How To Know When To Take Profits A Discussion Of Fear And Greed

Post on: 25 Июль, 2015 No Comment

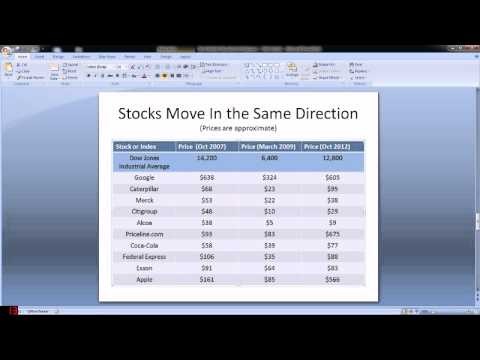

There are two things investors need to battle on a constant basis. The first thing is fear. We must eradicate fear when markets are collapsing because we know great fear is when fortunes are made. I distinctly remember when the S&P 500 closed at its low of 666 on March 6, 2009. The mark of the devil was such an insult to injury on Wall Street that hardly anybody decided to buy that day.

Fear can be overcome through experience as weve seen a rebound in plenty of asset classes time and time again. Were seeing a tremendous recovery in housing right now for example. Having a cash hoard so great that you can withstand any amount of body blows is also a key element of combating fear. But feeling secure is not the way to make money. Youve got to actually get over your fear of losing your security by deploying funds that will initially lose money since nobody can time the bottom.

Greed is the other element an investor must overcome. The desire to make an ever increasing amount of money has ruined peoples lives. Back in the dotcom bubble of 1999-2000, I had several friends who were paper millionaires and unwilling to sell their dotcom company shares out of belief prices would only go higher. Not only did their company shares tank, they ended up owing taxes on the value when their options were exercised. Lets say you exercise $1 million worth of options at $100 a share. You decide not to sell and the stock detonates to $10 a share. You still owe about $500,000 in taxes on the $1 million even though your shares are only worth $100,000! Another win for government.

Let me tell you another story about greed. The owner of a deli I went to for 11 years in downtown San Francisco was a jovial fella who used to make the best banana nut muffins. He margined up his $50,000 in capital to $200,000 online. One morning after the collapse he revealed to me over coffee that his portfolio was valued at $800,000 at the peak. $800,000 was enough to move back to his home country of Iran and live like a Shah for the rest of his life. Instead of selling everything to fulfill his dreams at the age of 32, he hung on and lost over $150,000 from his initial $50,000 investment due to margin. Thats a $950,000 swing. I stopped in last month to pay a visit. 13 years after the dotcom collapse hes still making breakfast burritos and banana nut muffins for whiny customers at the age of 45.

TWO SIDES TO EVERY ACTION

As an economics major in undergrad with a focus on finance during business school, Ive been trained to think in Yin Yang terms. When the economy is improving the stock markets tend to follow suite due to an increase in corporate profits. More people find jobs and the world is a better place again. When Im sitting in mega traffic thinking of bashing the Mercedes in front of me, to calm my nerves I think how wonderful it is everybody is working again so that my investments go higher.

What people forget during good times is that when there is a tighter labor supply prices go up for everything including rent, gas, food, and interest rates. Prices go from P1 to P2 and suddenly it becomes a little too painful at the pump to commute to work 40 miles a day. Interest rates inch up making your wasteful car payments no longer affordable. If salaries get too high companies begin to slow down hiring or even fire the now overpaid elder staff. You might even see a demand curve shift to the right due to expectation changes in incomes. The list goes on and on.

The rich are getting really rich in a bull market. while those who rent and diligently save but do not invest get poorer by the day. If you do not own real assets, you can kiss your happiness goodbye as things become unaffordable. As the middle class slows down consumption, so begins the decline in corporate profits. Thankfully the trend is up and to the right. But lets not kid ourselves about the cycles in between.

RECONCILING PREDICTIONS

My 2013 predictions state that the S&P 500 will climb 8.8% to 1,551. The post goes into detail how I came up with a 1,550 target price. At the close of March 8, the S&P 500 ended at 1,551.18 and its now looking like my call is a little too conservative. I had to make a decision Friday morning whether to let my investments ride or take profits. Things are obviously recovering quite handsomely and the sequester fear mongering did nothing but provide happiness to the rest of us given the government finally has to eat their own poop.

