Identifying your Mutual Fund Investment Objectives Financial Web

Post on: 5 Июль, 2015 No Comment

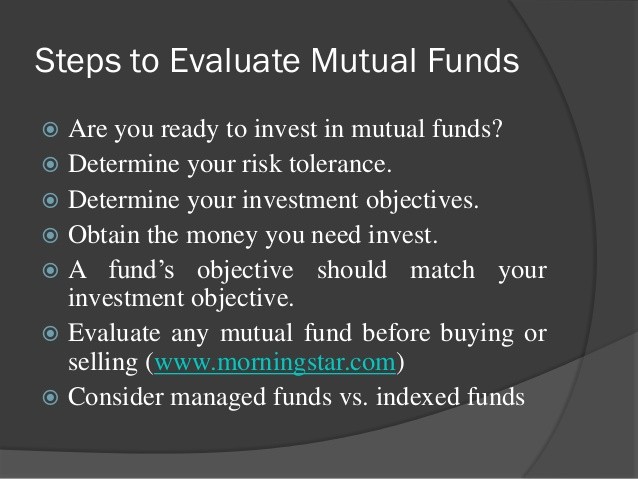

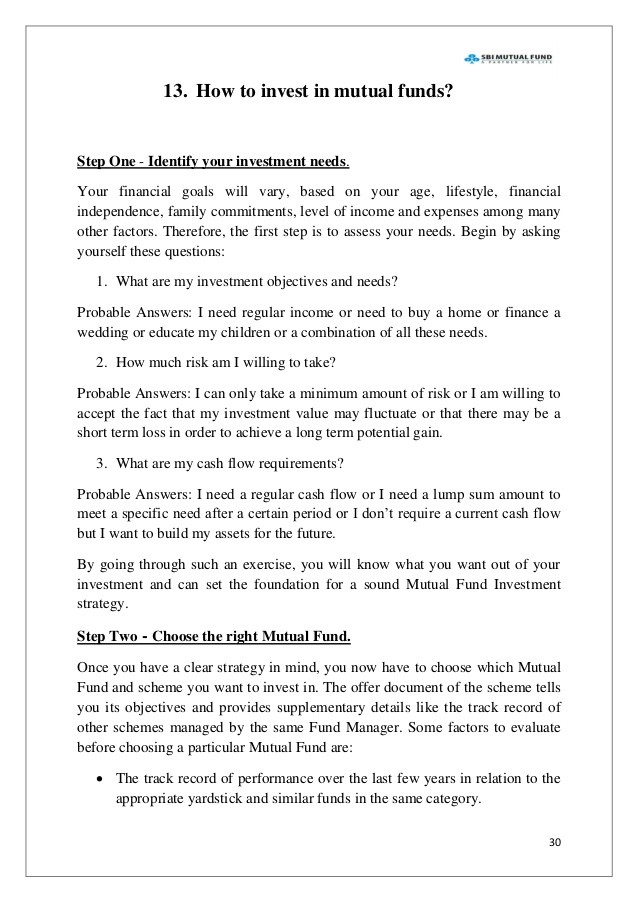

The first step in selecting a mutual fund (or any other investment vehicle, for that matter) is not evaluating the fund’s investment objective; instead, the first step is defining your own investment goals. You must clearly determine why you want to invest and what you wish to accomplish before sinking your money into any type of mutual fund. By taking the time to identify and articulate the purpose for making the investment, you’ll be better able to choose a fund that’s most appropriate for your needs. You’ll also give yourself the best chance of achieving your stated goals in light of the risks that you’re willing to take.

Investors with virtually the same financial profiles may want their money to work for them in substantially different ways. For example, a person looking to accumulate funds for retirement or a child’s education may want to invest in a mutual fund whose objective focuses on long-term stock price appreciations instead of dividend payments. On the other hand, someone who’s recently retired may wish to invest in a fund that provides additional income with little risk of loss to principal, such as a conservative stock fund that distributes dividends monthly or quarterly. Still another investor may want to use mutual funds to improve the return on his or her risk-free savings account at a bank. The investment should do at least as well as the overall stock market; therefore, a mutual fund that tracks the overall performance of a benchmark market index might be the most appropriate choice.

When determining your overall investment objective, you must carefully consider your response to three key questions. Let’s take a look at each one in order.

1. What’s the purpose of the investment?

In other words, why do you want to invest your money in mutual funds? Are you going to use them as a substitute for a traditional bank savings account? Do you want to accumulate money for retirement, your child’s education, or a down payment on a house? Or are you trying to supplement the return from a risk-free investment vehicle such as a bank certificate of deposit (CD) . Be specific when answering this question. You may find that you have more than one purpose for investing. If this is the case, you must think about the amount of money that you want to allocate for each purpose. Because there are few single mutual funds that can successfully satisfy multiple investment objectives, you may be looking at the possibility of investing in several different funds.

2. What’s your time horizon for the investment?

How long do you intend to leave your money invested in a fund; or, over what period of time do you plan to continue investing regularly in a mutual fund? Again, it’s important to clearly define your answer. You must consider your own age when establishing your investment’s time horizon. Generally speaking, the younger you are, the more growth-oriented your investments should be. Because your time horizon is long, you can withstand the inevitable cyclic downturns and profit over the long term because historically the investment markets have always moved higher. As you age, you should periodically adjust the mix of mutual funds in your portfolio to favor more conservative funds that focus on the preservation of capital and also possibly provide a steady stream of income. Adjusting your investment to fit your age is a dynamic process. Regularly- scheduled reviews (quarterly, semiannually or annually) are essential to maintain the proper mix of funds in your portfolio.

3. What’s your risk tolerance?

How much risk are you willing to accept in return for a potential gain? Many investors assume that because most mutual funds are diversified, they’re not subject to price fluctuations that are as great as those of individual stocks. Although this may be generally true, a specific fund’s volatility could still be somewhat substantial. Some people can tolerate market drops better than others, and it’s undoubtedly more distressing the older you get. If a 20- or 30 percent drop in the value of a particular mutual fund would disconcert you, then seek out a fund with less volatility. If you already own several funds, adjust the money you have allocated among them so that your overall risk is lessened. Or you can simply place your money in safer or risk-free instruments. Your goal in determining your risk tolerance is simple: to have as few sleepless nights as possible.

If you fail to clearly define your investment goals first, you increase the possibility of choosing a mutual fund (or whatever type of security you’re interested in) that’s less than best for your needs. Once your own goals are clearly in sight, you’ll be able to match your investment purposes, time horizon, and risk tolerance to the specific characteristics and objectives of the fund that’s most appropriate for providing the returns that you desire.

$7 Online Trading. Fast executions. Only at Scottrade