How To Choose Between A Roth And Regular IRA 401(k)

Post on: 1 Апрель, 2015 No Comment

T ax deductions are catnip for investors, right?

So why are millennials forsaking the upfront tax deduction on traditional IRAs by selecting an alternative type of retirement account which offers no deduction?

Because they realize the other benefits outweigh the upfront tax deduction, said Judith Ward, a senior financial planner for mutual fund giant T. Rowe Price.

That alternative retirement account is a Roth IRA. And T. Rowe Price data show that investors younger than age 34 have plowed over eight times more money into Roth IRAs than traditional IRAs as of the end of 2013.

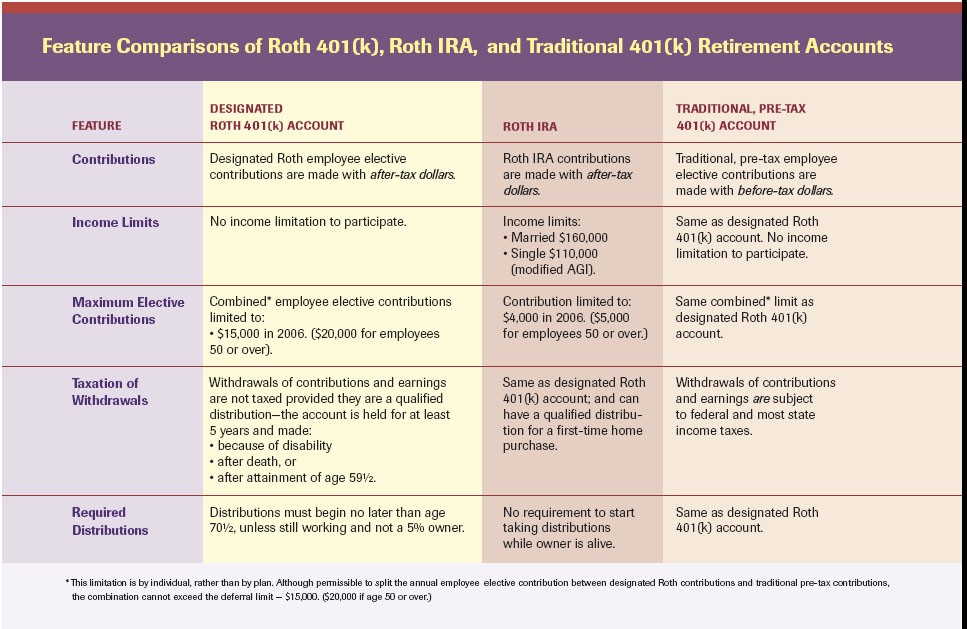

Those other benefits also generally apply to Roth 401(k) accounts.

Those benefits can mean more after-tax spending dollars and greater retirement planning flexibility.

The benefits bloom whether you invest in mutual funds or other securities in your retirement accounts.

Roth vs. non-Roth account comes down to one question, said Rob Austin, director of retirement research for Aon Hewitt. Do you think your tax bracket will be higher, lower or the same in retirement?

Direction of your tax bracket matters because of the key differences between Roth and non-Roth retirement accounts. Unlike traditional 401(k)s and IRAs, Roth users get no income-tax deduction on money they put into their account.

Uncle Sam’s Largesse

Uncle Sam returns the favor by letting Roth account owners withdraw money tax-free. Withdrawals from non-Roth accounts are taxed as ordinary income.

So if your bracket goes up in retirement, you save more in taxes on withdrawals with a Roth.

The more you withdraw, the bigger your tax savings. That’s why Roths appeal to younger investors. Their money has more time to grow and compound.

Gains on investments inside these retirement accounts are sheltered from income taxes in both Roth and non-Roth accounts. That tax-deferral is another key feature of both types of accounts.

What if your tax bracket falls? If your rate falls 6 percentage points or more, you might be better off with a non-Roth account. The fewer years until you start withdrawals, the more likely that you’ll have more spending money — after all taxes are paid — with a traditional account.

Take someone who contributed $1,000 once each to a Roth IRA and to a traditional IRA, and was in the 25% tax bracket. The $250 tax savings on the non-Roth contribution was plowed into a taxable account with the same investment. The accounts all earned 7% annually.

The person retires at 65. In retirement, the rate of return is 6% a year. Money is withdrawn over 30 years.

He is better off with a Roth retirement account if his one-time investment was at age 50 even if his retirement tax rate falls as much as 8 percentage points, says a T. Rowe Price study. (A single investment simplifies the example; the same idea applies to yearly contributions.)

But if his rate falls 9 points, he ends up with more money in a non-Roth account. The later he began saving, the less his tax rate must fall for him to come out ahead with a traditional account.

A Roth IRA has other advantages. The main one: You never have to take required minimum withdrawals from one. RMDs from a traditional IRA must start the year after you turn 70-1/2. RMDs do apply to Roth 401(k)s.