During my decision making process, I thought back to the 1997 Asian financial crisis, the 2000 dotcom meltdown, SARS/bird flu scare in 2003, and the Armageddon of 2008-2010 to remind myself of financial pain. I looked at the composition of my net worth on Personal Capital to see a full 73% of my wealth leveraged into the stock market and real estate market. Things felt good, but feeling good is almost always temporary.

Most of my equity exposure is in investments that cannot readily be sold (structured notes with 2-5 year time horizons, deferred compensation in the form of company stock, private equity etc). I like to feel in control of my finances, even though I may only be experiencing the illusion of control. Selling real estate is an entirely different ordeal that doesnt make sense now given were in a multi-year upcycle and transaction costs are prohibitively expensive. The only thing I can easily adjust is my 401k.

I came to the conclusion that its time to be disciplined and sell equities. My 401k is now 80% in stable value (50%) and fixed income funds (30%), and only 20% equities. The stable value funds should return at least 1.7% risk free for the remainder of the year. Meanwhile, I see value in 10-year treasuries above 2% over the short-term, but not over the long term. I believe the S&P 500 is fully valued at

16X-17X earnings. Rising interest rates and $4+/gallon gas will slow down the pace of consumption. Meanwhile, the sequester effect will start to be felt over the next six months.

BE HAPPY WITH WHAT YOU WANT

If Im wrong, then great. A rising stock market really helps those in the top 20% who own over 90% of stock market wealth. A rising stock market also helps everybody thanks to an improving labor market. Just like how nobody can pick the bottom, nobody can pick the top either. The momentum is there and we may very well keep charging to 1,600 on the S&P 500.

With my 401k rebalance, Ive now freed up time to focus my efforts on making money elsewhere. There are so many rental properties to see and so many online projects to execute. Perhaps the markets will rocket much higher, making a 8.8% prediction look completely silly. But at 1,551, Im happy to wait. Ive survived another year of not losing money and I hope the same goes for all of you.

To Recap: Deciding On When To Take Profits

* Review your predictions for the year and see what has gone right and what has gone wrong.

* Think about the various positive and negative catalysts in the economy that may improve or derail your arguments over the next six months.

* Reassess your financial situation. Do you have stable cash flow? Do you have passive income? Are there changes on the horizon such as an upcoming expense or an impending retirement?

* Evaluate current valuations and expected earnings 12 months out. Are they reasonable?

* Look for new opportunities and laggard stocks and sectors. Everything is relative in investing.

* Remind yourself that you can never lose if you lock in a gain.

* Repeat the cycle once youve mustered up the courage to invest again.

RECOMMENDATIONS TO BUILD WEALTH

Manage Your Money In One Place: The best way to growth your wealth is to stay on top of their finances by signing up with Personal Capital . They are a free online platform which aggregates all your financial accounts in one place so you can see where to optimize. Before Personal Capital, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to track my finances. Now I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going. Their 401K Fee Analyzer tool is saving me over $1,000 a year in fees I had no idea I was paying. There is no better free platform out there that is helping me manage my money. The entire sign-up process takes less than a minute and is free.

Be Your Own Fund Manager: Motif Investing allows you to build a basket of 30 stocks for only $9.95, instead of spending the normal $7.95 for each position ($230+ commissions). There’s no need to pay expensive and ongoing active management fees for mutual funds again. Once you build your own portfolio, or purchase one of the 150+ professionally created motifs, you can simple dollar cost average with one click of the button every time you have money to invest. You can even buy retirement Horizon motifs, that act like target date funds, except you don’t have to pay the 1% management fee either. Finally, you get up to $150 in free trading credit when you start trading with Motif Investing. Motif Investing is truly the low-cost, efficient, and most innovative way to invest today.

Updated for 2015. Let the bull market continue with the stock markets at record highs. Just dont forget to rebalance and manage your risk exposure.