Hussman Funds Mutual Fund Brokerage Commissions and Trading Costs

Post on: 2 Июль, 2015 No Comment

Mutual Fund Brokerage Commissions and Trading Costs

Hussman Funds

John P. Hussman, Ph.D.

President, Hussman Investment Trust

Originally published on October 1, 2003

(Updated December 31, 2012)

How much do mutual funds pay in commissions and trading costs? This is a question that the mutual fund industry seems reluctant to answer. In an industry already complicated by fees — sales loads, soft dollars, trailing fees, 12b-1 marketing fees — asking mutual funds to prominently disclose trading costs is unpopular among fund companies.

Since few mutual funds offer prominent, detailed information regarding trading costs (in fact, none that we know of), taking the lead is risky. After all, if one fund company publishes its costs, there is a risk that shareholders will simply add these costs to the expense ratio for that company’s funds, without doing the same for other companies that don’t disclose this information. For that reason, even funds with low trading costs (which we believe include the Hussman Funds) are reluctant to go first.

We’ve decided to take the lead anyway. It’s the right thing to do.

Expense Ratio

The following data is for the Hussman Strategic Growth Fund (HSGFX). For the fiscal year ended June 30, 2012, the Fund’s gross expense ratio was 1.05%, compared with an average expense ratio of 2.05% among the limited group of mutual funds pursuing similar strategies and classified as long-short funds by Morningstar. The Fund has no sales load (a charge for purchasing the fund), no soft-dollar arrangements (where fund managers receive research, data terminals and other benefits in return for paying higher commissions to brokers), no trailing fees (where funds pay brokerages an ongoing percentage of assets in order to bring business to the fund), and no 12b-1 marketing fees (where shareholders pay an amount over and above management and operating expenses, so that funds can advertise and attract new shareholders).

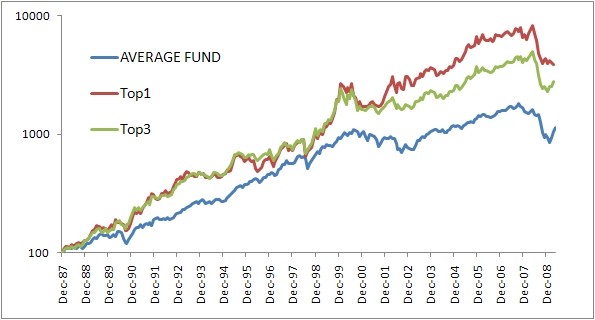

While it is possible to attain even lower expense ratios through passive investment strategies that neither evaluate securities nor manage market risk, our investment objectives are more demanding. For the Strategic Growth Fund, the objective is long-term capital appreciation, with added emphasis on protection of capital during unfavorable market conditions. This is an approach that requires a much different set of skills than passive strategies do. Our expenses should be evaluated based on the extent to which we satisfy our investment objectives, and whether we deliver incremental long-term return and investment stability that is worth the management expense.

Brokerage Commissions

According to data from Greenwich Associates presented in testimony to the House Committee on Financial Services (Harold Bradley of American Century Management, March 12, 2003), mutual funds pay an average of between 5.1 and 5.5 cents per share in commissions to make securities transactions — a rate that has not changed significantly in the past decade.

As of December 31, 2012, the transactions for the Hussman Strategic Growth Fund were subject to commissions of 1.3 cents per share and $1.30 per option contract. Given the Fund’s approach to trade execution, our transactions are handled using verbal orders through traders with direct access to the trading floors of major exchanges. While it would be possible to obtain somewhat lower commissions using strictly electronic trading platforms, we believe that until liquidity on these platforms becomes substantially deeper, we would lose more on execution than we would gain through modest commission savings. Still, we do intend to seek further commission reductions as net assets grow over time.

The following table presents the brokerage costs of the Hussman Strategic Growth Fund from its inception on July 24, 2000 through December 31, 2012. When evaluating commission costs, it is important to remember that taking advantage of opportunities in the financial markets requires trading. Commission costs (as well as other costs) should be judged in the context of whether these transactions generate value for shareholders over time. Note also that while the assets of the Fund have grown substantially since inception, this growth began from an extremely small base. As noted later in this report, there is no evidence that the Fund’s asset growth has resulted in substantial market impact or reduction in Fund performance.