Impact of Benchmark Change on Vanguard MSCI EAFE ETF (VEA)

Post on: 18 Апрель, 2015 No Comment

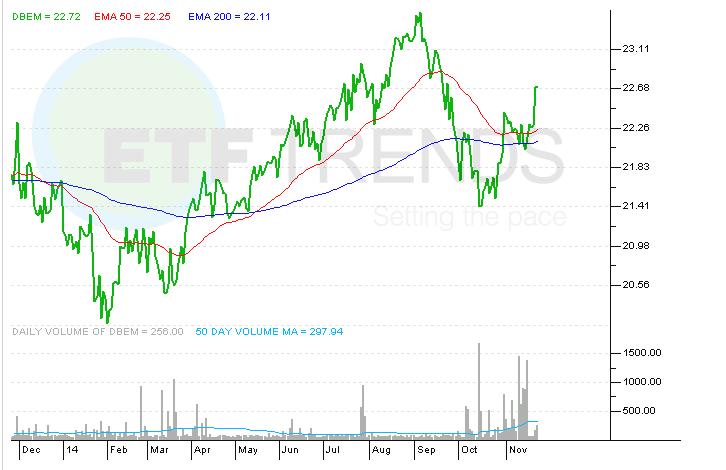

Recently, Vanguard announced that it will be switching the benchmark index for many of its Exchange-Traded Funds (ETF). In an earlier post. we took a closer look at what the benchmark change means for the Vanguard Emerging Markets ETF (VWO) and found a significant difference in past performance. In this post, well take a closer look at the impact of the benchmark change on the Vanguard MSCI EAFE ETF (VEA).

This article has 15 comments

Great analysis! As I was reading through some bigger concerns emerged in my mind in terms of implications for average investors specifically:

Concerns:

1)Do investors need an understanding of statistics along with financial accounting/investing principles? Most investors and clients I’ve worked with simply will not have the time or could be bothered to dig that deep into the composition of these type of ETFs.

2) Im concerned that most advisors will not drill down to this level for their clients.

3) How is this type of adjustment any different than a mutual fund that changes managers who has a different philosophy? Is the expectation that investors have to track the minutae of index construction and behaviour? That doesn’t sound like something that a passive/Potato investor would subscribe to. The basic strategy is to allocate portfolio to basic asset classes/broad indexes and rebalance 1-2 times per year. These types of adjustment force investors to monitor more closely than necessary.

3) The claim is the change will lower costs, but a lot of these ETF’s are priced aggressively in terms of costs (e.g. Vanguard’s are as low as 7bp). If they go lower, how do they make money?

Your doing a great service with your analysis and yes even if the difference in performance between the 2 indexes is about 13%, as you have commented in the past, it can add up pretty fast over the long term. It’s a nice chunk of change to leave on the table.

www.sage-investors.com/Articles.articles.cfm ) on how wary I’m becoming with ETF’s as the fund companies are putting a lot of marketing into promoting these funds which with their more active nature are becoming more like closet mutual funds with higher fees, yielding sub-par returns. The traditional vanilla based ETF’s which I’m totally a proponent of seem to be getting crowded out. In my time in the mutual fund industry, I’m seeing many of these elements with ETF’s than when I did at the peak of the mutual fund frenzy in the mid-late 90’s. Im wondering if we are at or nearing a Jump The Shark moment with ETFs?