Hussman Funds Weekly Market Comment Unbalanced Risk May 7 2012

Post on: 31 Март, 2015 No Comment

Unbalanced Risk

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

In recent weeks, I’ve noted that our estimate of the prospective market return/risk profile has shifted to the most negative 1% of instances we’ve observed in the historical data. Most of the time, a given set of market conditions is associated with some mix of positive and negative outcomes, so we focus on the average of those outcomes in the expectation that doing so will produce good results over the complete market cycle even if we are incorrect in specific instances. With regard to current conditions, there is an absence of redeeming instances where things worked out well, coupled with an abundance of starkly negative market outcomes that have accompanied similar conditions. This uniformity of bad outcomes is why I keep using the word warning lately. The market’s prospective return/risk tradeoff here is highly unbalanced toward the risk side.

This isn’t just a matter of advisory bullishness being high in one week or another, or even valuations being rich, or just economic risks appearing high. Rather, what concerns us most is the syndrome of evidence: the fact that we observe so many red flags at the same time — rich valuations, overbullish sentiment, heavy institutional saturation in risk-on trades, near-panic levels of insider selling, a burst of new stock issuance, overbought conditions (focusing on intermediate-term horizons), a two-tiered market that couples speculation in a handful of momentum stocks with broadly deteriorating market internals, a variety of historically hostile syndromes (see An Angry Army of Aunt Minnies ), and increasing likelihood of oncoming recession.

Various observers will undoubtedly take issue with each of these measures. One can look at the Investors Intelligence bullish sentiment figure, which has eased back to 43% from over 50% in early April, but ignore that bearish sentiment is down to 20.4%, less than half of the bullish sentiment figure, and the lowest level since just before the 2011 market rout. One can look the market’s price-to-forward-operating earnings multiple, which seems to be in an acceptable range, but ignore the stratospheric profit margins baked into earnings estimates. One can take issue with our recession concerns, choosing one rule-of-thumb or another that has gone quiet out of the broad ensemble of measures that we’ve presented over time, but ignore everything else we’ve written on the subject.

For example, our Recession Warning Composite is quiet here, as it usually becomes active only after a market loss of about 10-15%, yet still generally well before a recession is obvious to all (as was true both in late-2000 and late-2007). Strictly defined, the composite would require the manufacturing PMI to decline by a fraction of a point, year-over-year payroll growth to slow another 0.08%, and credit spreads to widen by about 0.25% here. The composite is generally a useful and early signal of recession, and it’s clear that the signal last August was either false or more likely just deferred by monetary interventions. Still, we’ve always advised against focusing on any single indicator, and there’s certainly no lack of additional evidence that I’ve presented on the subject of recession risk in recent months, so that shareholders can see the same things that I’m looking at. The value of research is that it constantly gives you better tools. Our research in areas like ensemble methods and noise reduction (including what we developed through our work in autism genetics ) contributes firepower to that arsenal, and we try to approach economic and market issues with everything we’ve got.

Investors wishing to wait for a fresh negative signal from our Recession Warning Composite can do so, but should again recognize that it typically goes negative only after the market has lost some significant ground already. More often than not, stock market weakness continues well beyond those signals, but it’s not a market timing tool and isn’t intended for that purpose. It’s worth noting that aside from the S&P 500 — which has benefited from monetary-driven risk-on speculation, the other components of that composite are still fluctuating within a hair of their respective trigger points. Meanwhile, however, it isn’t helpful to ignore that we’ve never seen the components of economic activity as uniformly weak as they are today on a year-over-year basis except in association with recession (e.g. real final sales, real personal income, real personal consumption, employment growth, etc).

Just an analytical sidenote while we’re on the subject: when evaluating economic risk, it isn’t enough to show that some indicator has a high correlation with GDP growth. You also have to test that the indicator leads that growth rather than lags it. Otherwise it’s not a suitable way to identify a turn. We’ve seen a lot of charts lately that fail to make that distinction.

The chart below updates our estimate of the most leading unobserved component based on a broad ensemble of economic data. The green line is the average standardized value (mean zero, unit standard deviation) of more than two dozen economic variables, including growth rates in GDP, real consumption, real income, commodity prices, and other economic measures, broad measures of economic activity such as the Chicago Fed National Activity Index, purchasing managers indices, and financial variables such as stock prices, credit spreads, yield curve measures and other variables. The average of these provides a measure of coincident or observable economic data.

