funds as explained below:

1. The first difference is with regard to hours as well as manner of trading. While exchange traded funds are traded like stocks through the day, mutual fund orders are executed at the end of the day based on the NAV (net asset value) of the fund at the close of trading hours.

2. Mutual funds are considered to be an active investment as they have a fund manager who actively manages and churns the portfolio of stocks and other investments held in a particular fund. ETFs, on the other hand, are passive investments, as they are tracked to a particular index and move in line with the index.

Types Of Exchange Traded Funds

Typically exchange traded funds are categorized based on the nature of investment and the category of asset it is tracked to. ETFs are normally classified as per the following nomenclature:

Index ETFs Tracking Market Indices

These funds are the most common types of ETFs and are usually actively traded on the market they tracked. Typically they replicate a stock market index’s performance and are backed by securities in the same proportion as the stock market index they are linked to. The objective of such a market index ETF is to follow the direction of the market.

Investors choose to buy into market ETFs when they want exposure in a particular market. For example, an investor wishing to build an exposure to the German stock market can buy into an ETF linked to the DAX average. Similarly there are ETFs tracking the S&P500, Nasdaq 100, Brazil’s Bovespa, Korea’s Kospi and many other indices.

ETFs Based On a Investment Strategy

Exchange Traded Funds created on the basis of market capitalization of stocks fall into this category. Separate ETFs exist for large-cap, mid-cap or small-cap stocks. These ETFs are also sometimes called style ETFs as their purpose is to copy a particular investment strategy or style. These ETFs generally track growth or value investment style indexes such as the Barra’s composite, Russell and Standard & Poor.

Industry Or Sector ETFs

Exchange traded funds which are linked to a specific sector index which comprises of stocks belonging to a particular industry fall into this category. These include specific funds for industries such as pharmaceuticals, real estate, utilities, technology, etc.

Commodity ETFs such as oil exchange traded funds or gold exchange traded funds also come into this category. Commodity exchange funds are typically index funds but track indexes which are not securities based. Thus a gold exchange traded fund would track gold prices.

Country Or Region Based ETFs

These funds track the performance of a region or country and are tracked to a primary index of a country.

Currency Based ETFs

A currency based exchange traded fund was first launched in 2005 to track the Euro. Subsequently numerous ETFs have been launched which track all major currencies like the Yen, Pound, Swiss Franc, Aussie Dollar, etc. As is obvious, these are linked to the value of the currency they track.

Benefits of Investing Using ETFs

ETFs offer significant advantage over investment in individual stocks particularly when market behavior is erratic and it is hard to assess which stock to invest in. Individual stocks move up and down on announcements by the company, by the government, changes in the market scenario, and so on.

Thus many investors favor ETFs over other market related investment option such as individual stocks or mutual funds because of the features they offer. Advantages of investment in ETFs are listed below:

1. ETFs typically have a lower cost than other funds such as mutual funds as they are not actively managed.

2. Trading in ETFs can be undertaken at current prices at any time throughout the trading day.

3. ETFs are considered to be more tax efficient than other classes of securities.

4. Exchange traded funds allow for a large degree of diversification in an investor’s portfolio as the investment is spread out over the entire market. For instance, if one was to buy into an S&P 500 tracked ETF; one would effectively be buying all stocks which make up the S&P 500 index.

Where Does One Start?

All of this sounds very technical and complex for an individual investor. And it throws up a host of other questions like:

1. How does one figure out which ETFs are performing well?

2. How does one go about buying into an ETF?

3. Which brokers should one use for these ETFs?

4. When should one sell an ETF?

5. Which ETFs can be used to profit from down markets?

6. How many ETFs should one invest in to create a diversified portfolio?

7. How to use trailing stops to minimize risk in turbulent markets?

This is where an investment newsletter like the ETF Global Investor can help, where sophisticated computer models analyze close to 900 ETFs every week and tell you exactly which ones to buy, sell and hold.

In the current market scenario, where uncertainty reigns supreme and practically all mutual funds have lost massive amounts of money since 2007, investment in some well chosen ETFs can not only diversify your portfolio but also help optimize your returns by using a mix of domestic & foreign markets.

The ETF Global Investor system simplifies the entire investment process for you by choosing 10 ETFs which make up your model portfolio. A 30-day trial subscription with 7 free gifts is available for just 4.97 Dollars.

You may not have considered investing in an ETF till now. But it is never too late to start, and now is a perfectly good time. Start with a trial subscription to the ETF Global Investor and learn to profit from an increasingly globalized world markets.

Not only can ETFs generate double and triple-digit returns in ANY market — but they’re also a great way to diversify your portfolio. With ETFs, you’re not putting all your eggs in one basket by investing in a single stock. It’s no wonder informed investors are looking to ETFs for safety and profits.

About the Author: