ICI Frequently Asked Questions About 401(k) Plans

Post on: 21 Июнь, 2015 No Comment

How large are 401(k)s?

As of June 30, 2014, 401(k) plans held an estimated $4.4 trillion in assets and represented nearly 18 percent of the $24.0 trillion in U.S. retirement assets, which includes employer-sponsored retirement plans (both defined benefit (DB) and defined contribution (DC) plans with private-sector and public employers), individual retirement accounts (IRAs), and annuities. In comparison, 401(k) assets were $2.2 trillion and represented 16 percent of the U.S. retirement market in 2004.

401(k) Plan Assets

Billions of dollars, end-of-period, selected periods

Sources: Investment Company Institute, Federal Reserve Board, and Department of Labor.

See Investment Company Institute, “The U.S. Retirement Market, Second Quarter 2014 ” (September 2014).

How many Americans have 401(k)s?

In 2012, about 52 million American workers were active 401(k) participants, and there were about 515,000 401(k) plans.

How did 401(k) participants fare through the financial crisis and economic recession?

401(k) participants generally stayed the course through the financial crisis and economic recession. An examination of account records of more than 22 million DC plan participants found that in 2008 only 3.7 percent of participants stopped contributing to their accounts. In addition, most participants maintained their asset allocations, with 14.4 percent changing the asset allocation of their account balances and 12.4 percent changing their contribution investment mix. These activities have become only slightly less prevalent since 2008. For example, an analysis of nearly 24 million DC accounts in 2013 found that 2.7 percent of participants stopped contributing, 10.7 percent changed the asset allocation of their account balances, and 7.4 percent changed the asset allocation of new contributions.

Analysis of workers with consistent participation in 401(k) plans finds that 401(k) accounts accumulate significant assets. According to research released as part of the Employee Benefit Research Institute (EBRI) and ICI Participant-Directed Retirement Plan Data Collection Project, the largest database on participants in 401(k) plans, the average account balance of 401(k) participants with consistent participation from year-end 2007 through year-end 2012 increased at a compound annual average growth of 6.8 percent over that five-year period.

What role do mutual funds play in 401(k) plan investing?

About 64 percent of 401(k) plan assets were held in mutual funds such as equity, balanced, bond, and money market funds, as of June 30, 2014. The remaining 401(k) plan assets include company stock (stock of the employer), guaranteed investment contracts (GICs), bank collective trusts, life insurance separate accounts, and other pooled investment products.

What role do retirement account investments play in the mutual fund industry?

Mutual fund assets held in retirement accounts (IRAs and DC plan accounts, including 401(k) plans) stood at $6.8 trillion as of June 30, 2014, or 43 percent of overall mutual fund assets. Fund assets in 401(k) plans stood at $2.8 trillion, or 18 percent of total mutual fund assets as of June 30, 2014. Retirement savings accounts held about half of long-term mutual fund assets industrywide but a much smaller share of money market fund assets industrywide (14 percent).

What is the average 401(k) plan account balance?

When looking at 401(k) account balances it is important to account for participant age and tenure. Account balances tended to be higher the longer 401(k) plan participants had been working for their current employers and the older the participant. In the EBRI/ICI 401(k) database, participants in their sixties with more than 30 years of tenure at their current employer had an average 401(k) account balance of $224,287 at year-end 2012. Participants in their forties with more than five to 10 years of tenure at their current employer had an average 401(k) balance of $53,060. The median 401(k) plan participant was 45 years old at year-end 2012, and the median job tenure was eight years.

401(k) Balances Tend to Increase with Participant Age and Job Tenure

Average 401(k) participant account balance, year-end 2012

Note: The tenure variable is generally years working at current employer, and thus may overstate years of participation in the 401(k) plan.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project. See ICI Research Perspective , “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2012 .”

