How to Create a Couch Potato Portfolio

Post on: 12 Июнь, 2015 No Comment

by Mike | Posted on January 24, 2011 | Write a Comment (3 Comments)

Last week we talked about the Top 10 Reasons to Save For Your Retirement . Once you have achieved the motivation required to put some of your hard-earned cash aside, youll want to figure out how to invest it. Before getting into what is involved in creating a Couch Potato portfolio, remember back to what is involved in achieving superior returns. Many experts believe that choosing your asset allocation is the most important step to maximizing your investments. So now that you have determined you want to Take Responsibility for Your Investment Returns, you can work towards your investment strategy.

Create Your Investment Strategy

Heres where you will decide, in advance, how to implement The Couch Potato Portfolio. Your strategy starts with the products you will use; index mutual funds or ETFs. Next is how often to rebalance: annually, twice a year or quarterly. And last but not least is your asset allocation which is determined by your investor profile.

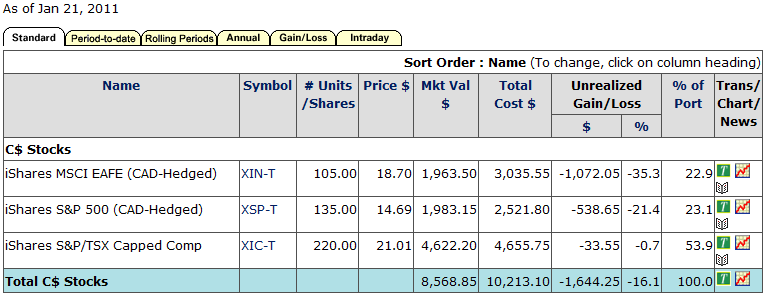

Your Couch Potato Portfolio

The reason it is so named is that once you have created the portfolio, you do nothing (cept be a couch potato). The theory is that you rebalance your asset allocation on a regular basis, 1 to 4 times a year, to ensure that you buy low and sell high.

Products Best Suited for You

In order to make your portfolio worthy of Couch Potato efforts, limit your product choices to either, index mutual funds or ETFs. The key is to be comfortable with what you are buying. Remember that you should not buy anything you dont understand. Examples are broad-based funds that replicate the Dow Jones, S&P500 or the TSX if you are looking for Canadian stocks, fixed income products will include funds that track short-term bonds/mortgages or long-term bonds.

The products you choose are also dependent on management fees and transaction costs. If you opt for an annual revision and rebalancing act, then lean towards the funds with the lowest management fees. If you decide on a quarterly schedule, then look to minimize transaction fees.

When to Rebalance Your Couch Potato Portfolio

Next is how often to rebalance: annually, twice a year or quarterly. While the true couch potato would look over their portfolio only once a year, you may opt for a little more activity. The most important consideration would be objectivity. In order to remain as neutral as possible, pick a revision schedule ahead of time and stick to it. Ideally, choose times of the year when you are likely to be interested in revising your portfolio, maybe its when you are preparing your income taxes, summer holidays, etc. If you are looking on quarterly basis, go with the week you receive your investment statements.

Your Asset Allocation

In order to determine how much to spend on what products (allocating your assets), first youll want to

Determine Your Investor Profile . follow the link for more on the subject. Lets use a simple example, you decide on the traditional Couch Potato asset allocation:

- 50% bonds,

- 50% stocks.

You would divide the savings you want to invest equally and buy two products. Next, return to couch potato mode until your next revision date.

At that time, you are almost guaranteed that the two funds will be worth different amounts. The act of rebalancing the investments will be to bring the funds back to your original 50/50 split. This is when you sell what has gained the most and buy what has under performed.

Couch Potato vs Active Portfolio management

Every investor is different. That being said, the Couch Potato method is not for everyone. If you are holding back on saving for retirement because investing is complicated or you havent found an investment advisor you can trust, the Couch Potato portfolio could be the ticket to get going. Its simple, the costs are minimal and can produce decent returns when compared to passive strategies.

How comfortable are you with this investment method? Feel free to ask questions. Or, maybe you have tried a couch potato portfolio in the past. We would love to hear about your experience.