How to Invest in a Hedge Fund

Post on: 5 Апрель, 2015 No Comment

Hedge funds are still a mystery to most main street investors. They are hyped up as these investments that millionaires and billionaires use to make even more money. But the truth is, they are more like mutual funds that are extremely specialized and follow a specific manager. However, they are still extremely popular over $2 trillion is calculated to be invested in hedge funds (which is only 10% of the amount invested in mutual funds).

Regardless, you want to know what these investments are all about.

What is a Hedge Fund

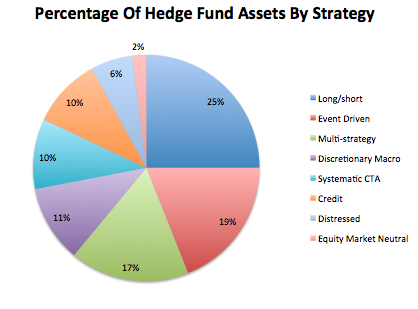

Hedge funds are simply investment funds that follow the strategy championed by their managers. Many funds try to capitalize on both short term and long term returns investing in everything from private start-up companies, to taking short positions in publicly traded companies. Many hedge funds also use leverage to try to magnify returns.

Hedge funds originally got their name because they acted as a hedge to the general equity stock market. However, over time, more and more correlation between hedge funds and the stock market have emerged since hedge funds have invested more in the stock market.

How to Invest in a Hedge Fund

If you want to invest in a hedge fund, you have to be an accredited investor which means you have over $1 million in assets or make over $200,000 per year. However, the truth is, you probably need to have much more than $1 million to invest in a hedge fund, especially if you want to be properly diversified. The typical hedge fund requires you to invest a minimum of at least $100,000, but many require minimums of $250,000 or even $1 million.

If you want to invest in a hedge fund, you typically need to contact the hedge fund company and talk with the company. However, professional wealth managers (especially those specializing in high net worth individuals) can also help you invest in hedge funds.

Warnings About Investing in Hedge Funds

Hedge funds dont come without serious risk. Beyond the investment risk of investing in funds that short sell and use leverage, hedge funds typically have two policies that can be really detrimental to investors.

First, they charge incredibly high fees. Many hedge funds use the pricing policy 2/20, which means 2% annual management fees and 20% of the profits after a specific target has been reached. This can seriously eat into any profits you may have.

Second, they typically have lock-up periods, which means that you cannot withdraw your money at any time. Many hedge funds typically have a once a year withdraw period, which makes them very illiquid investments. The reason hedge funds lock up funds because many hedge funds invest in start-up companies or other illiquid investments. These investments take time to generate a substantial return, so withdraws could be very detrimental to the fund as a whole.

What are your thoughts on investing in hedge funds?