Important Mutual Funds Tax and Capital Gains Facts

Post on: 16 Июль, 2015 No Comment

“If I exchange mutual funds do i still have to pay taxes?” Understanding the tax implications of your investments will help you appropriately structure your personal investing strategy in order to maximize your returns.

This post focuses on non-tax sheltered investments so it includes any regular (non categorized) investments.

What Are Capital Gains?

A capital gain is money you make from the sale of an investment (we will speak strictly of mutual funds in this post).

Let’s assume you invested $50,000 in a non-tax sheltered investment account.

That mutual fund grows to be worth $75,000 when you sell it.

You now have a capital gain of $25,000 ($75,000 $50,000).

You must pay capital gains on this $25,000.

The capital gain rates vary depending on how long you own the mutual fund.

Short-Term Capital Gains Tax Rates

A short-term capital gain applies to investments that are held for less than one year.

Short term gains are currently taxed at your ordinary income tax rate (up to 35%).

For example, if you had $100 in short-term capital gains and you were in the 15% bracket, you would pay $15.00 in taxes. If, on the other hand, you were in the 35% bracket, you would pay $35.00.

Long-Term Capital Gains Tax Rates

A long-term capital gain refers to an investment that has been held for more than one year.

For tax payers in the 10%-15% bracket, there is no tax. That’s right as of 2008, your rate is zero percent.

For tax payers in the 25%, 28%, 33%, and 35% brackets, the taxes paid on a longer term capital gain is 15%.

For example, if you were in the 35% bracket and you had a long-term capital gain of $100, you would pay $15.00.

As you can see, there are a lot of advantages to holding your investments over one year. Besides, not timing the market is a good investment strategy.

Important Tax Implications For Mutual Funds

- You can pay capital gains even when you don’t sell a mutual fund. This is because within the mutual fund, stocks are beings purchased and sold. Even though you have not sold your mutual fund, the stock funds held by your mutual fund have been sold. You will have a tax liability for your portion of the capital gains based on the number of shares you have. The mutual fund company will send you a statement at the end of the year letting you know how much your capital gains are.

- When a mutual fund receives a distribution, (like a dividend) you are responsible for your part. Since most mutual funds pay out distributions in December, you are often better off waiting until January. Here’s why. If you bought $1,000 worth of a share Dec. 1st, and then on Dec. 15th you received a short term gains distribution of $45. You are now liable to pay taxes on a $45 gain. If you waited until January you would not be responsible to pay taxes on the $45 gain.

- You don’t make money with a mutual fund distribution. Consider the example from #2. You might think it is cool that you just got $45. However, if the share was worth $1.15 and they decided to pay out a .15 cent distribution per share, your share is now only worth $1. In other words, your money was shifted and transferred, but you didn’t make any money. It is not a wise tax move to try and get in before the distribution.

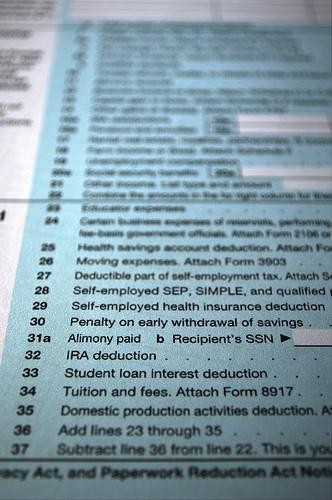

- Your mutual fund company will send you a 1099-DIV. This form lets you know exactly how much tax liability you have for both short and long term capital gains.

- Mutual funds that have higher turnover rates will likely be subject to more short term capital gains. The more money you make, the bigger this factor becomes. If you are in a high end taxation bracket, you might even consider something with less turnover like an index fund.

- Your tax liability is not what you sell a share for minus what you bought it for. If you do not add the cost of the additional shares purchased and dividends, you will effectively be taxed twice. Because of the possible disadvantage, you may be better off not reinvesting your dividends (in non-tax sheltered accounts).

General Mutual Fund Information

- There are tax fee mutual funds.

- When feasible, always choose a tax sheltered or deferred account like a Roth IRA or Traditional IRA.

- If you do not receive your 1099, you should contact your broker or mutual fund company.

- Information can be verified or obtained directly from the IRS – www.irs.gov .

Comments

Darren says

Very informative post! Regarding your 1st and 5th points, thats exactly why I like investing in index funds. Since index funds are, by definition, created to track an index, theres a lot less buying and selling of stocks. The only reason any buying or selling should happen is if a stock enters into or falls out of the actual index. These capital gains taxes within a fund can be a sneaky fee that many people arent aware of!

And just to clarify a bit, a short-term capital gain applies to a holding period of one year or less, rather than just less than one year. Its a subtle difference, but it can cause confusion if you happen to sell exactly one year later. For instance, if you buy a stock on January 1, 2009, and sell it on January 1, 2010, the holding period is exactly one year. This would be considered a short-term gain, which would be taxed at the higher rate. Better to wait an additional day if you want the more favorable tax rate!

Craig says