ING Retirement Plans

Post on: 15 Июль, 2015 No Comment

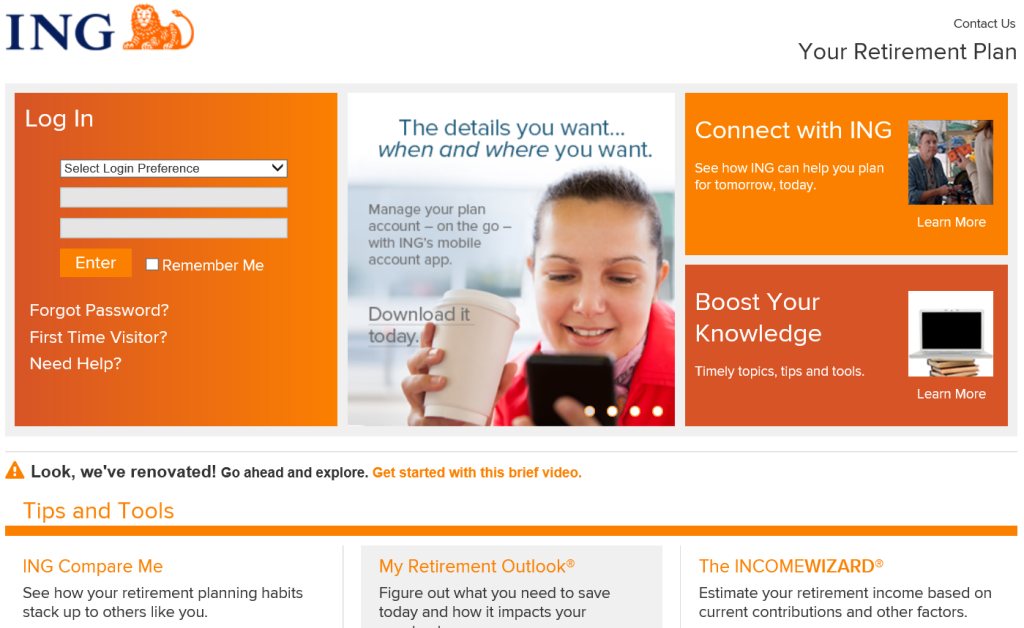

Are thinking about your retirement? Then hire the retirement planning services that will provide financial planners to suggest a best retirement plan such as ING Retirement, Fidelity NetBenefits, etc, and make your future secure as well as comfortable. Retirement plans provide individuals an income or pension during their retirement when they are not any more employed and earning. Through retirement planning service you will get thoroughly educated on many aspects of retirement plans.

You need to select a reliable retirement planning service that will offer a group of experienced financial consultants with great knowledge of investment management and financial planning. They will make you feel comfortable while focusing and preparing solutions for your financial requirements. The knowledgeable financial consultants will provide array of choices in planning out rest of the years of your life; this will strengthen financial security during most precious time of your life.

The financial consultants will take stock of your investments, future plans, retirement portfolio, your future needs, unexpected health care possibilities, featured cost of living, etc. By combining these all data, they will minutely analyze and prepare a written financial guide or document for your retirement years with a practical sense that will lead you in living a deserving life without worrying about money.

You must consider that the agency providing retirement planning services should be experienced enough with a satisfied list of clientele which will provide maximum returns on investment. And make sure if you are hiring them then will get right investment and financial advice or else it could result in disastrous consequences. You can select effective retirement plans such as ING Retirement, Fidelity NetBenefits by hiring The Retirement Group’s retirement planning services. Our knowledgeable representatives will help you in educating and assisting as well as tailoring your retirement plans that will secure your future.

There can be so many things to consider and calculate about retirement planning which is an overwhelming task for you. But it should be done as to live your retirement years in a peaceful way. This requires hiring a professional retirement planning service that will help to plan your retirement successfully. You will get the assistance of financial professionals who have all the information about retirement plans like ING Retirement, Fidelity Net Benefits, etc, and will educate about each individual plan and its benefit.

The professionals will create a saving plan that includes considering some factors like present income; in what amount it will be converted after ten years, your present age, what will be your retirement age or at what age you want to retire with how much money, if having a spouse then what is his/her financial plan, etc. The professionals or representatives will ask a long list of questions which will help them to select the best retirement plan for you.

You can find a good retirement planning services in different ways like looking through phone book, referring ads in your local newspaper or can go with the best option is to search them online. After finding the best one you need to discuss about their fees and what your plans are with the professionals or representatives of the retirement planning services. Your retirement planning agency will plan successfully to save for your retirement and get a better retirement plan to secure future.

You can get effective information about retirement plans such as ING Retirement at The Retirement Group® . Our knowledgeable representatives will assist in giving professional solutions for your any pension and retirement issues.

According to a survey report, many Americans will retire in the coming years; however, the report also states, the percentage of those who choose not to retire are increasing at faster rates and the reason behind that fast fire rate seems to be the financial fear, perhaps, which is motivating them.

According to AARP Bulletin, there are several other reasons that can give benefits to the seniors, if they urge to postpone their retirement .

Below are the advantages of delaying retirement. If you are one of those is going to retire in coming days, then make sure, you read the following to know the benefits before you finally take your retirement.

