Index Investing V Picking How To Choose

Post on: 8 Июнь, 2015 No Comment

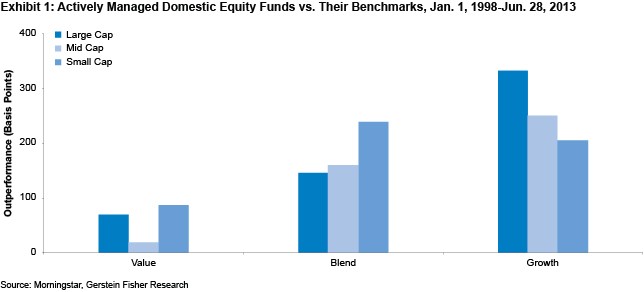

Ever hear this one, 80% of funds underperform the market? Stop and think about what that is saying though. If you look at almost the whole market (funds do make up most of the market), it can’t possibly outperform once those high management fees are subtracted. Let’s look further into whether it’s best to hold individual stocks, mutual funds, or index funds. I’m going to exclude hedge funds for now because they differ so widely and aren’t available to most people. Buying an actively managed mutual fund is similar to paying someone to pick individual stocks for you, so I’m going to group them with individual stock picking for this article. With actively managed funds you get instant diversification, so you don’t have to buy many different ones, but otherwise it’s essentially paying a fee for someone else’s advice on which stocks to buy. Certainly some actively managed funds are so diversified they act much like an index, so keep in mind there is a sliding scale between these two groups.

For analysis purposes we’re now down to two options, either using an index fund to try to own a bit of everything, or having more ownership in a few companies. Let’s take a look at some of the logic behind each. You have heard arguments for both sides before, and they can both be convincing and depend on your situation. To be able to get a better return than a market index, you need a strategy. But are there strategies that will beat the market consistently, or is it just luck? Certainly luck (or random chance if you prefer) is a major factor, but some strategies are clearly superior to others.

Let’s take a glance at everyone’s favorite example when talking long term market beating results. Of course, this is Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B ). Berkshire, which was listed on the NYSE in 1988, has a return of about 3800% since then, compared to the S&P return of about 570% for the same time period. A good summary of his strategy can be found here. However, the current market environment is very different from what it was even a few years ago, with the majority of volume coming now from a combination of dark pools (trades you won’t see on the exchange), high frequency trading using algorithms to make decisions, and stock shorting. Even ignoring those problems, you don’t have as much time or resources to research the companies like the professionals, nor enough money and power to influence companies like the bigger investors do.

Don’t give up on picking stocks quite yet though, some advantages can be found. The finance world, as well as most of corporate America, is currently very shortsighted and puts too much weight on the latest and next quarter in terms of company financial performance and stock price. Remember the money managers are usually paid quarterly, or occasionally yearly, and you can bet that is what they are most concerned about. So most stock trades take place hardly caring about what the stock will be worth in 5 or even 2 years in the future. For example, most of the technical indicators are short term in nature, and only try to predict short and medium term price movements. As long as your time horizon is longer than wall street’s horizon (many people say forward looking by 6-12 months), you can start to value companies in a superior way than nearly everybody. This is where discipline comes into play. If your main advantage to others trading the stock of a particular company is looking farther out, don’t expect the share price to immediately move up to your fair value price. Remember, it has close to a 50% chance it will go down over the next several months. Only when you commit to holding longer and set clear sell points, reevaluating when the underlying business changes significantly from your expectations, can you benefit from this market mispricing. By sell points I don’t mean stop loss orders, that’s the opposite of what you want to do. When a business becomes cheaper, you want to buy more, not sell what you have. Stop loss orders don’t reduce your risk from sudden drops either, only selling after a stock has fallen below the target price. Also, traders will find out where your stop orders are and gain an advantage by crashing the price temporarily making you buy back shares later at a higher price.

It takes times and patience to evaluate company stocks only from a long term perspective, and greater risk is taken on the fewer the companies you hold. For most individuals, I would not recommend having less than 5 stocks at any point in time, and closer to 20 would be helpful. The bigger your portfolio and the later you are in your career, the more you should have. So if you have the time, discipline, patience, and can afford to take on more risk, seriously consider buying individual stocks. If you don’t have all of these, buying an index fund like the (NYSEARCA:SPY ) or (MUTF:VFINX ) really can’t be beat.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.