How to Find and Invest in Japanese ETFs

Post on: 23 Май, 2015 No Comment

Easily Invest in the World’s 3rd Largest Economy

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Japan is the third largest free market economy in the world after the United States and People’s Republic of China. Despite a setback in the 1990s, known as the Lost Decade. the country’s economy has since begun to recover and is expected to post 2.9% growth in 2012. Those looking to invest in the country may want to take a look at Japanese ETFs.

Exchange-traded funds (ETFs) — equities that mimic the movement of an underlying index — offer international investors an easy way to gain diversified exposure to Japan. Like mutual funds, these ETFs invest broadly across many industries and sectors. They also offer some liquidity, cost and tax advantages that aren’t available through traditional mutual funds.

Why Invest in Japanese ETFs?

Japan’s economy is the third largest in the world with a gross domestic product (GDP) of $4.3 trillion in 2010. Like most developed countries, the country’s services sector accounts for about three-quarters of its total economic output. Most of the remaining economic output is attributable to its highly advanced manufacturing sector.

Given Japan’s large economy, international investors seeking broad global exposure usually end up with some Japanese holdings. Many investors view Japan as a relative safe-haven during tough economic times, due to its liquid currency, high savings rates and proactive central bank. Finally, others see opportunity after the country’s encounter with catastrophes.

Most Popular Japanese ETFs

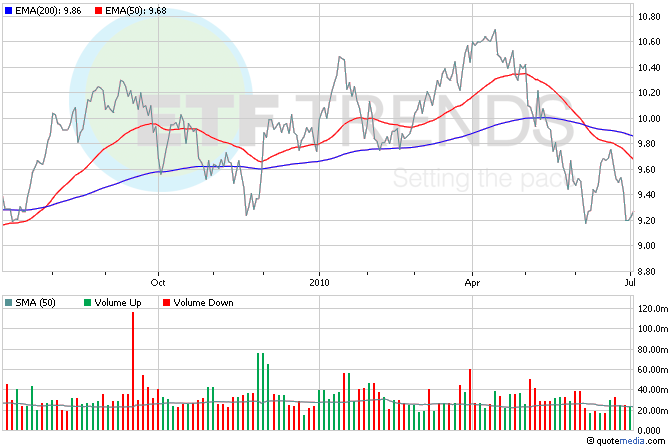

There are more than a hundred ETFs that hold Japanese securities, but the most popular option is the iShares MSCI Japan Index (EWJ). By mimicking the MSCI Japan Index, the ETF has exposure to hundreds of companies across many sectors with an expense ratio of 0.54%. And its popularity gives it a level of liquidity not seen in many other Japanese ETFs.

Some additional Japanese ETFs with significant exposure include:

- iShares MSCI Japan Index (EWJ )

- WisdomTree Japan Hedged Equity Fund (DXJ )

- First Trust Japan AlphaDEX Fund (FJP )

- WisdomTree Japan Small Cap Dividend Fund (DFJ )

- SPDR Russell Nomura PRIME Japan (JPP )

- iShares MSCI Japan Small Cap Index Fund (SCJ )

- iShares S&P/TOPIX 150 Index (ITF )

- SPDR Russell Nomura Small Cap Japan (JSC )

- DBX MSCI Japan Currency-Hedged Equity Fund (DBJP )

Japanese ETFs Benefits & Risks

There are many benefits and risks to consider before investing in Japanese ETFs. While Japan is the world’s third largest economy, the country also has the world’s highest sovereign debt and its economy is still recovering from several catastrophes. Investors should carefully weigh these risks before investing in Japanese ETFs or other types of investments.

Benefits of Investing in Japanese ETFs

- High Savings Rate — Japan has historically had one of the world’s highest savings rates, but some analysts see this rate declining over the coming years.

- Technology Leader — Japan is well known for its technology leadership with its world class companies and high R&D spending to GDP ratio.

- Wealthy Consumers — Japanese consumers are generally wealthier early adopters, while the country’s per capital household consumption ranks third in the world.

Risks of Investing in Japanese ETFs

- Sovereign Debt — Japan has the world’s highest gross sovereign debt that amounts to 225% of its gross domestic product (GDP) at $10.55 trillion.

- Difficult Demographics — Japan has experienced net population decline over the past decade, due to falling birth rates and little net immigration.

Alternatives to Investing in Japanese ETFs

Investors looking for an alternative to Japanese ETFs can purchase individual Japanese stocks with American Depository Receipts (ADRs). Since they trade on U.S. exchanges, ADRs can be easily bought and sold using traditional brokerage accounts. But it’s important to note that some may be less liquid than U.S. blue chip stocks or their Japanese counterparts.

Some popular Japanese ADRs include:

- Canon Inc. (CAJ )

- Honda Motor Co Ltd (HMC )

- Kyocera Corporation (KYO )

- Sony Corporation (SNE )

- Toyota Motor Corporation (TM )