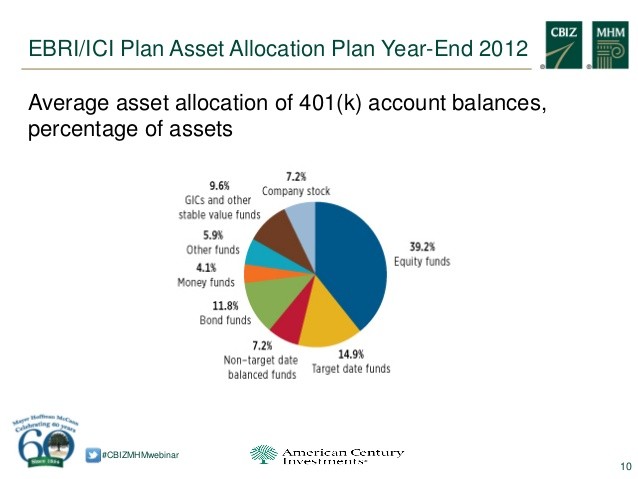

How have 401(k) participants allocated their investments?

On average, 401(k) participants had 61 percent of their 401(k) plan balances invested directly or indirectly in equity securities at year-end 2012 in the EBRI/ICI 401(k) database. That consisted of equity funds, including mutual funds and other pooled investments (39 percent of plan balances), employer’s company stock (7 percent), and the equity portion of balanced funds (15 percent). Twelve percent of plan balances was invested in bond funds, 4 percent in money market funds, 10 percent in guaranteed investment contracts (GICs) and other stable value funds, and 7 percent in the fixed income portion of balanced funds.

401(k) Asset Allocation

Average asset allocation of 401(k) account balances, percentage of assets, year-end 2012

Note: Funds include mutual funds, bank collective trusts, life insurance separate accounts, and any pooled investment product primarily invested in the security indicated. Percentages are dollar-weighted averages. Components do not add to 100 percent because of rounding.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project. See ICI Research Perspective , “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2012 .”

Does age affect a 401(k) participant’s asset allocation?

The asset allocation of participant account balances varies considerably with the age of the 401(k) participant. Younger participants invest more in equities and older participants tend to invest more in fixed-income securities such as bond funds, money market funds, stable value funds, or GICs. At year-end 2012, on average, participants in the EBRI/ICI 401(k) database in their twenties had 73 percent of their 401(k) assets invested in equities (equity funds, company stock, and the equity portion of balanced funds) while participants in their sixties had 48 percent of their 401(k) assets invested in equities.

401(k) account portfolio allocation also varies widely within age groups. At year-end 2012, 64 percent of 401(k) participants in their twenties held more than 80 percent of their account in equities, and 10 percent held 20 percent or less. Of 401(k) participants in their sixties, 20 percent held more than 80 percent of their account in equities, and 23 percent held 20 percent or less.

Asset Allocation to Equities Varied Widely Among 401(k) Plan Participants

Asset allocation distribution of 401(k) participant account balance to equities, percentage of participants, year-end 2012

Note: Equities include equity funds, company stock, and the equity portion of balanced funds. Funds include mutual funds, bank collective trusts, life insurance separate accounts, and any pooled investment product invested primarily in the security indicated.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project. See ICI Research Perspective. “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2012 .”

How many participants borrow against their 401(k)s?

Although most 401(k) participants have access to loans from their plans, most 401(k) plan participants do not borrow against their balances. The EBRI/ICI 401(k) database reveals that about 87 percent of 401(k) participants were in plans that offered a loan option in 2012, and only 21 percent of those eligible for loans had loans outstanding.

What is the average outstanding loan balance through 401(k) plans?

For those with outstanding loans at the end of 2012, the average unpaid loan balance was $7,153. This represents about 13 percent of the participant’s remaining account balance. Loan ratios (outstanding loan balance as a percentage of the remaining account balance) were higher for participants in their twenties (25 percent) and thirties (20 percent) and lower for participants in their fifties (11 percent) and sixties (9 percent).