How to interpret retained earnings

Post on: 16 Март, 2015 No Comment

Retained Earnings Defination & Example | Investing Answers www.investinganswers.com Retained earnings are the sum of a company’s profits, after dividend payments, since the company’s inception. They are also called earned surplus, retained .

Retained Earnings Definition | Investopedia www.investopedia.com The formula calculates retained earnings by adding net income to (or subtracting any net losses from) beginning retained. Reading The Balance Sheet.

How to Calculate Retained Earnings: 10 Steps (with Pictures) www.wikihow.com Retained earnings is the portion of a company’s net income which is kept by. Understanding Retained Earnings Calculating a Company’s Retained Earnings.

Understanding Retained Earnings | The TGG Way — TGG Accounting tgg-accounting.com Sep 28, 2012. Retained Earnings is an important piece of the balance sheet and can often be misunderstood. We often hear clients mention that they see it as .

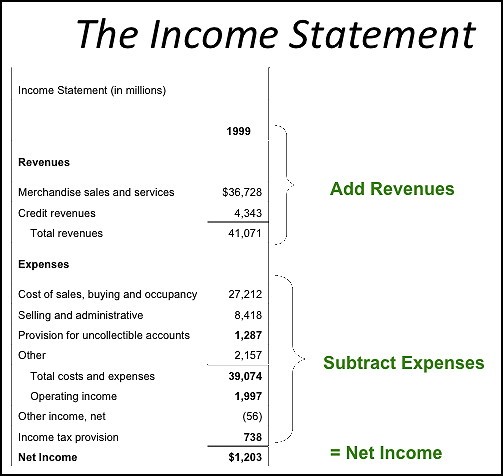

Retained Earnings on the Balance Sheet — Investing for Beginners beginnersinvest.about.com Once you learn to read the income statement, you can use the retained earnings figure to make a decision on how wisely management is deploying and .

Learn more about How to interpret retained earnings

Reticulocyte Count — Family Practice Notebook This page includes the following topics and synonyms: Reticulocyte Count. Retic. Example. Autoimmune Hemolytic Anemia; Usually ARC > 100 x10^6/L and .

Two — way ANOVA results section? For each main effect and for the interaction, you have. F(1,18) = X.XX. The 1’s are the between groups df’s and the 18 is the within. Error df is another nam.

Return On Assets (ROA) Definition | Investopedia An indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate .

How to interpret results from animal tests . Results from 80 rubber chemicals in the chicken embryo test were reviewed and compared, when data were found, to results on teratogenicity in mammalian test sys.

Asset Turnover Ratio Interpretation . The asset turnover ratio indicates how well a company implements its assets in the production of revenues. It includes all assets and total revenue, meaning tha.

How to Interpret Factor Analysis Results . 1. Determine the purpose of your factor analysis before running the procedure and interpreting the output. A common use of factor analysis is to define a set of.

What is Return On Capital Employed — ROCE? A ratio that indicates the efficiency and profitability of a company’s capital investments. Calculated as: Investopedia Says: ROCE should always be higher than.

Odd Pearson correlation coefficient results ? You are calculating your standard deviation as: sx = sqrt((sx / n)); and similarly for sy. The equation you have used uses n-1 in the denominator for calculatin.

Is return on capital employed the same as a gearing ratio ? No, a gearing ratio is a measure of financial leverage, demonstrating the degree to which a firm’s activities are funded by owner’s funds versus creditor’s fund.

This is somewhat of a beginner’s question, but how does one inter. It will take us a while to get there, but in summary, a one-unit change in the variable corresponding to B will multiply the relative risk of the outcome (compa.

Return on Equity (ROE) — Investing for Beginners — About.com Return on Equity, ROE, tells investors how much profit a company relative to the total amount of shareholder equity on the balance sheet. A high return on equity , .

en.wikipedia.org/wiki/Mul.

We hear that your target is a total return ratio of 100%, however. A3. Certainly, if there is a large project in the period of this first Mid-term Business Management Plan, we will need to make considerations, including whether.

How to Interpret Glucose Tolerance Tests An oral glucose tolerance test may be performed on healthy individuals, people with diabetes or pregnant women to observe the effects on blood sugar levels foll.

Return on Investment Ratio Analysis. When calculating the return on investment. an investor should understand that both the definition and the calculation have some flexibility in determining what.

Annotated SPSS Output: Factor Analysis — IDRE — UCLA Annotated SPSS Output Factor Analysis. This page shows an example of a factor analysis with footnotes explaining the output. The data used in this example .

Return On Sales (ROS) — ReadyRatios.com Definition. Return on sales (ROS) is a ratio widely used to evaluate an entity’s operating performance. It is also known as operating profit margin or operating .

How to Use Statistics to Interpret Survey Results . 1. Calculate the mean. To do so for this example, add the heights together and divide by 10, which is the number of heights there are. This provides the mean, o.

What is rate of return on net sales ratio ? Rate of Return on Net Sales = (Net Income) / (Total Sales )

How do i use the chi squared value to interpret my results ? It means you cannot reject that the distribution is a normal distribution. This class of tests can only tell you what is not true, not what is true. What you ar.