The blue line our best estimate of the most leading economic signal in that data, derived using a widely-used unobserved components method known as Kalman Filtering. Essentially, we model todays observable data Y(t) as a function of unobservable states of the economy, starting with the most leading component X(t) and past economic components, X(t-1), X(t-2) and so on. The Kalman Filter is a standard statistical method that essentially sorts out leading components from the lagging ones. So a good leading indicator like the Chicago Fed National Activity Index might place a high weight on X(t), while a lagging indicator like the unemployment rate might place most of its weight on past values like X(t-5) and X(t-6). See the note on extracting economic signals in Do I Feel Lucky? for more on this approach. Back in March, we already saw a clear downturn in the extracted signal, which tends to lead coincident economic measures by several months. This signal shows no sign of improvement, while the observed data is now characteristically rolling over.

Interestingly, the most leading component that we infer in U.S. data looks a great deal like what we are already observing globally, particularly in Europe. The path traced out by the Eurozone PMI however, does suggest that we should take any upward bump in first quarter GDP figures in the Eurozone with a grain of salt, being largely old news from a predictive standpoint. The Markit Eurozone PMI is a survey of purchasing managers across European countries. These purchasing managers indices are widely used among investors and financial analysts to obtain indications of economic activity on a more timely basis than is available through quarterly GDP reports.

As for U.S. data, the broad aggregate continues to come in weaker than expected, with a recent downturn in a broad basket of national and regional economic surveys, and of course, a disappointing April unemployment report (avoiding a negative print, however, which I suspect will come in the May report). From our standpoint, this stream of data is largely as expected, with gradual deterioration likely to accelerate as we move into mid-year. While the stock market enjoyed a brief surge of speculation following a modest positive surprise in the manufacturing Purchasing Managers Index for April, this was an outlier in the context of fairly relentless downward surprises both domestically and all across Europe. Note the concerted downturn in the overall indices, backlogs and new orders in the latest U.S. readings. Again, we would expect this deterioration to accelerate as we move into mid-year.

While I remain concerned about the high risk of a blindside recession, the broad consensus of economists and Wall Street analysts remains confidently optimistic. So recession risk is admittedly a fringe view — though a fringe view backed by the data. Still, it’s notable that many of our concerns are joined by observers with respectable records and no hesitation about taking fringe views, including Lakshman Achuthan at the Economic Cycle Research Institute and Martin Feldstein at the National Bureau of Economic Research.

It’s no secret that when Alan Greenspan stepped down from the Federal Reserve, I had hoped that Martin Feldstein would be chosen as Fed Chairman, instead of appointing Ben Bernanke to that role. In early 2008 (see Round Two — Home Price Erosion ), while Bernanke was still downplaying mortgage risks, and the economy was already quietly in a recession that began nearly 6 months earlier, Feldstein was openly warning about housing and economic risks. He continued to advocate for proactive policies to blunt the oncoming damage, and criticized Bernanke’s willingness to hit CTRL+P, saying They’ve used up half their balance sheet setting up credit lines to take on questionable credits from the banks and the securities firms. Since then, the Fed has remained on exactly the same course, only with bigger numbers. This has encouraged needless speculation and sporadic bursts of pent-up demand, but has done nothing to address the underlying debt issues or the continued need for broad restructuring of bad credit both domestically and globally.

Notably, Feldstein is not just any Harvard economist, but is a member of the business cycle dating committee of the National Bureau of Economic Research (the official body that dates U.S. recessions), the president emeritus of the NBER, and the former head of the Council of Economic Advisors. In an interview last week on CNBC, Feldstein provided a good summary of present conditions:

We are not doing very well. The economy is just coming along at a snail’s pace. The first quarter numbers that we just got last week were not very good at all. The GDP number was 2.2%. That was a disappointment, but you know, it was all automobiles. 1.6 out of the 2.2 was motor vehicle production. So, people were catching up after not being able to buy them the year before. So, this is a very weak economy. I think the real danger is that this is a bubble in the stock market created by low long-term interest rates that the Fed has engineered. The danger is, like all bubbles, it bursts at some point. Remember, Ben Bernanke told us in the summer of 2010 that he was going to do QE2 and then ultimately they did Operation Twist. The purpose of that was to make long-term bonds less attractive so that investors would buy into the stock market. That would raise wealth and higher wealth would lead to more consumption. It helped in the fourth quarter of 2010 and maybe that is what is helping to drive consumption during the first quarter of this year. But the danger is you get a market that is not with the reality of what is happening in the economy, which is, as I said a moment ago, is really not very good at all.

