How to Rebalance Your Portfolio

Post on: 24 Май, 2015 No Comment

Savvy investors rebalance their portfolio often to ensure proper asset allocation. Fear not: even for novices, rebalancing isnt as hard as it sounds.

It’s that time of year again. The leaves are changing, weather is turning cold, and the year is rapidly coming to an end. You may be thinking it’s time to go holiday shopping. Although this may be true, it’s also time for you to do something else. It’s time to look at your investments and rebalance your portfolio.

What is rebalancing anyway?

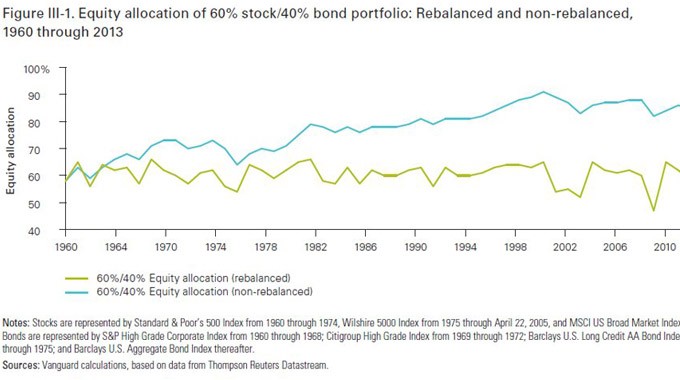

We have talked about the importance of proper asset allocation in previous posts. Rebalancing is the process of bringing one’s portfolio back into proper asset allocation.

During the year, the mixture of stocks, bonds. mutual funds, and cash has likely shifted. Stock and bond values go up and down all the time. Your portfolio mix may be out of whack.

For example, you may have started the year with 70% of your money in stocks and stock funds and 20% in bonds and 10% in cash. The stock portion of your portfolio may have grown larger than your initial allocation percentage. Now you may have 80% of your money in stocks and 20% in bonds. You will want to trim your stock exposure back to its normal level.

Another reason to rebalance is that you are another year older.

Like it or not, we all get older during the year. This means that the dynamics of your portfolio have to change. Every year, your stock percentage should go down 1 percentage point and your fixed income securities should go up one percent. Every year that you get closer to retirement, the more conservative that your portfolio should become.

How do you rebalance your portfolio?

This is the easy part.

If you handle your own portfolio, then you will want to shift your assets from the portfolio portion that has become too top heavy. For example, reduce your position in a stock or stock fund that has gained significantly during the year.

Add these proceeds to the portion of your portfolio that is lagging. For example, let’s say own an aggressive small cap fund and a moderate large cap fund. If the aggressive small cap fund has significantly outperformed the large cap fund then you may want to trim your position. Make sure that your portfolio fits in line with your risk tolerance. A lot of people thought they were risk takers until the market crash of 2008 caused their portfolios to crash 50 to 60%.

If you want to switch up your retirement plan then you will want to speak with the company that handles your plan. A good strategy to take is to sell off funds that have become big and bloated. Maybe you are overly invested in domestic markets and need more international exposure. Look for funds that may have underachieved the last year or so that may be due for a breakout. Yesterday’s market losers may be tomorrow’s winners and yesterday’s winners may be tomorrow’s losers.

When should you rebalance?

You should rebalance your portfolio every single year .

Many people never rebalance their portfolios and do not find out that they are overly concentrated in one area until it’s too late. You can pick the time of year that work’s best for you. I prefer to rebalance my portfolio at the end of the year. This way I can sell off positions that I want to get out of and start the year off fresh. It also allows me to take any necessary tax losses to offset gains on my portfolio.

What about you? How often do you rebalance your portfolio?