How to Calculate Your Roth IRA s Return

Post on: 23 Май, 2015 No Comment

September 20, 2010

In my previous article I explained that while many people search online for best Roth IRA rates what they are truly looking for is an easy way to find the best accounts. Unfortunately it just isn’t that easy because Roth IRAs, Traditional IRAs, and 401ks are all investment accounts that hold investments. Those investments determine the rate of return you receive. Your choices directly impact that return — if you and I both have a Roth IRA with Vanguard we would likely make different investment choices. If the mutual funds you selected outperform the mutual funds I selected then you come out ahead even though we are both with Vanguard.

Today we’re going to see how you can actually calculate the return within your Roth IRA. Most of the banking and brokerage companies that offer Roth IRAs will automatically calculate your return for you, but I’m a firm believer in understanding the math behind what they tell you. In the last post I gave an example that your IRA is a box that holds money. If you just put money in the box, nothing happens, and you don’t earn any more money. Inside the box we put our money into envelopes — investments — and at the end of the year we hope our investments have increased in value.

Let’s say you opened your very first Roth IRA 12 months ago. You started with $0.00 as an account balance. Your goal was to save the maximum amount allowed by the Roth IRA’s contribution limit (The current contribution limit is $5,500, but we chose a round number of $5,000 for this example).

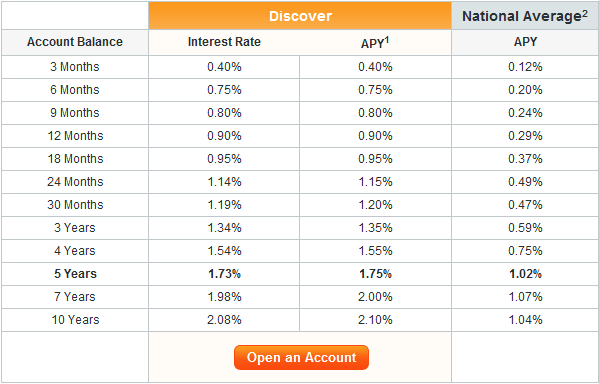

If you break that amount up by 12 months you need to save $416.67 per month. You stick to the plan and over the time period you diligently transfer $416.67 to your Roth IRA every month. You investment mix is split up amongst a CD, a bond mutual fund, and a stock mutual fund. There’s a piece of paper in the box stating you earned a 5.88% return on your investment. But how did they come up with that number?

How to Calculate Investment Return

You check out the envelopes and your Roth IRA provider has written the return of that investment on the outside of the envelope. On the CD the provider has written 1.0% and put $1,010 back in the envelope. (Okay, this is using simple compounding and not daily, monthly, or semi-annual compounding. Forgive me!) On the bond envelope the firm has written 4.2% and put $2,084 back in the envelope. And of course on the stock envelope the firm has written 10% and placed $2,200 in the envelope. These are the rates of return of the investments in the account. But it doesn’t help you much to know how much return you receive on one specific investment. If one investment did great, but you lost everything in the other investments then you wouldn’t be happy. To calculate the return of all three investments, you do the following:

- Calculate your total contribution (investment) — in this case, $1,000 + $2,000 + $2,000 = $5,000

- Calculate the total current value — in this case, $1,010 + $2,084 + $2,200 = $5,294

- Subtract the current value from the original investment — $5,294 minus $5,000 = $294 (this is your return in dollars)

- Divide your investment return ($294) by the original investment ($5,000) = 0.0588 or 5.88%

This is extraordinarily important to understand. If you had simply looked at your account value at the beginning of the 12 month period you would have $0 in your account. At the end you would have $5,294. That’s great! But $5,000 of that growth in your account came from your diligent saving and investing. You earned $294 by making smart investment choices, not $5,294. That’s a huge difference!