In short, there is no question that at least on the surface, there is a lot of contradictory data available to support differing views about market valuation and economic prospects. However, once we make distinctions that have clearly been relevant in the historical data — normalizing earnings, recognizing the difference between leading, coincident and lagging indicators, weighting indicators based on their relationship to outcomes they purport to measure — much of the noise drops away, and we infer clearly negative risk for both stocks and the economy.

All of these conditions will change, and it’s certain that our return/risk estimates will not remain in such an extreme condition for very long. Maybe our present concerns won’t amount to as much downside as we expect. But if investors were to choose a point to test the hypothesis that this time will be different and risk will be well-rewarded, I hardly think a worse moment could be found.

Unbalanced Risk

Last week, Michael Wilson of Morgan Stanley noted (via ZeroHedge ), Make no mistake, institutional investors are all in. Confirming our own observations about the elevated betas of the largest mutual funds, Wilson reported that the monthly rolling beta of mutual funds (their sensitivity to market fluctuations) now exceeds 1.10 and is the highest since the previous record, just before the wicked market plunge in 2011. Meanwhile, examining the sectors in which institutions hold their largest overweight relative to the S&P 500, institutions are more concentrated in high-beta sectors than at any time since the start of Morgan Stanley’s data, and long-short funds are also near their most leveraged long positions in history. Of course, mutual fund cash levels also remain at record low levels.

Still, one feature of the iron law of equilibrium is that if institutions are heavily overweight high-risk sectors, other classes of investors must be underweight. The question is then which class of investors is most likely to shift positions. In my view, the two classes of risk-off investors are individual investors and value-driven, risk-conscious investors like us. On the individual side, we observe depressed home equity, plunging levels of labor force participation (except for workers over the age of 65, where labor force participation is hitting new highs), weakening employment growth, expiring unemployment compensation, repressively low interest rates on savings, and a coming fiscal drag. These investors already perceive sufficient risk in their overall portfolio of investment assets, home equity, and human capital that we doubt they will suddenly decide to take a flier in high-beta stocks to see if they can speculate themselves into financial security.

For our part, despite our 2009-early 2010 suspension of risk-taking on the hedging side (see Notes on Risk Management for a broad review of that period), the fact is that our stock selections have significantly outperformed the major indices over time, without the need to drink the Kool-Aid by buying low-quality garbage stocks or chasing the overvalued speculative momentum darlings of the moment. We have no plans to take high-beta stocks off the hands of existing holders at even richer valuations and even lower expected returns than they already have.

To some degree, those who are willing to establish very high beta portfolios may be doing it because they are speculating with Muppets money, with little of their own skin in the game. In any event, those assets are all in, and as a result, my impression is that institutions are likely to have unusual difficulty shifting out of their high-beta positions if the need arises. Investors who want high risk already own it, and the ones who don’t are likely to have far lower reservation prices and far higher required returns than are presently available to compensate for that risk.

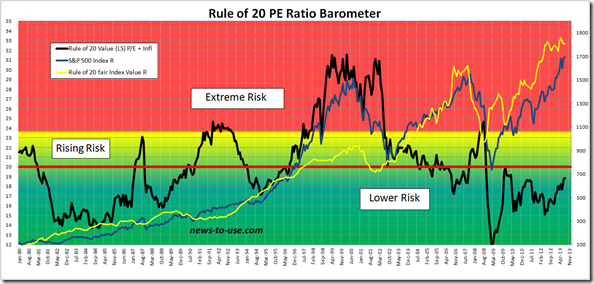

Valuations are also a problem. While we continue to hear that the market is cheap on forward operating earnings, analysts who worship at the altar of forward operating earnings seem to overlook two factors, in my view. First, profit margins are more than 50% above historical norms, and profits to GDP are nearly 70% above historical norms. There is a strong accounting relationship between those profit shares and the combined savings of households and government (see Too Little to Lock In ). To rely on permanently high profit margins, one must rely on the permanence of unsustainably large fiscal deficits and unusually low savings rates.

