ICI Frequently Asked Questions About Individual Retirement Accounts (IRAs)

Post on: 12 Август, 2015 No Comment

What are IRAs?

In 1974, the Employee Retirement Income Security Act (ERISA) created individual retirement accounts (IRAs). Congress initially designed IRAs to have two roles: (1) to give individuals not covered by retirement plans at work a tax-advantaged savings plan, and (2) to play a complementary role to the employer-sponsored retirement system by preserving rollover assets at job change or retirement. Over the past 38 years. this flexibility has helped millions of U.S. households save for retirement through IRAs.

IRA Assets

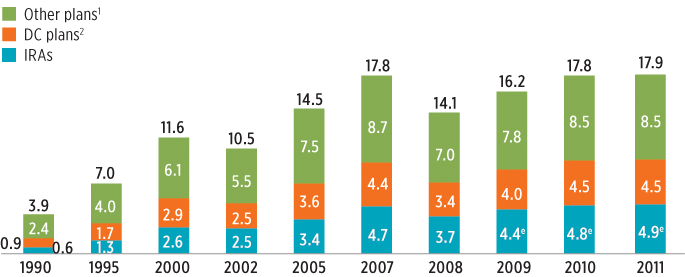

*Data are estimated.

Note: Total IRA assets include traditional IRAs, Roth IRAs, and employer-sponsored IRAs (SEP IRAs, SAR-SEP IRAs, and SIMPLE IRAs).

Sources: Investment Company Institute, Federal Reserve Board, National Association of Government Defined Contribution Administrators, American Council of Life Insurers, and Internal Revenue Service Statistics of Income Division

How large is the IRA market?

IRAs have been one of the fastest growing components of the U.S. retirement market during the past decade. Totaling $5.4 trillion in assets at the end of the fourth quarter of 2012, IRA assets represented more than one quarter of the $19.5 trillion U.S. retirement market. Assets held in IRAs have increased on average 10 percent per year, from $636 billion in 1990.

How many U.S. households own IRAs?

Millions of Americans use IRAs to save for retirement. An estimated 48.9 million U.S. households. or 40.4 percent, owned IRAs as of 2012. An estimated 39.4 million households owned traditional IRAs, making it the most common type of IRA. A total of 20.3 million households owned Roth IRAs, and 9.2 million U.S. households owned employer-sponsored IRAs such as SEP IRAs, SAR-SEP IRAs, or SIMPLE IRAs.

Where do IRA owners invest their money?

At the end of the fourth quarter of 2012, an estimated 46 percent of IRA assets were held in mutual funds, while the remaining assets were managed by brokerage accounts, banks, and insurance companies. In 1990, mutual funds’ share of IRA assets stood at 22 percent.

What role do IRA investments play in the mutual fund industry?

IRA assets held in mutual funds represented about 19 percent of total mutual fund assets at the end of the third quarter of 2012, or $2.5 trillion.

How are IRA mutual fund assets allocated?

At the end of the third quarter of 2012, 38 percent of mutual fund assets in IRAs were invested in domestic equity funds. World equity funds held 13 percent, hybrid funds (which include the bulk of lifestyle and lifecycle funds) held 21 percent, bond funds held 20 percent, and money market funds held 9 percent of IRA mutual fund assets.

What are annual IRA contribution limits?

Tax legislation, enacted in 2001 and 2006, contained several significant provisions designed to encourage greater retirement savings, including gradual increases in annual IRA contribution limits. In 2002 through 2004, the annual contribution limit for both traditional and Roth IRAs was $3,000. The contribution limit increased to $4,000 for tax years 2005 through 2007, to $5,000 for tax years 2008 through 2012, and to $5,500 for tax year 2013. Furthermore, individuals aged 50 or older may be eligible to make additional “catch-up” contributions.

Where can I find more information on IRAs and IRA investors?

ICI also conducts research on U.S. household ownership of IRAs and tracks assets and other statistical data on the IRA and defined contribution plan retirement markets. In addition, research has also analyzed the history of IRAs and the evolving role of IRAs in U.S. retirement planning.