Intro to Harmonic Trading Part Seven

Post on: 16 Март, 2015 No Comment

Introduction to Harmonic Trading — Part Seven

harmonicedge.com/tow/TradeTipsG.html

As you begin your journey as a short term trader it is your job to accurately evaluate supply and demand within the market and correctly position yourself to profit from the markets volatility. Once you have learned to do this you can give consideration to scalping or learning to day trade if that is your desire. Short term trades are trades lasting a few hours to a few days. In this section we will be looking at the best patterns for short term trades and attempt to show you how harmonic price patterns fit within Elliott Wave theory. As stated previously, it is not essential for you to become an Elliott wave technician but it is very useful for you to have a basic understanding for several reasons:

- Wave theory provides a useful way to frame out a market. This structure provides order amidst chaos. Wave theory gives you the tools to project extended price targets and capture potentially large moves that you might otherwise miss.

- Wave theory can help you make better trade management decisions and reduce risk.

Harmonic Patterns

The best harmonic patterns for short term trading are:

- The Gartley pattern (a special type of abc correction occurs at the end of W.2)

- The 3 Drives pattern (occurs at the end of some Wave 3 or Wave 5 patterns)

- The 5 Wave pattern (the best Elliott Wave pattern)

- The Butterfly pattern (can occur at the end of W.3 but performs best at the end of W.5)

- The ABC correction (can occur at the end of W.2 or W.4)

It is not necessary for you trade all of these patterns. Some traders make a very nice living trading only 1 or 2 patterns that they are comfortable with and have taken the time to learn all of the subtle nuances. It is very important that you learn to trade consistently when your pattern or edge is present. It is unwise to cherry pick your trades in an attempt to profit from the winners and avoid the losers. You will inevitably find yourself in the losers and missing out on the winners. This is not to say that you cannot weight the size of your positions according to various factors which is something that some experienced traders do.

The following charts demonstrate the structure of the harmonic patterns listed above and provide some background on the pattern.

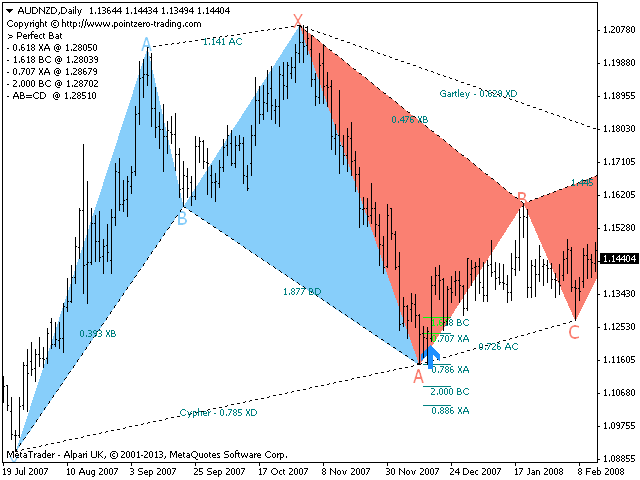

Gartley

The Gartley pattern comes from the book Profits in the Stock Market by H.M. Gartley, published in 1937 and sold for the sum of $1,500.00, it was the best book on the stock market and trading of its time. On page 222 of the book, Gartley describes a pattern that is a re-test of a top or bottom. This pattern prevents you from taking a gamble at a high or low since the 222 is a re-test of a previous high or low. The pattern contains an abc wave that appears to be testing an old high (Bearish Gartley) or testing an old low (Bullish Gartley). The assumption is that the previous high or low will not be violated. The previous high or low should be a significant one that ideally completed a larger degree 5 Wave pattern. If this is the case, the Gartley pattern should be forming a Wave 2 and have you on the right side of the market for a potential Wave 3 trend move. With a little practice you will be able to spot these patterns on your own.

3 Drives Pattern

The 3 drive pattern was first introduced by George Cole in the 1930s and is also found in the classic, Profits in the Stock Market by H.M. Gartley, published in 1937. The 3 drives pattern was also used by Wycoff in the 1930s and later by William Dunnigan in the 1950s. Recent traders have used additional names for the pattern.

The best 3 Drives patterns are generally found near the end of major Elliott 5 wave patterns when a market is very stretched out (like a rubber band) and ready to snap back. Additionally, they frequently will show up on the shorter term charts (5 minute 15 minute). I know of no better pattern for identifying a potential significant top. The only real drawback to this pattern is that there arent more of them. Consider this example:

Elliott 5 Wave pattern

The 5 wave pattern comes directly from the work of R.N. Elliott and was re-introduced to the trading community in 1978 in the book Elliott Wave Principle Key to Market Behavior by A.J. Frost and Robert R. Prechter. The basic assumption is that following the completion of the 5 th wave the market will retrace at least 50% of the entire move. The 5 th and final wave can unfold in several different ways (typical 5 th wave, truncated or failed 5 th wave, diagonal 5 th wave). In recent years, no one has done better work with this pattern than Robert Minor of Dynamic Traders. Here are some examples:

Butterfly

The butterfly pattern has its origins in the work of Larry Pesavento and Bryce Gilmore. Larry told me that he discovered it in 1991 while sitting on the beach with Bryce Gilmore looking at some charts produced on the Wave Trader. The pattern as described by Larry contains an AB =CD move that completes at a new high or new low.

This pattern produces some spectacular wins and losses. My experience with this pattern over the past decade has led me to offer some additional guidelines for identifying and trading this pattern:

- The final leg of the pattern, what Larry would call C:D, can be either a Elliott W. 3 or 5. The pattern should only be traded if it completes with a clear momentum divergence (price makes an new high but RSI or oscillator does not) The final leg of the pattern should subdivide into 5 smaller waves Profits should be taken aggressively.

Here are some examples:

The abc correction (also referred to as an ab=cd) is by far the most common harmonic trading pattern. These form in all markets and on a daily basis. They can be very effective ways to jump on a trend. The challenge with this pattern comes in correctly identifying trend and realizing when your abc is morphing into something else like a complex correction or an impulse wave.

In the final part of this introduction to Harmonic Trading we will discuss trade plans and look at the kinds of results that are possible when you begin to put all of the pieces together.