Benefits of Postpone/ Delaying Retirement –

• You may be at the age of your retirement, but if you have not saved enough to finance your retirement, extending your work life can be a good idea. This is the most significant benefit that you can get by delaying retirement, you can not only fund yourself with Fidelity NetBenefits but also you can reduce the number of years of retirement.

• Health is a major concern when reaching ING retirement age. People who are age 65 although qualify for Medicare but barely get all the benefits they expected. Hence the reason, keeping yourself into the job for a little longer time can help you to retain health insurance longer and can allow you to take advantage of taking preventative care in a better way to stay healthy. Furthermore, studies also states that senior citizens who make themselves involve into certain work at the age of retirement, enjoy a greater level of health.

• Many business companies offer certain benefits to their senior employees such as free memberships to gyms, and even other health related benefits. Moreover, the companies also offer holiday bonus, which is another advantage of it.

• Making delay in retirement also has impact on lifestyle. According to studies, people those extend their work habit live a more active life than those who have taken their retirement. Seniors who continue to work are more socially active and are more eligible for living a happy and prosperous life.

So friends, as you can realize, these are the benefits that a senior can get if he/ she postpone their retirement.

If you are one of them who want to take all these advantages, you certainly can delay your retirement too and can live more financially-secured and an active life.

A 401(k) is a retirement savings plan that is usually funded through pre-tax payroll deductions and grows tax-deferred. Literally there are a number of different accounts where funds in the account can be invested in through stocks, bonds, mutual funds and other assets etc.

401k is a profit sharing contribution where you just need to give 50% to get 100% of retirement benefits. And as said, you can invest in stocks, bonds to secure your future after the retirement.

Almost every people around the USA have been taking retirement benefits through different retirement plan and securing their lives. If you are one of them want the same and want to live wealthy even after your retirement, then you can setup an ING Retirement . Fidelity NetBenefits or 401k account.

However, if you choose 401k plan, there are basically 5 key advantages that you can get from it –

- Income tax benefits

- Employer match programs

- Customized investment and flexibility

- Portability

- Loan and hardship withdrawals etc.

So friends, as you can see, 401k retirement plans give employees a wide range of options. So as an individual investing on 401k retirement plan is really worth it to acquire retirement benefits.

Retirement in our life is something that is sure; we just can’t avoid it. Though it is true, now days we all must prepare for our future quite earlier as these days managing our expenses is a bit harder than earlier times. If we acquire the habit of savings and if we learn to plan further, we can lead a well organized life and a very secure old age without depending on others, while we are retired. You may not be able to plan all this on your own but good habits are to be followed religiously and making your future secured is thing that will only make your life better. Here given below are 5 Retirement tips for College Students

Learn to save -

It is a good habit learning to save is the best thing ever. It is not something that will trouble you anyway, it’s a scheme of only profit no loss. Early beginners definitely save better and make their future brighter. There are so many schemes and saving options available for students, if you really care about your life then you can take this pain of early savings as you must be aware of this fact that we all have to retire someday or the other and that moment what will help you will always be your savings.

Debts are really bad -

Keeping debts on head may become a real big headache for you further. So while you have decided to save, wee you need to organize everything in a way that you clear out all your debts before starting to save. Manage your expenses don’t live a life of wasteful expenditures, only buy things that you really actually need.

Emergency savings -

This is something that we all must do, to save some funds to meet any kind of emergency that may occur out of nowhere, so it is always important to save some funds to meet any sort of emergency that may come your way.

Social security funds -

This also one of the things that all students must know about though this shouldn’t be the only type of income on which anyone must rely on, we all must have different plans, planned precisely to meet any type of hard situations.

Retirement accounts -

You can also try this; banks provide several ING retirement plans which you can consider to take advantage of it in your future.

It’s easier to think about spending more than your capacities while you are working and you have a job deep down you know you will pay out your debts, but have you ever thought about what will happen when you will retire, you won’t have any source of earning left, at that time only thing that will keep you satisfied would be your savings, what you save today out of your income. To make a better tomorrow you have to improve your today it is said, in order to spend your after retirement life in a smooth way, you have to start practicing Retirement Savings techniques . little things that will help you make your rest of life better. Here are few tips How to catch up on Retirement Savings -

Know your expenses:

Too much of anything can lead you towards destruction, hence, you should know your expenses, you should understand that spending more money than your earnings won’t lead you anywhere. Wasting your money on things that you least require would give you big troubles once you get retired. So it is always advisable to think before you spend.

Think wisely:

This is one thing that can actually bring changes in your life. Think wisely for everything. Try out ways of spending your money on useful stuffs only.

If you are worried about you’re over expensive nature, talk to your close ones, they will surely help you in decision makings. Talk to your friends about new investment schemes, where your money would not only be secured but also would give you some profit after years, after you are retired.

Start planning for your retirement days from now onwards. Make plans like if plan A fails you must have other plans ready to back you up, point is to work accordingly in such a way that even if you have no jobs while you are retired you must not frown, you must save enough that it doesn’t affects you in a negative way when of course you are not earning anymore, invest your money, save your money.

Retire but you can earn:

Nowadays it is such a waste to even worry about what will you do once you retire, you still have so many options you can earn through. You can browse the web and you will find multiple options through which you can earn sitting at home. All you need to do is look for opportunities and remember to save.