How to Invest in Mutual Funds and Build Significant Wealth

Post on: 16 Март, 2015 No Comment

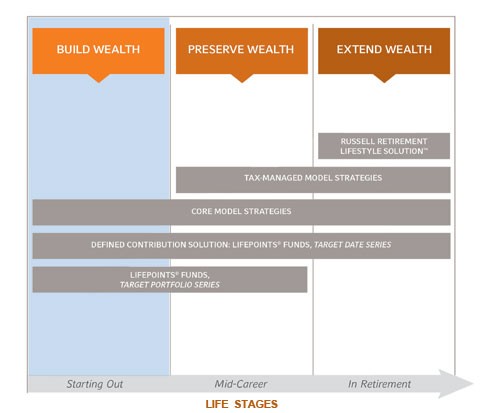

With the arrival of 401(k). Roth IRA and other self-directed retirement programs. the onus has been strictly on the individual investor to figure out how to invest in mutual funds and other securities to ensure a comfortable retirement. Since mutual fund investing, at least on the surface, seems to offer the combination of lowered risk and good performance that most individuals seek, there has been an explosion of interest and money invested in mutual funds.

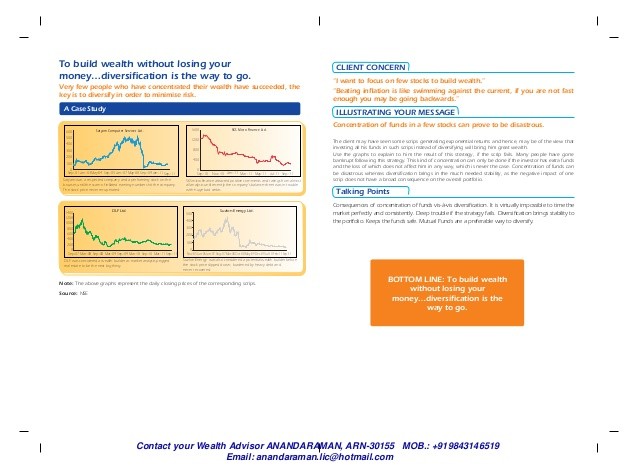

The basic advantages of investing through a mutual fund are instant diversification. and expert management of your money. At least theoretically, you can choose a good mutual fund and put money away regularly, and cruise towards a nice nest egg.

The ugly side of mutual fund investing is that 75-80% of mutual funds cannot keep up with the market or index funds that track the market (S&P 500, DJIA, Wilshire). Moreover, many mutual funds change their management and management style frequently (3-5 years), which causes fundamental changes in the way your money is managed. And then again, not all mutual funds offer the diversification that you seek — they may be country specific, sector specific, industry specific — and thus may actually raise your overall risk profile.

This already gives you a good sense of the qualities to seek while investing in a mutual fund:

Use Morningstar to check performance of various mutual funds over a 10 year period. In effect, you are checking the performance of the fund over one bull and one bear market period. Check the yearly fluctuations in returns, and run an example with actual cash invested, as opposed to looking at average returns. Large losses tend to lower your cumulative returns far more than what becomes visible as average returns (for example: $100 invested becomes $50 if there is a 50% drop in year 1. A 50% rise in the next year, only makes your money into $75 — though the average return for the two year period is 0%!).

Ensure that the same manager guided the mutual fund over the period that you are evaluating and that this manager continues to be at the helm and shall remain so for the foreseeable future. The manager and his or her philosophy have the single largest effect on the performance of a mutual fund, so it is important to know whom you are backing. Also, take the time to understand the manager’s philosophy and the fund’s overall investment style. Ensure that you buy into the philosophy and that the manager is actually managing according to that style.

All things being equal choose value over growth. Value Investing is the art of buying under-priced securities, eventually hoping that the market will recognize the full value, at which time you can sell with a tidy profit. This form of investing is more staid, and even boring, but comes with a larger margin of safety than pure growth investing, where there is much onus on beating market expectations. Legg Mason Value Trust is a good example of such long term value investing, as is Berkshire Hathaway under Warren Buffett.

Diversify outside of a mutual fund as well. Mutual funds are good vehicles of diversification, but they have their own focus as well — small cap, large cap, mid-cap, real-estate, commodity and so forth. Thus, make sure that your asset allocation reflects — US or your local country, International markets (Euro, Japan), Emerging markets (China, India, Brazil, Russia), Commodity nations (Canada, Australia) as well as sectors such as Energy and Real-estate. Allocating a portion of your money to each of these areas and then rebalancing regularly (annually, semi-annually or quarterly), will ensure that you maintain good stability and returns for your portfolio!

With this approach, seek to gain

12%/year growth over a 10 year bull and bear market period. The additional 1% over the index funds will compound over time to add significantly to your nest egg.