How to Calculate Your Internal Rate of Return

Post on: 23 Май, 2015 No Comment

Use Internal Rate of Return for Investment Comparisons

Your internal rate of return can be quite different than published returns. Don Bayley/E+/Getty Images

It should be easy to calculate the rate of return (often called an internal rate of return or IRR) you earned on an investment, right? You would think so, but sometimes it is more difficult than you would think. First, let’s look at a simple example.

Simple Interest Example

If you put $1,000 in the bank, the bank pays you interest, and one year later you have $1,042. In this case it is easy to calculate the rate of return at 4.2%. You simply divide the gain of $42 into your original investment of $1,000.

Uneven Cash Flows and Timing Make it More Difficult

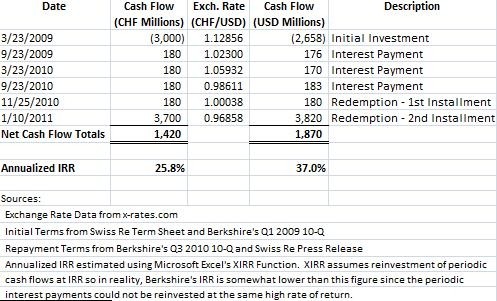

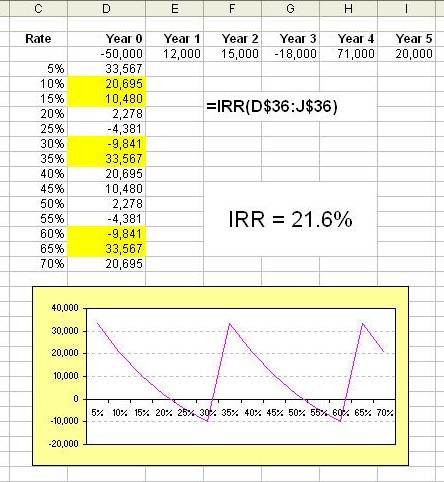

When you receive an uneven series of cash flows over several years, or over an odd time period, calculating the internal rate of return becomes more difficult. To do this type of calculation you need to use software, or a financial calculator, which allows you to input the various cash flows as they occurred. Below are two resources that can help.

- Here is a free online internal rate of return calculator that allows for up to twenty five years of cash flow entries.

- You can also download a Microsoft Excel internal rate of return spreadsheet template from Microsoft online. You can use this spreadsheet to input expected investment amounts, cash flows, and expenses, and it will calculate the corresponding internal rate of return.

It is important to calculate the expected internal rate of return so you may adequately compare investment alternatives.

For example by comparing the estimated internal rate of return on an investment property to that of an annuity payment to that of a portfolio of index funds. you can more effectively weigh out the various risks along with the potential returns — and thus more easily make an investment decision you feel comfortable with.

Expected return is not the only thing to look at; also consider the level of risk different investments are exposed to.

Internal Rate of Return is NOT the same as Time Weighted Returns

Most mutual funds and other investments that report returns report something called a Time Weighted Return (TWRR). This shows how one dollar invested at the beginning of the reporting period would have performed.

For example, if it was a five year return ending in 2013, it would show the results of investing on January 1, 2009 through December 31, 2013. How many of you invest a single sum on the first of each year? Because most people do not invest this way there can be a large discrepancy between investment returns (those published by the company) and investor returns (what returns each individual investor actually earns).

As an investor, time weighted returns do not show you what your actual account performance has been unless you had no deposits or withdrawals over the time period shown. This is why internal rate of return becomes a more accurate measure of your results when investing cash flows over time rather than in one lump sum.