How to identify highprobability reversal zones

Post on: 16 Март, 2015 No Comment

KevinHaggerty

Kevin Haggerty has more than 40+ years of experience in the institutional equity and professional trading business, including serving for seven years as as Senior Vice President in charge of Equity Trading at Fidelity Capital Markets Boston, a division of Fidelity Investments. He also was a member of the managing directors committee of the CBOE, a member of the NYSE Stock Allocation Committee; and a member of the S.I.A. Committee to advise the Securities and Exchange Commission on various aspects of the securities industry. He currently runs Kevin Haggertys Professional Trading Service. and is the author of Markets Trade with Geometric Symmetry, which can be found at www.geometricmarkets.com .

Kevin Haggerty’s Latest Posts

You cannot predict markets with any high degree of success, or the duration and extent of a market move, but you can anticipate and pinpoint high-probability reversals or acceleration price and time zones with a positive mathematical expectation of success.

However, when a market nears a potential turning point, you must look for confirmation from other technical evidence that indicates either an overbought or oversold condition to determine if a reversal is indeed supported.

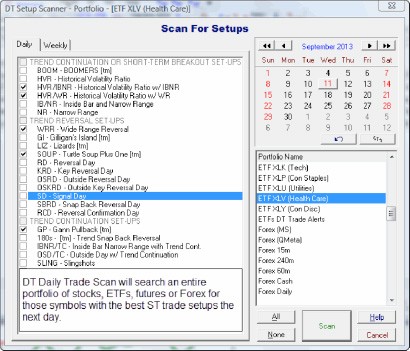

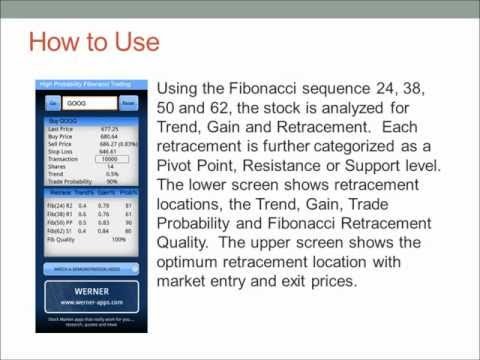

In order to be successful at pinpointing these high-probability zones where you identify key market turns and pinpoint highs and lows, I use specific primary tools such a Square Root Relationships, Fibonacci and Pi.

You can successfully time the markets regardless of whether you are a money manager, investor, trader or analyst by using this clearly defined methodology. It’s based on the principle that markets move in cycles just like many things in the universe, and they will trade geometrically over time, which is why you must use the primary-market tools mentioned above to anticipate the key market turns in advance.

The most current example of using the primary-tool symmetry confirmed by other technical evidence to identify a high-probability reversal zone is the recent May 22 S&P 1687 bull-cycle high which has declined -5.3% so far to a 1598 intraday low as I complete this commentary on June 6, 2013.

The SPX monthly 5 RSI was extreme at 91.30 in May, as were most any other momentum or sentiment indicators, and the market was obviously overbought on a long-, intermediate- and short-term basis, as indicated on the monthly, weekly and daily charts. On just a momentum basis, why would anyone be surprised that the market would sell off at some point when the technical evidence was so lopsided regardless of the Fed?

The overbought condition was obvious, and there was also a 5 RSI negative momentum divergence on both the weekly [intermediate] and daily charts [short term], so the technical evidence would confirm any significant price and time symmetry which I have outlined below.

The SPX made a 1687 high on May 22, 2013, which is +153% in 1538 CD`s from the March 6, 2009, 667 bear-cycle bottom. On the Square of 9 Calculator chart, you can see that 1687 is a major angle [225 degree] measured from the March 6, 2009, 667 bear-cycle bottom.

On the Geometric Date Calculator, the time symmetry of May 20, 2013, and May 24, 2013, measured from both the low and high of the 1474.51-1343.35 leg used to form the triangle necessary to calculate the time symmetry is highlighted, so the probability was strong for a reversal that week, and that is what occurred.

The Fibonacci Time Ratio Calculator chart highlights the May 20, 2013, time symmetry which is the 1.50 fib extension of the previous two significant tops at 1422.38 and 1474.51.

The price and time zone had symmetry, and that was confirmed by the technical evidence of a very overbought condition, so it was a high-probability zone which has resulted in a -5.3% reversal so far from 1687 to 1598.

There is key Pi symmetry in the third week in June and the first week in August, which I mentioned in my previous article and will address in my next commentary.