How to Find The Hidden Cost of Mutual Funds

Post on: 27 Июль, 2015 No Comment

I wish mutual fund companies actual sent us a bill each time they charged us. They dont, of course, and so like The Dark Side of Placing Your Finances on Autopilot. we can easily forget about just how much they cost us. On top of that, not all costs of owning a mutual fund are easy to determine or understand. So here is a quick breakdown (if you want to jump to the hidden cost of mutual funds, see the last bullet point):

- Loads. Loads come in two varietiesfront-end and back-end. A front-end load is paid when you buy the fund. A back-end load is paid when you sell the fund. Loads generally go to the broker-dealer that is selling you the fund. Given all of the great no-load funds available, buying a load fund is almost always a waste of money.

The next group of fees are paid out of the fund, thereby reducing the funds returns:

- Management Fee. These fees are paid to the investment advisor who runs the fund. The fees are accrued daily and usually paid monthly or quarterly.

- 12b-1 Fee. Named after the SEC rule that authorized funds to charge these fees, 12b-1 fees cover the costs of marketing the funds. The theory behind these funds (for those who care), was that by attracting more fund investors, over time, the fund could lower its costs as a percentage of money under management. Note that a fund cannot charge more than .25% in 12b-1 fees and still describe itself as a no-load fund.

- Other Expenses. This is like the miscellaneous category in your budget, but generally pays the funds service providers.

In a funds prospectus, it must list its expense ratio, which is the amount of the above three expenses expressed as a percentage of the funds assets. For example, an expense ratio of 1% means that 1% of the money you invest in the fund each year will be paid to cover these costs. You can learn how to examine a funds expenses using Morningstar.com from the How to Make the Most of Morningstar series. Oddly enough, there are additional costs that fall outside of the expense ratio! Here they are:

- Redemption Fees. Redemption fees are charged when you sell or exchange a fund. Unlike back-end load fees, however, the fees go back into the fund to the benefit of the remaining investors in the fund. The purpose of redemption fees is to discourage short-term trading of the fund and to offset the related costs.

- Brokerage Fees. Now we get to the hidden cost of mutual funds. The funds transaction costs from buying and selling securities are NOT included in the expense ratio. What! Yes, its true.

Here is a quote from Vanguards prospectus from one of its funds:

As is the case with all mutual funds, transaction costs incurred by the Fund for buying and selling securities are not reflected in the table, although such costs are reflected in the investment performance figures included in this prospectus.

So how do you determine those costs? Well, you have to go to a document funds are required to prepare called the Statement of Additional Information. In this document, the funds list the transaction costs from previous years. Particularly with smaller funds where these costs cannot be spread over a larger asset base, these expenses can be significant.

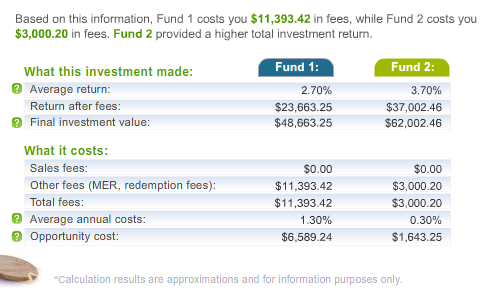

With that, the question is how much do you pay for your funds? My goal is to keep the weighted average cost of all funds under .25%. Currently, Im at .22%. You can see how I do it in this post and podcast on how and why to keep investing costs low .

If you are not sure what your total fees are, check out Personal Capital. Its a free online tool that will evaluate your portfolio, including fees. It even has a 401k fee analyzer.