How to Invest in Oil Find Out How to Invest in Oil and Why from

Post on: 20 Май, 2015 No Comment

Why Invest In Oil?

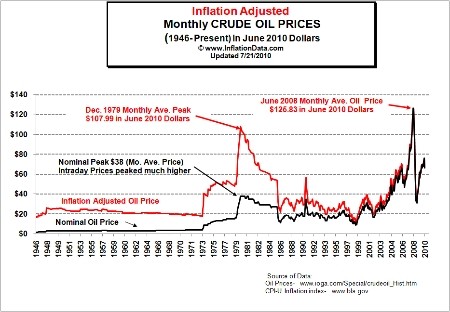

Often referred to as black gold, oil has clearly made itself a profitable industry for many. Between rising prices and a continually growing demand for millions of barrels per day in the United States alone, investing in oil may be a tempting option for diversifying your portfolio. Oil is part of a collection of resources considered energy, a growing sector in the investment arena that many are turning to with the rise in worldwide energy consumption.

Types Of Oil

Oil drilled from around the world is classified into different types with specific names like Brent Crude and Brent Sweet Light Crude. Oil is classified by the American Petroleum Institute gravity system of measurement, which determines the weight of crude oil in comparison to water, leading to the specific names.

Where Does Oil Come From?

Oil is drilled in various locations around the world. It can be taken from both underground sources on land, as well as deep sea drilling. Areas with multiple sources of oil drilling are known as oil fields. Some of the most prominent and profitable oil drilling areas include:

- The North Sea

- United States Gulf Coast

- Alaska

- Saudi Arabia

- Libya

- Iran

- Iraq

- Kuwait

How To Invest In Oil

Investing in oil directly is still difficult, as you won’t physically own barrels of it. Part of the appeal of commodities like gold and silver is the investor’s ability to physically own bars or coins of the precious metals, which is not an option when investing in oil. Currently, investors have the option to place their money in exchange traded funds (ETFs), energy mutual funds, or individual stocks in oil drilling companies.

Individual Oil Companies: Investing in individual oil stocks means you are placing your investment in a company, rather than in oil itself. Investing in oil service companies can be lucrative, but should not be confused with investments in the actual commodity. Investors typically purchase stocks in all major oil companies to spread out their portfolio. Major oil companies include:

- Exxon Mobil (traded as XOM)

- Royal Dutch Shell (traded as RDS.A)

- BP (BP)

- Chevron (traded as CVX)

- Conoco Phillips (traded as COP)

Oil ETF: In precious metal exchange traded funds, investors place their money in a fund that physically owns bars of gold or silver. With oil exchange traded funds, investments are placed in a basket of future contracts, which means a set of 15 or more contracts obligating the investor or seller to buy or sell commodities stock at a predetermined time. Why purchasing an oil ETF may be right for you:

- Only one purchase is made, rather than the many required with purchasing an oil index or individual oil company stocks.

- You save money on commissions by only making one purchase.

- Capital gains taxes are not incurred until the fund is sold, creating several tax advantages over other forms of oil investment.

- Oil ETFs can be sold in one trade.

Energy Mutual Funds: Rather than merely investing in oil ETFs or drilling companies, energy mutual funds allow investors to place their money in a wide variety of materials and companies. Within oil, the mutual fund will often both include major and independent drillers. Energy mutual funds also include stocks in natural gas.

If you have decided that investing in oil is the right decision for your portfolio, begin gathering a thorough understanding of the oil market. Track the rise of oil prices, and how specific ETFs react. By understanding how the rise in price of oil affects the price of ETFs, you can make an educated decision about which specific fund is best for you.

Last Updated: August 12, 2011