Our concern about operating earnings is not just that earnings are likely to dip in a recession, but that these elevated earnings are being used as the entire basis for stock valuation. That is, expected operating earnings are essentially being treated as a sufficient statistic for the whole long-term stream of cash flows that investors can expect. Failing to adjust for the cyclicality of profit margins isn’t just a transitory issue of oh, well then we might have next year’s earnings estimates a bit high. No, failing to adjust for the cyclicality of profit margins means that the entire estimate of fair value is off by something on the order of 50-70% from where it would be on the basis of normalized margins (somewhere in the range of 850-950 on the S&P 500).

This leads to the second factor that analysts seem to ignore. Specifically, major market downturns are not driven by a simple downturn in earnings over a year or two, but instead invariably reflect a change in the valuation of the entire long-term stream of cash flows (either because expected long-term cash flows are revised, or because investors require greater long-term prospective returns). We often hear analysts talk as if the change in the S&P 500 should simply track the change in earnings over the same period. But the historical correlation between the two — for example, the year-over-year change in earnings versus the year-over-year change in the S&P 500 — is close to zero. Major stock price fluctuations nearly always reflect a shift in expected long-term cash flows or in required long-term prospective returns.

This can be illustrated using the standard dividend-discount model, which is a widely known starting point for equity valuation. Suppose you have a company that is expected to earn $2 per share next year, pays half of earnings out as dividends, and grows at 5% annually each year, ad infinitum. In order to expect a 10% return from this stock over the long-term, you would pay $20 a share today (essentially giving you 5% from expected price growth and 5% from dividend yield). In order to expect a 6% return on this stock, you would pay $100 [5% growth + 1% yield: P = D/(k-g)]. Now let’s wipe out all of the earnings and dividends in the coming year, but leave the long-term flows unchanged. If you do the math, you’ll find that in each case, the value of the stock drops by only about 90 cents. The only way you’ll get a huge change in the price of the stock is if you’ve misjudged the whole stream of long-term cash flows (which is what I believe analysts are doing by failing to adjust for profit margins and using a single year of earnings as the whole basis for valuation), or if you change the long-term prospective return that the stock is priced to achieve.

My view on this is simple — if you’ve overestimated the long-term stream of cash flows by failing to adjust for elevated profit margins, if the prospective return on stocks is unusually low even on the basis of normalized earnings (as it is today), and if you’ve set your portfolio up in a crowded trade that takes record-high beta exposure to market fluctuations (as many institutions have now done), you just might be in for some trouble.

Market Climate

As of last week, our estimates of prospective return/risk in the stock market remained in the most negative 1% of historical observations. That overall assessment reflects a variety of horizons from 2 weeks to as much as 18 months (on a longer horizon that purely reflects valuations, we estimate 5-year S&P 500 total returns of roughly zero, and 10-year prospective returns at about 4.7% after last week’s market decline). All of this can comfortably be dismissed as the ranting of a perma-bear by those who disregard our record through 2009, disagree with my insistence in 2009 to stress-test every method against Depression-era data, and doubt that we will remove our hedges in more favorable conditions (as we did in 2003, and which our ensemble methods would have supported in much of 2009-early 2010). For those who are not so easily dismissive, I appreciate your trust. Very simply, I remain concerned about a blindside recession, significant market losses, and overconfidence in the ability of the Fed to create anything but temporary psychological lifts in the face of real structural economic problems.

Strategic Growth and Strategic International remain fully hedged, Strategic Dividend Value is hedged at 50% of the value of its stockholdings (its most defensive stance), and Strategic Total Return continues to carry a duration of about 2.8 years, precious metals shares amounting to about 12% of net assets, and a few percent of assets in utilities and foreign currency shares.

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic Total Return Fund, the Hussman Strategic International Fund, and the Hussman Strategic Dividend Value Fund, as well as Fund reports and other information, are available by clicking The Funds menu button from any page of this website.